- United States

- /

- Banks

- /

- NasdaqGM:SFST

Southern First Bancshares (SFST) Profit Margin Jumps, Reinforcing Bullish Growth Narratives

Reviewed by Simply Wall St

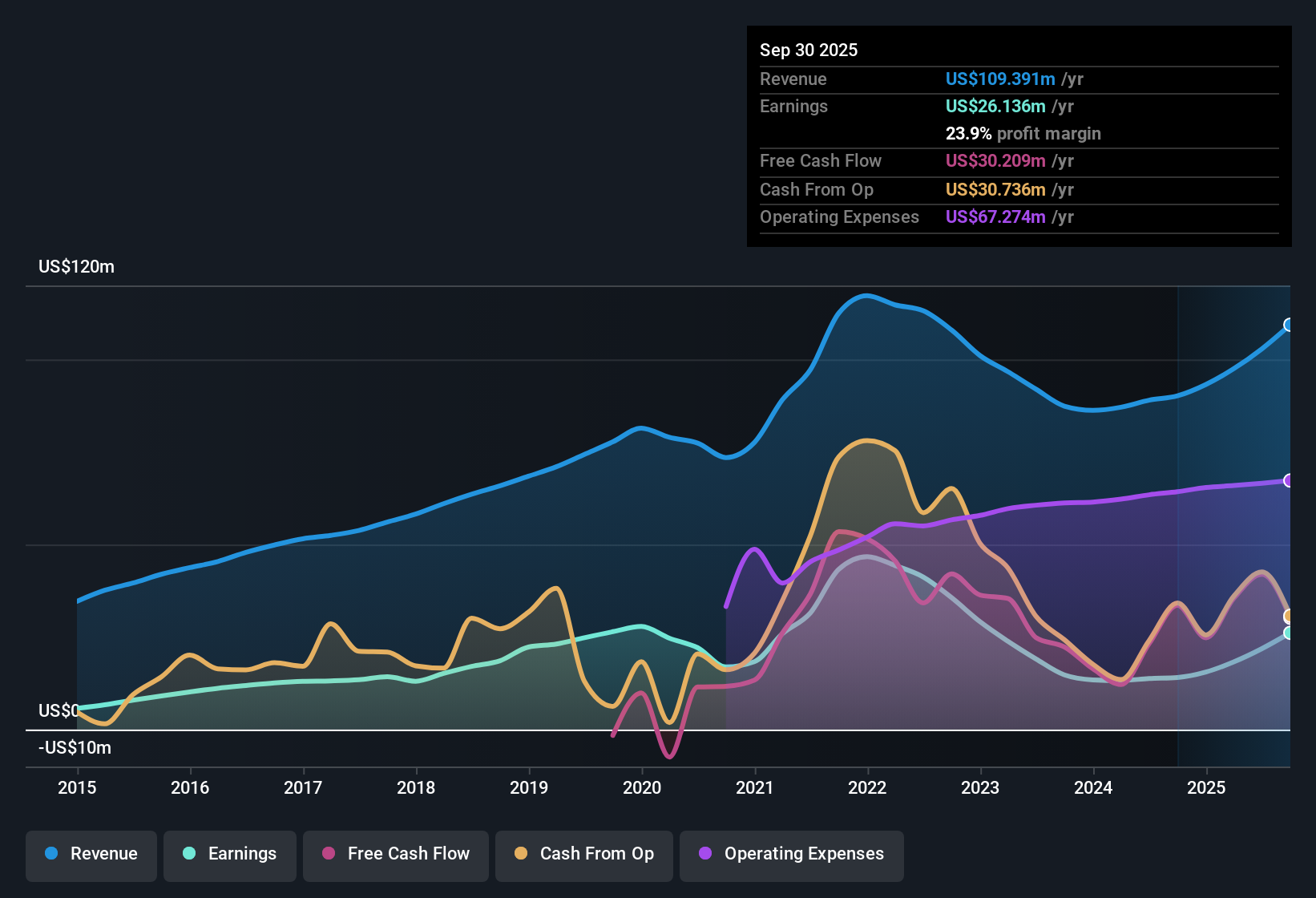

Southern First Bancshares (SFST) reported a net profit margin of 23.9%, marking a notable increase from 15.6% the prior year. While earnings had declined by 13.4% per year over the last five years, the latest results reveal a dramatic earnings growth of 85.8% year-over-year. Looking ahead, analysts expect annual earnings and revenue to climb by 20.42% and 17.4%, respectively, both outpacing averages in the US banking sector. A robust run in profits and growth projections is drawing attention. However, questions remain about the stock’s premium valuation and its implications for long-term positioning.

See our full analysis for Southern First Bancshares.Next, we will see how these headline results compare to the most widely discussed market narratives. Some perspectives may be confirmed, while others could be challenged by the numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Jumps to 23.9%

- Net profit margin climbed sharply to 23.9% from last year’s 15.6%, highlighting meaningful improvement in operational performance and efficiency.

- What is notable is how resilient Southern First’s profit profile appears, with the company’s strong net profit margin signaling disciplined cost handling and lending practices.

- Despite sector pressures on banks in the US, this jump showcases the bank’s ability to convert revenue into bottom-line profit at a pace that stands out.

- This increase directly supports the view that management is focused on steady fundamentals while navigating a cautious environment.

Growth Forecasts Outpace Industry Averages

- Analysts project earnings growth of 20.42% per year and revenue growth of 17.4% per year, both of which are stronger than average expectations for the US banking sector.

- Analysts highlight that sustained high-quality earnings and robust growth forecasts set Southern First apart from many peers.

- This sharp acceleration in both earnings and revenue sits in clear contrast to the historical 13.4% annual earnings decline over the last five years.

- Strong forward projections give bulls reason to view Southern First as a potential standout if current momentum is maintained.

Premium Valuation Raises Questions

- Shares currently trade at a Price-To-Earnings ratio of 13.7x, making the stock more expensive than both peers and the broader US banks industry. Meanwhile, the $43.87 share price is well above the DCF fair value estimate of $29.87.

- The prevailing market view notes that while robust profit trends and growth forecasts may attract investor attention, the premium valuation could cause hesitation for those focused on long-term value.

- The share price’s notable premium to fair value and industry multiples introduces debate about how much future growth is already reflected in today’s valuation.

- For value-focused investors, this disconnect signals that expectations for Southern First are elevated compared to what more conservative models would suggest.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Southern First Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Southern First’s premium valuation signals that current price levels may already reflect much of its expected growth, which could limit long-term value opportunities.

If you’re concerned about overpaying for future performance, discover these 853 undervalued stocks based on cash flows that are trading below their intrinsic value and could offer better upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SFST

Southern First Bancshares

Operates as the bank holding company for Southern First Bank that provides commercial, consumer, and mortgage loans to the general public in South Carolina, North Carolina, and Georgia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives