- United States

- /

- Banks

- /

- NasdaqGS:SSBK

Exploring Three Undiscovered Gems In The US Stock Market July 2024

Reviewed by Simply Wall St

Amidst a rebound in the US stock market, with the Nasdaq 100 and S&P 500 both climbing over 1% as investors anticipate key economic data and earnings reports, there remains a fertile ground for uncovering less recognized stocks. In such an environment, identifying companies with solid fundamentals yet overlooked by broader market trends could offer interesting opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Farmers National Banc (NasdaqCM:FMNB)

Simply Wall St Value Rating: ★★★★★★

Overview: Farmers National Banc Corp., with a market cap of $548.23 million, serves as a bank holding company for The Farmers National Bank of Canfield, offering services in banking, trust, retirement consulting, insurance, and financial management.

Operations: Farmers National Banc primarily operates through its banking segment, generating significant revenue of $165.62 million, alongside a smaller contribution from its trust and retirement consulting segments totaling $12.07 million. The company has consistently demonstrated a strong net income margin, highlighting efficient operational management and profitability across its financial services offerings.

Farmers National Banc, a lesser-highlighted entity with $5.1B in assets and a robust financial base, has outperformed its sector with a 4.4% earnings growth while the industry faced a 15.1% contraction. With total deposits at $4.2B and loans at $3.1B, its prudent management is evident from a bad loans ratio of only 0.4% and an ample bad loan allowance covering 277%. Recent strategic moves include declaring dividends and buying back shares worth $6.57M, underscoring confidence in its fiscal health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Farmers National Banc.

Understand Farmers National Banc's track record by examining our Past report.

Diamond Hill Investment Group (NasdaqGS:DHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diamond Hill Investment Group, Inc., operating through its subsidiary Diamond Hill Capital Management, Inc., offers investment advisory and fund administration services primarily in the United States, with a market capitalization of approximately $426.97 million.

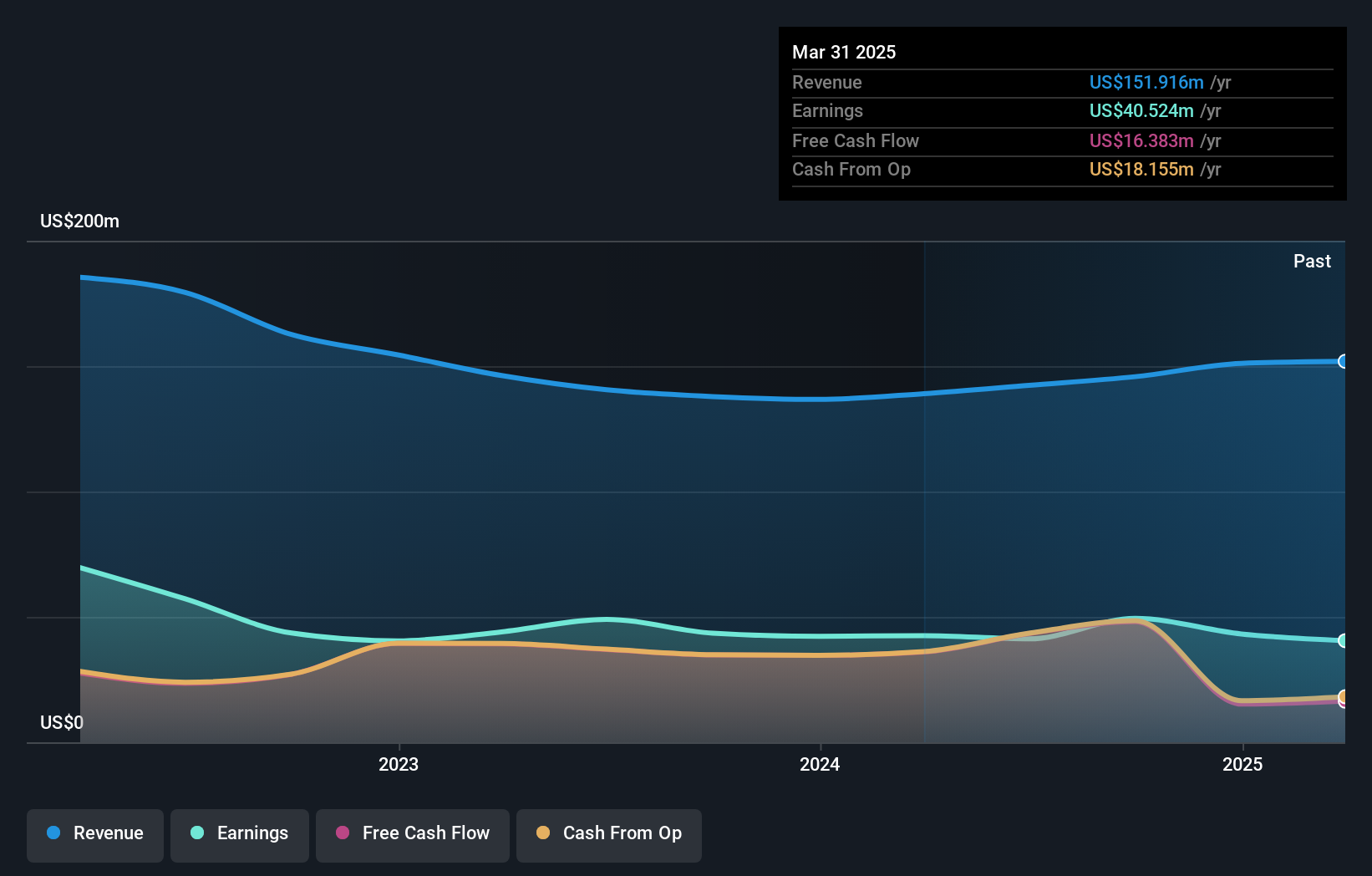

Operations: DHIL primarily generates revenue through investment advisory and related services, evidenced by its consistent focus on this sector which accounted for $139.02 million in revenue. The company's business model involves managing substantial operating expenses and non-operating costs, impacting net income margins which have shown variability over the years.

Diamond Hill Investment Group, recently added to several Russell indexes, showcases robust financial health with no debt for the past five years and a consistent dividend payout of $1.50 per share. Despite a slight earnings decline of 0.5% annually over the past five years, the company's first-quarter revenue rose to $36 million from $34 million year-over-year, indicating resilience. Moreover, its strategic share repurchases totaling $36.64 million underscore confidence in its value, trading at 49.7% below estimated fair value.

Southern States Bancshares (NasdaqGS:SSBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern States Bancshares, Inc., serving as the bank holding company for Southern States Bank, offers community banking services to businesses and individuals, with a market capitalization of approximately $267.26 million.

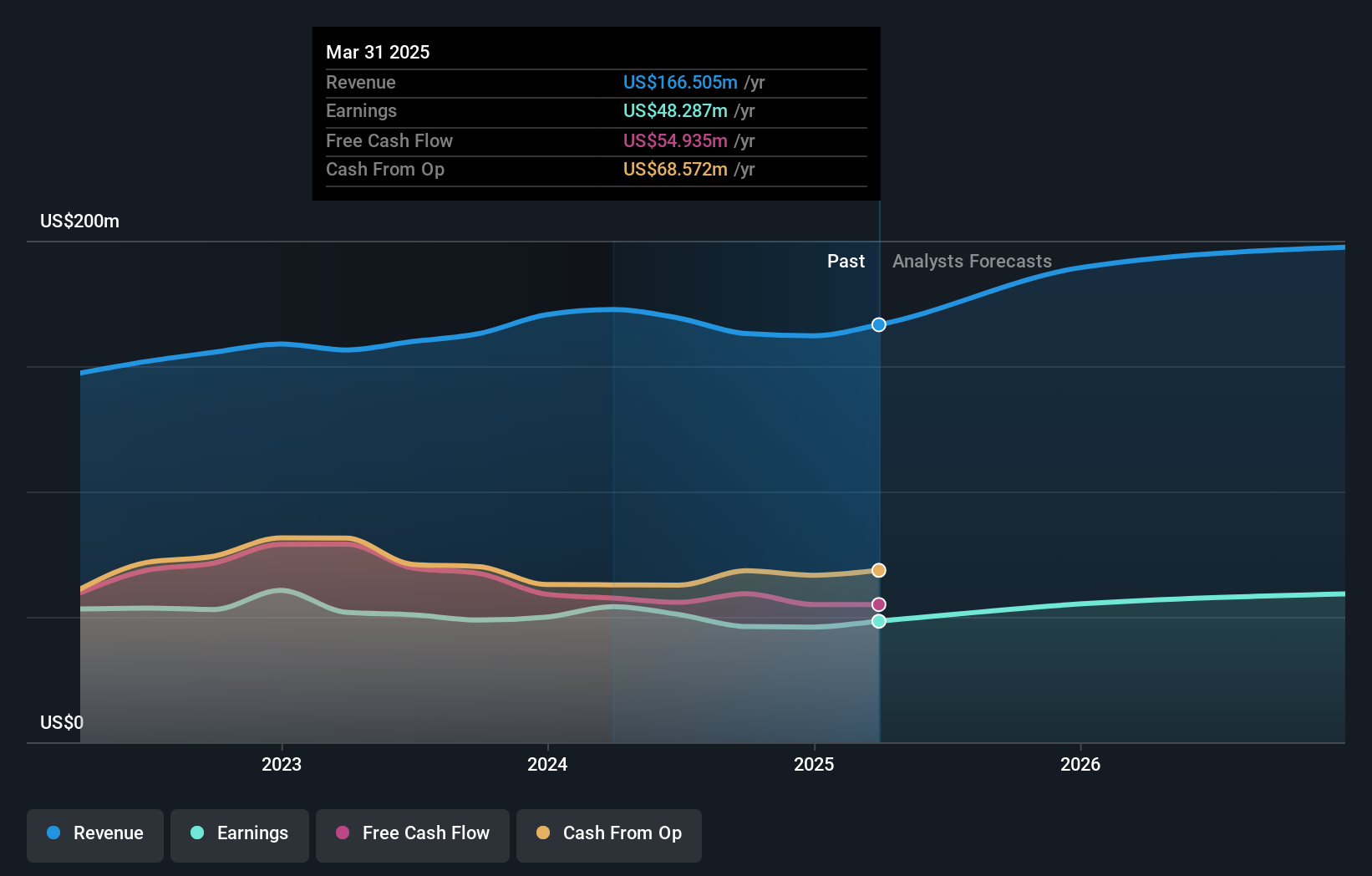

Operations: This financial entity has demonstrated a consistent increase in revenue, growing from $30.93 million in 2018 to $80.76 million by mid-2024, alongside a notable rise in net income from $7.71 million to $31.84 million over the same period. The company operates with no cost of goods sold (COGS) and maintains a gross profit margin at 100%, reflecting its operational efficiency and direct generation of revenue primarily through service-oriented or non-product-based activities.

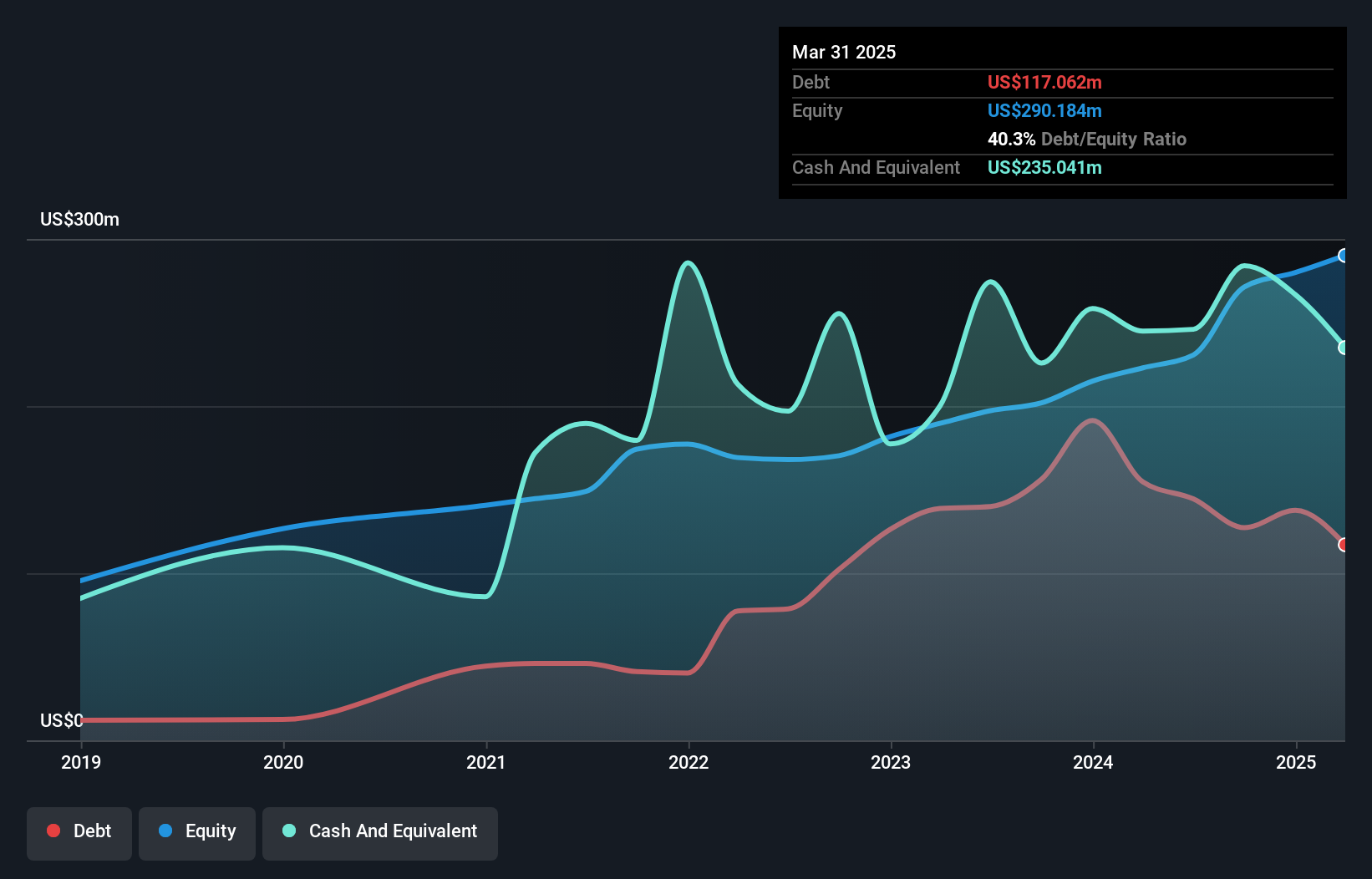

Southern States Bancshares, trading significantly below its fair value, showcases robust financial health with total assets of $2.6B and a strong equity base of $230.6M. The bank maintains a low-risk funding model, with 93% of liabilities covered by customer deposits, enhancing stability. Impressively managed credit risks are evident from its mere 0.2% bad loans ratio and a well-covered allowance for bad loans at 730%. Despite a slight dip in earnings growth last year, projections indicate an optimistic 20% annual increase in earnings moving forward.

Key Takeaways

- Gain an insight into the universe of 224 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSBK

Southern States Bancshares

Operates as the bank holding company for Southern States Bank that provides community banking services to businesses and individuals in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives