- United States

- /

- Semiconductors

- /

- NasdaqCM:NVEC

US Market's Hidden Gems: 3 Undiscovered Stocks to Watch

Reviewed by Simply Wall St

As the U.S. market navigates mixed signals from economic indicators and awaits crucial decisions on interest rates and tariffs, investors are keenly observing how these factors impact small-cap stocks, often seen as barometers of domestic economic health. In this dynamic environment, identifying promising yet under-the-radar stocks can offer unique opportunities for diversification and potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

NVE (NasdaqCM:NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation specializes in developing and selling spintronics-based devices for information acquisition, storage, and transmission, with a market capitalization of $296.37 million.

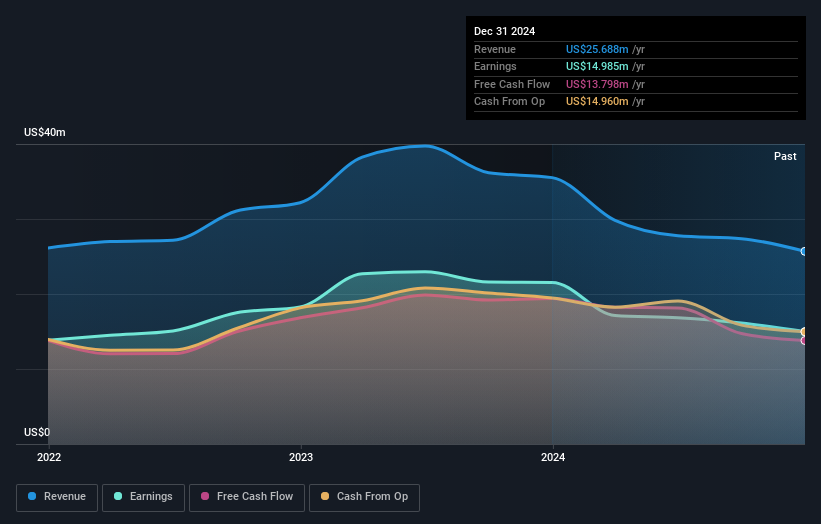

Operations: NVE Corporation generates revenue primarily from its electronic components and parts segment, which accounted for $25.69 million. The company's financial performance is influenced by its ability to manage costs and achieve a favorable net profit margin.

NVE, a nimble player in the semiconductor space, boasts high-quality earnings and operates without debt, which is a rarity in its industry. Its price-to-earnings ratio of 19.6x undercuts the industry average of 22.9x, hinting at potential value for investors. Despite these strengths, NVE faced a challenging year with earnings growth slipping by 30%, contrasting sharply with the industry's positive trend of 5.9%. On the bright side, it remains free cash flow positive at US$13.80 million as of May 2025, providing some cushion as it navigates market dynamics and prepares to announce its Q4 results soon.

- Delve into the full analysis health report here for a deeper understanding of NVE.

Gain insights into NVE's historical performance by reviewing our past performance report.

Southern States Bancshares (NasdaqGS:SSBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern States Bancshares, Inc. is the bank holding company for Southern States Bank, offering community banking services to businesses and individuals in the United States, with a market cap of $346.18 million.

Operations: Southern States Bancshares generates revenue primarily through interest income from loans and investments, alongside fees for banking services. Its cost structure includes interest expenses on deposits and borrowings, as well as operational costs. The company's net profit margin is a key indicator of its financial health, reflecting the efficiency of its operations after accounting for all expenses.

