- United States

- /

- Banks

- /

- NasdaqGS:SRCE

A Fresh Look at 1st Source (SRCE) Valuation Following Strong Q3 Results and Dividend Hike

Reviewed by Simply Wall St

1st Source (SRCE) delivered higher net income and net interest income in its third quarter, while announcing a boosted dividend for shareholders. These updates point to positive progress that investors will be watching closely.

See our latest analysis for 1st Source.

1st Source has seen only modest price movement recently, with a 1-day share price return of 0.40% and a year-to-date share price return of 4.05%. Looking at the longer term, its momentum is steady, with a 1-year total shareholder return of 2.27% and a strong 80.62% gain for shareholders over the past five years. Alongside third quarter earnings improvements and a dividend boost, the recent share buyback and executive retirement announcement round out a year of active updates. Performance signals resilience even amid a challenging banking sector environment.

If you’re interested in broadening your scope beyond the banks, it’s a great moment to discover fast growing stocks with high insider ownership

With shares trading nearly 21% below the average analyst price target and a track record of strong execution, investors may be wondering whether 1st Source is undervalued or if the market has already accounted for its future growth.

Price-to-Earnings of 10x: Is it justified?

1st Source is trading at a price-to-earnings ratio of 10x, putting it below both its peer average and the wider US banking industry. With the last close at $60.11 and the typical peer average at 12.9x, shares appear attractively priced for earnings-focused investors.

The price-to-earnings ratio shows how much investors are willing to pay for each dollar of profit. In banking, a lower ratio may suggest the market is not fully appreciating the company's earnings stability or future growth potential, especially for firms reporting robust and sustainable profits.

1st Source's P/E ratio is not only better value than its industry average (11x), but the number is also well beneath that of its peers. However, compared to the estimated fair P/E ratio for SRCE (9.9x), the stock is actually slightly above its modeled "fair" valuation. This suggests that, while the market gives the bank a discount compared to its peers, it is still not significantly cheaper than what a regression-based analysis might imply as fair value.

Explore the SWS fair ratio for 1st Source

Result: Price-to-Earnings of 10x (UNDERVALUED)

However, slower revenue growth and a modest annual increase in net income may temper expectations if broader economic challenges persist.

Find out about the key risks to this 1st Source narrative.

Another View: What Does the SWS DCF Model Say?

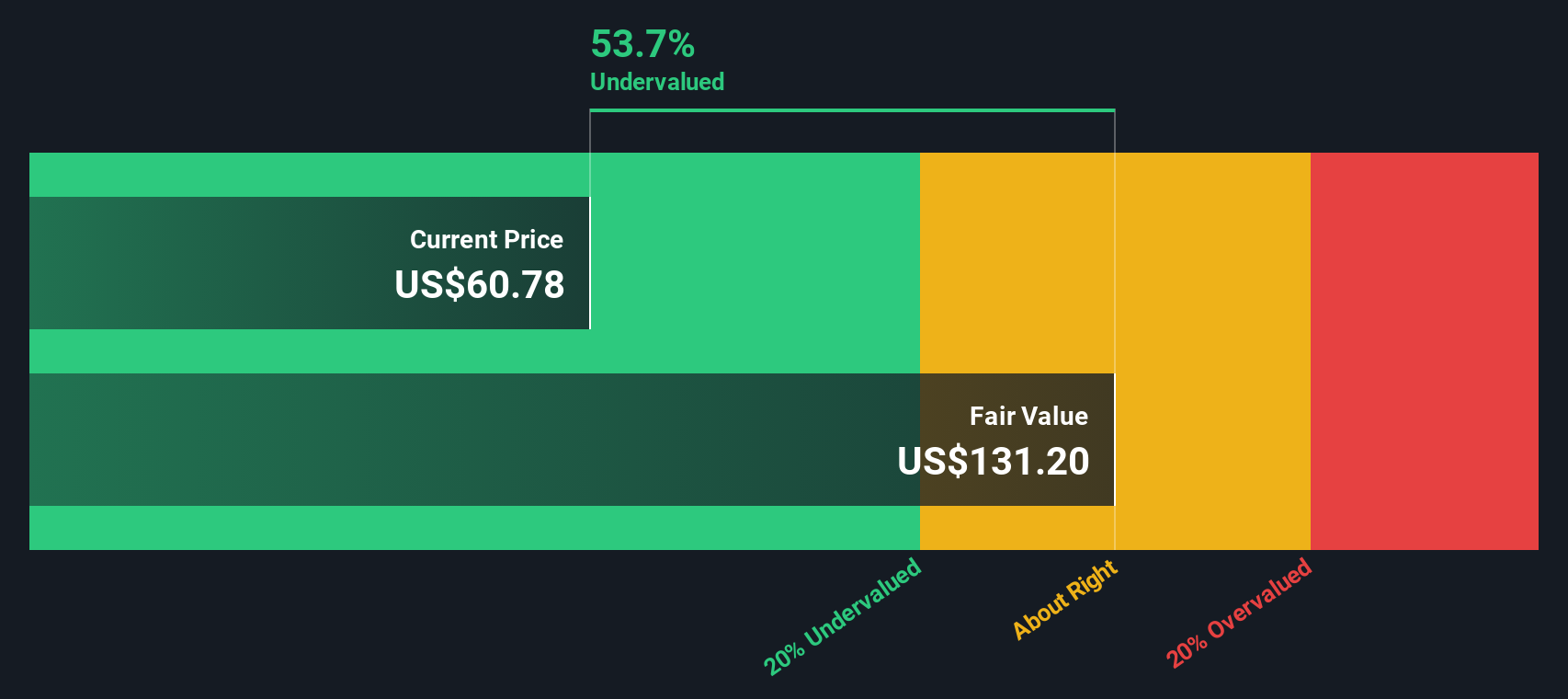

Switching to our SWS DCF model presents a very different perspective. It estimates 1st Source’s fair value at $133.97, which suggests the current price of $60.11 is deeply undervalued by over 55%. This significant disconnect raises the possibility that the market may be missing something important. Could the consensus be too conservative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out 1st Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own 1st Source Narrative

If you think a different story is taking shape or want to explore the data for yourself, you can build your own narrative quickly. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding 1st Source.

Looking for more investment ideas?

Expand your portfolio by tapping into fresh opportunities and powerful themes. Don’t miss your chance to get ahead with strategies built on actionable data.

- Reap the perks of stable income streams and see which companies top the list for high yields with these 20 dividend stocks with yields > 3%.

- Capitalize on cutting-edge advancements by searching for tomorrow’s biggest wins using these 26 AI penny stocks.

- Spot hidden gems trading below their true worth and take action today with these 842 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives