- United States

- /

- Banks

- /

- NasdaqGS:TCBK

How Analyst Upgrades and a Dividend Hike at TriCo Bancshares (TCBK) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- TriCo Bancshares recently received an average "Moderate Buy" recommendation from seven brokerages, with several analysts upgrading their ratings and increasing targets, and announced a quarterly dividend increase to US$0.36 per share.

- This combination of analyst optimism and a higher dividend payout signals growing confidence in the company’s direction and outlook.

- We'll explore how the dividend hike reflects management's confidence and what it could mean for TriCo Bancshares' investment appeal.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is TriCo Bancshares' Investment Narrative?

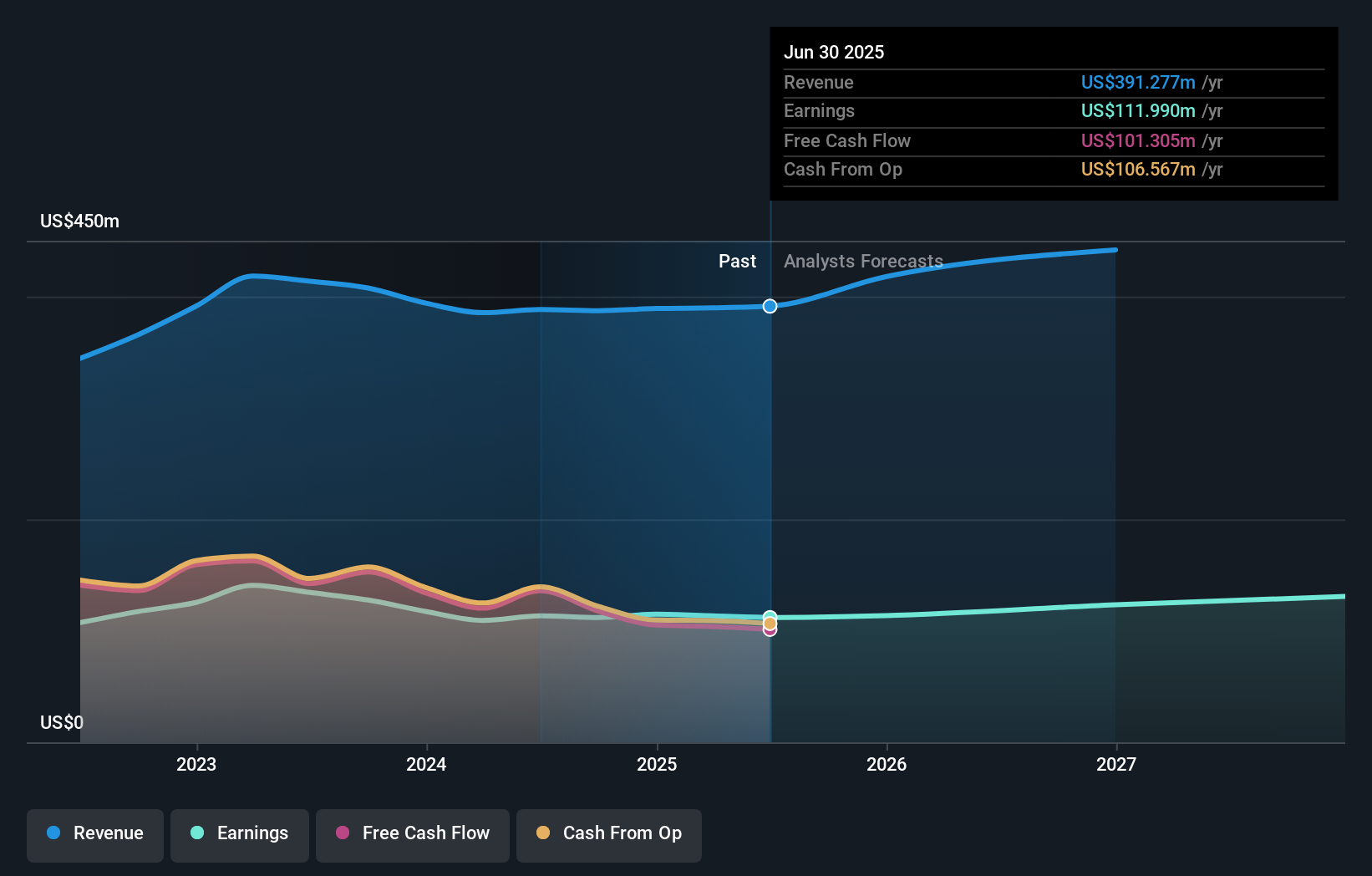

To believe in TriCo Bancshares as a shareholder, you’d need conviction in its ability to steadily grow earnings and maintain reliable dividends in a sector where consistency is often valued more than rapid expansion. The recent analyst upgrades and a dividend hike to US$0.36 per share appear to reinforce management’s confidence, while also serving as a signal to the market about the underlying stability of TriCo’s core operations. Short term, these developments may slightly strengthen sentiment, especially given the uptick in earnings after a softer first half of the year. However, the catalysts for meaningful price appreciation remain tied to improvements in profit growth relative to the broader market and addressing ongoing risks like rising loan charge-offs and board refreshment concerns. These new announcements don’t remove those risks but may provide some cushion against volatility if fundamentals hold up.

On the other hand, charge-offs and a lack of board renewal remain key issues that investors should be mindful of.

Exploring Other Perspectives

Explore 2 other fair value estimates on TriCo Bancshares - why the stock might be worth 38% less than the current price!

Build Your Own TriCo Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriCo Bancshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free TriCo Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriCo Bancshares' overall financial health at a glance.

No Opportunity In TriCo Bancshares?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives