- United States

- /

- Banks

- /

- NasdaqGS:TBNK

Territorial Bancorp (NASDAQ:TBNK) Is Due To Pay A Dividend Of US$0.23

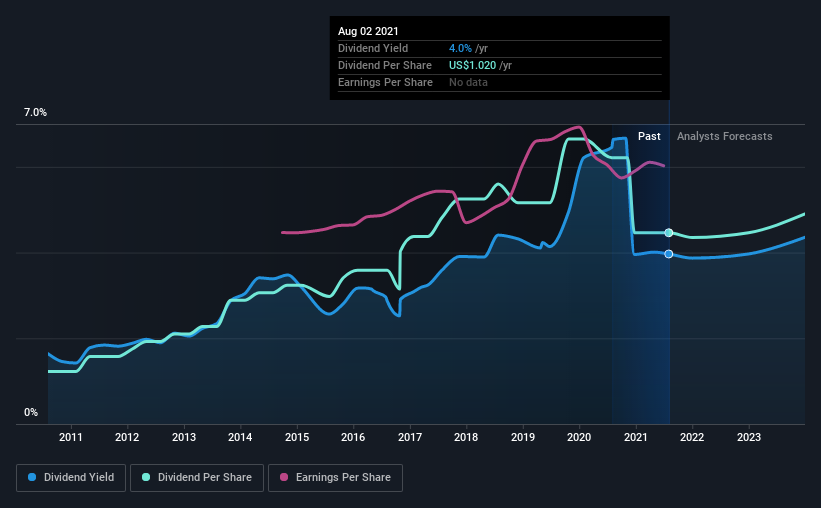

Territorial Bancorp Inc. (NASDAQ:TBNK) will pay a dividend of US$0.23 on the 26th of August. This means the dividend yield will be fairly typical at 4.0%.

See our latest analysis for Territorial Bancorp

Territorial Bancorp's Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, Territorial Bancorp was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, earnings per share is forecast to fall by 18.4% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 65%, which is comfortable for the company to continue in the future.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the first annual payment was US$0.28, compared to the most recent full-year payment of US$1.02. This means that it has been growing its distributions at 14% per annum over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Territorial Bancorp May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings have grown at around 4.4% a year for the past five years, which isn't massive but still better than seeing them shrink. The company has been growing at a pretty soft 4.4% per annum, and is paying out quite a lot of its earnings to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

In Summary

Overall, a consistent dividend is a good thing, and we think that Territorial Bancorp has the ability to continue this into the future. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for Territorial Bancorp (of which 1 is significant!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Territorial Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Territorial Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:TBNK

Territorial Bancorp

Operates as the holding company for Territorial Savings Bank that engages in the provision of various financial services to individuals, families, and businesses in the State of Hawaii.

Flawless balance sheet and good value.

Market Insights

Community Narratives