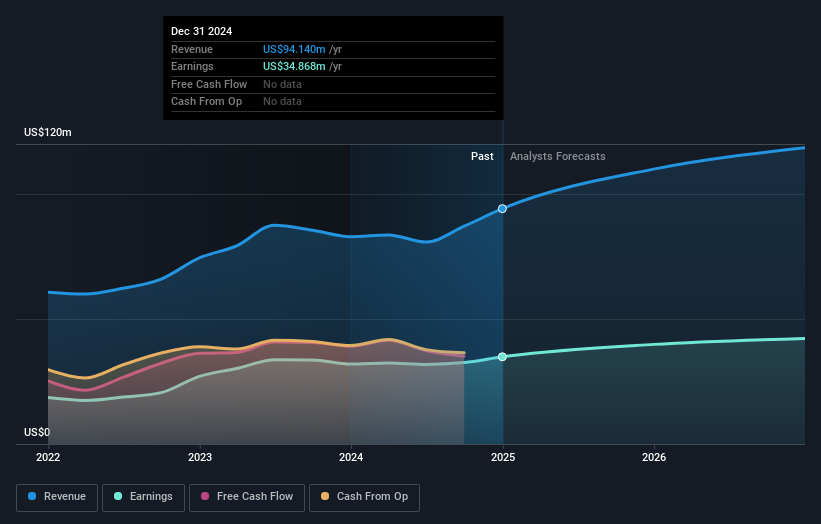

Southern States Bancshares, with total assets of $2.9 billion and equity of $290.2 million, is making waves in the banking sector. Holding deposits worth $2.4 billion and loans totaling $2.2 billion, it maintains a net interest margin of 3.6%. The company has a solid allowance for bad loans at 402% with non-performing loans at just 0.3%, showcasing prudent risk management. Earnings grew by 14% last year, outpacing the industry average of 4%. Recently announced merger plans with FB Financial Corporation valued Southern States shares at approximately $37 each, reflecting strategic growth potential in its market position.

Sila Realty Trust (NYSE:SILA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, is a net lease real estate investment trust specializing in the healthcare sector with a market cap of $1.44 billion.

Operations: Sila Realty Trust generates revenue primarily from commercial real estate investments in the healthcare sector, with reported earnings of $186.86 million.

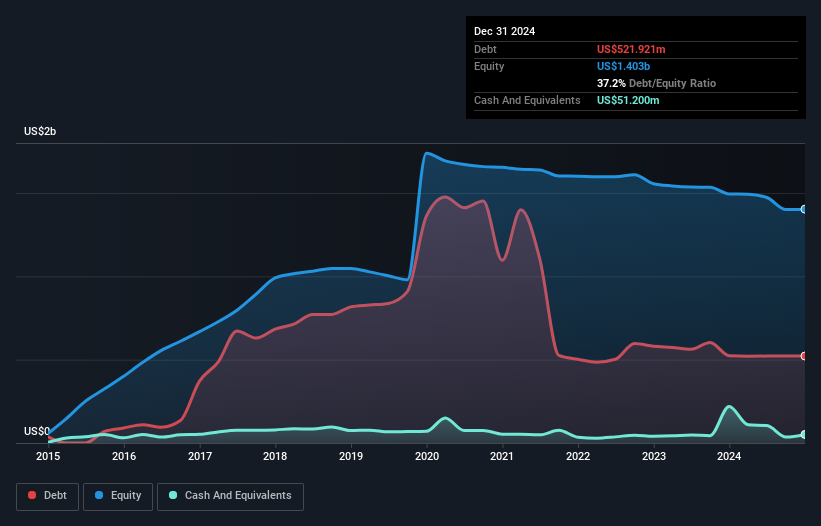

Sila Realty Trust, a Tampa-based real estate investment trust, focuses on healthcare properties and has seen impressive growth. Over the past year, earnings surged by 77%, outpacing the industry’s 52% rise. The company's debt to equity ratio improved significantly from 78% to 37% over five years, reflecting prudent financial management. Its net debt to equity ratio stands at a satisfactory 34%, and interest payments are well-covered at 3.7 times EBIT. Recent strategic moves include acquiring a $35 million Knoxville rehabilitation facility and securing a $600 million revolving credit line, positioning Sila for continued expansion in its niche market.

Where To Now?

- Access the full spectrum of 281 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NVEC

NVE

Develops and sells devices that use spintronics, a nanotechnology that relies on electron spin to acquire, store, and transmit information in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives