- United States

- /

- Banks

- /

- NasdaqGS:TBBK

Bancorp (TBBK) Valuation Check After Recent Share Price Rebound

Reviewed by Simply Wall St

Bancorp (TBBK) has quietly marched higher, with the stock up around 8% over the past month and nearly 30% year to date, even as three month returns remain in the red.

See our latest analysis for Bancorp.

The recent bounce, including a 1 month share price return of about 8% and a 1 day gain that pushed the share price to $66.98, suggests momentum is cautiously rebuilding after a weak 3 month stretch, while longer term total shareholder returns remain robust.

If Bancorp’s move has you thinking about what else is gaining traction, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares still trading at a double digit discount to analyst targets and a sizable intrinsic value gap, the key question now is whether Bancorp is genuinely undervalued or if the market already reflects its growth runway.

Most Popular Narrative: 12.4% Undervalued

With Bancorp last closing at $66.98 against a narrative fair value of $76.50, the storyline points to potential upside if its assumptions hold.

The Fintech Solutions Group's addition of new partnerships and expansion of existing programs, particularly in credit sponsorship, is expected to contribute to future earnings. This is connected to anticipated balances reaching $1 billion by the end of 2025.

Curious how flat revenues can still underpin a richer valuation story, driven by rising margins, shrinking share count and a lower future earnings multiple than today? Explore the full analysis behind that fair value.

Result: Fair Value of $76.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavier reliance on fintech partners and rising REBL loan risks could quickly pressure fee income, asset quality, and the margin expansion story.

Find out about the key risks to this Bancorp narrative.

Another Take on Valuation

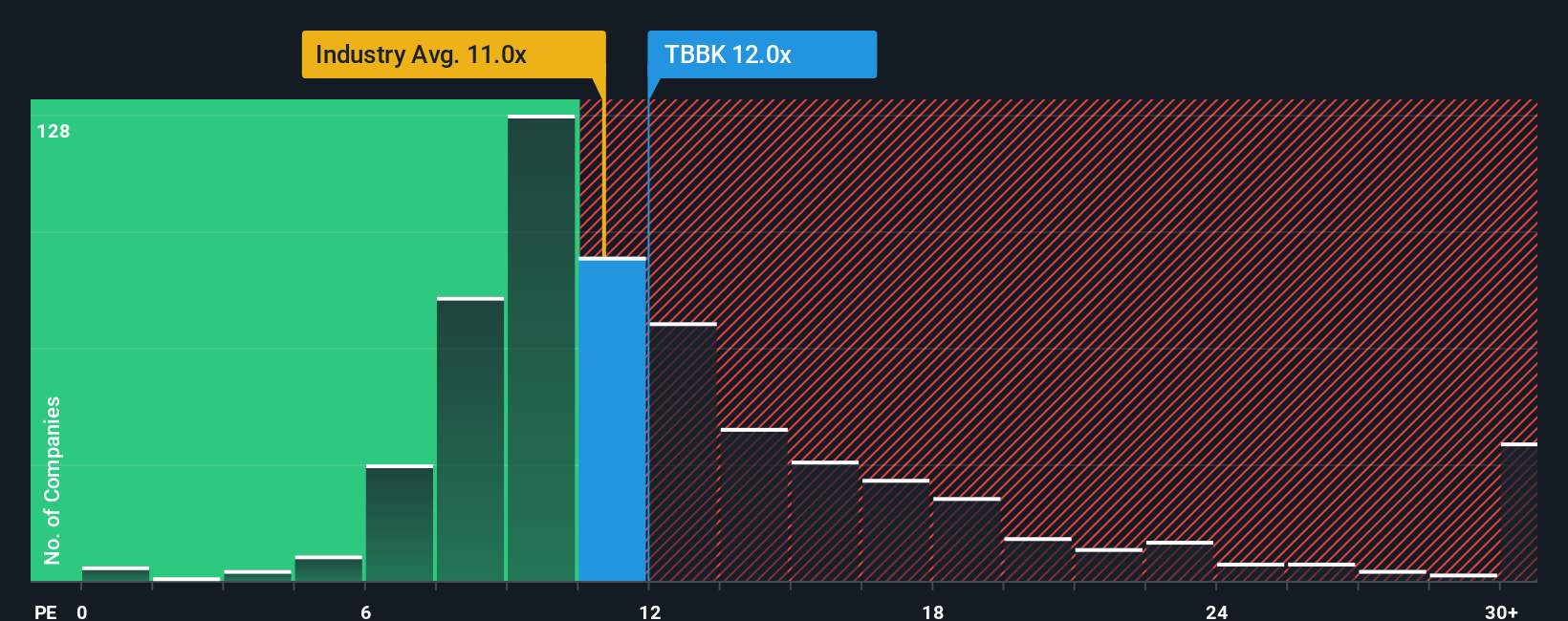

Analysts see Bancorp as modestly undervalued at $76.50, but our SWS earnings based fair ratio tells a stronger story. With the stock at 12.9x earnings versus a 14.7x fair ratio, investors may be underpricing its quality and growth, or simply demanding a larger safety buffer. Which do you think it is?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bancorp Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider scanning carefully selected stock ideas our research team has already sorted for quality and potential to help you identify your next set of opportunities.

- Look for powerful price swings early by targeting under the radar opportunities through these 3573 penny stocks with strong financials with stronger fundamentals than typical speculative names.

- Explore companies involved in AI by screening for businesses contributing to the shift to intelligent software using these 26 AI penny stocks.

- Review potential income ideas by focusing on cash-generating companies via these 14 dividend stocks with yields > 3% that combine specific yields with defined payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026