- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Texas Capital Bancshares (TCBI) Is Up 8.2% After Fed Comments Raise Hopes for Interest Rate Cuts – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Recently, Texas Capital Bancshares and other regional bank stocks rose after comments from New York Federal Reserve President John Williams heightened expectations for an interest rate cut, boosting industry optimism.

- This shift in rate expectations may reshape the earnings and profitability outlook for regional lenders navigating balance sheet and credit margin pressures.

- We'll explore how growing hope for lower interest rates could influence Texas Capital Bancshares' investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Texas Capital Bancshares Investment Narrative Recap

To be a shareholder in Texas Capital Bancshares, you need to believe that the company's focus on commercial growth and fee-based businesses, together with the continued expansion of Texas's economy, will help offset the challenges of margin pressure and geographic risk. The recent optimism around potential interest rate cuts has strengthened near-term sentiment, as lower rates could provide relief to net interest margins, although risks tied to a concentrated geographic footprint and competition from bigger banks remain material concerns.

Against this backdrop, Texas Capital Bancshares' most recent quarterly earnings report stands out, showing higher net interest income and a return to strong profitability on a year-over-year basis. This improved performance highlights how changes in the rate outlook can quickly influence core earnings drivers, emphasizing the importance of staying alert to macroeconomic shifts as a catalyst for both revenue and credit quality.

But even as rate expectations shift, investors should also keep in mind that Texas Capital's exposure to the Texas economy continues to present a concentration risk if...

Read the full narrative on Texas Capital Bancshares (it's free!)

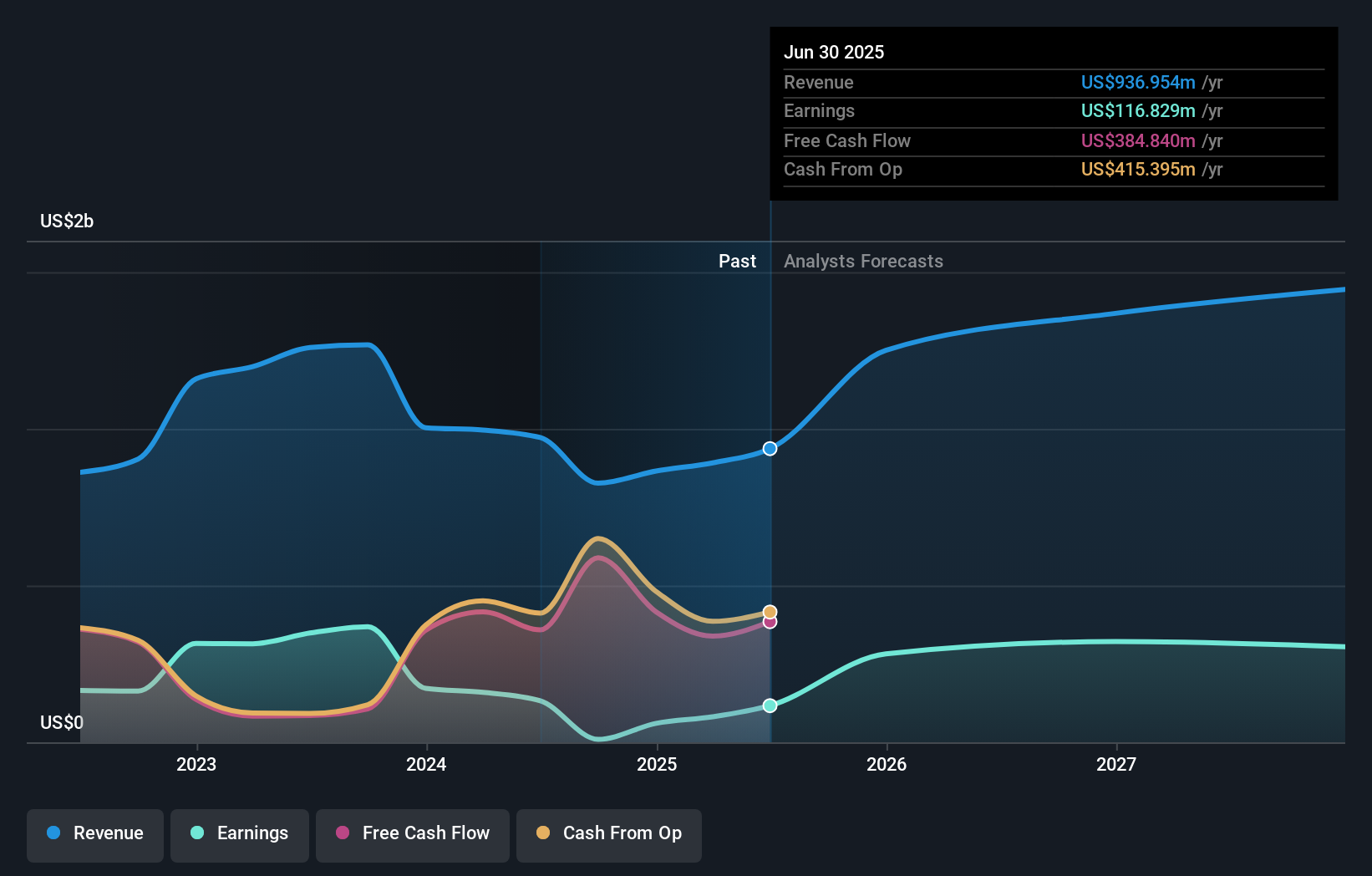

Texas Capital Bancshares is expected to reach $1.6 billion in revenue and $438.9 million in earnings by 2028. This outlook relies on a 20.6% annual revenue growth rate and an increase in earnings of $322.1 million from the current $116.8 million.

Uncover how Texas Capital Bancshares' forecasts yield a $92.00 fair value, in line with its current price.

Exploring Other Perspectives

There is just one Simply Wall St Community fair value estimate, at US$92, reflecting limited diversity among private investor views. While some market participants focus on Texas Capital’s potential for margin relief if federal rates fall, this also highlights the ongoing importance of managing geographic risks for the company’s long-term outlook.

Explore another fair value estimate on Texas Capital Bancshares - why the stock might be worth just $92.00!

Build Your Own Texas Capital Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Capital Bancshares research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Texas Capital Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Capital Bancshares' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success