- United States

- /

- Banks

- /

- NasdaqGS:SFNC

Analyst Upgrade and Dividend Hike Might Change the Case for Investing in Simmons First National (SFNC)

Reviewed by Sasha Jovanovic

- On November 10, 2025, Simmons First National Corporation announced its board declared a quarterly cash dividend of US$0.2125 per share, payable January 2, 2026, reflecting a 1% increase compared to the prior year's period.

- A recent analyst upgrade, supported by a securities repositioning and management's focus on profitability, has drawn fresh attention to Simmons' growth strategies and net interest margin improvement.

- We’ll examine how the analyst upgrade, anchored by expectations for stronger profitability, could reshape Simmons First National’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Simmons First National Investment Narrative Recap

To be a shareholder in Simmons First National, you need confidence in management's ability to restore consistent profitability and sustain loan growth, especially as the company pivots to improve net interest margins. The recent analyst upgrade and dividend increase may boost short-term sentiment, but the most important near-term catalyst remains a return to positive earnings, while the biggest risk is ongoing stress in commercial real estate loans; neither appears significantly changed by this news, though positive signals have emerged.

The board’s steady, incremental dividend increases, most recently a 1% bump alongside the quarterly payout announcement, reinforce Simmons’ intent to provide ongoing shareholder returns, even as its near-term performance turns on effective execution of its profitability turnaround and prudent loan underwriting. This dividend decision aligns with management’s theme of stability, while highlighting the importance of sustainable earnings growth as core to the current investment case.

However, investors should be aware that in contrast to rising dividends and growth efforts, risks remain around the company’s exposure to commercial real estate credits and potential volatility if...

Read the full narrative on Simmons First National (it's free!)

Simmons First National's outlook anticipates $1.3 billion in revenue and $354.8 million in earnings by 2028. This scenario assumes a 19.7% annual revenue growth rate and a $194.6 million increase in earnings from the current $160.2 million.

Uncover how Simmons First National's forecasts yield a $22.80 fair value, a 31% upside to its current price.

Exploring Other Perspectives

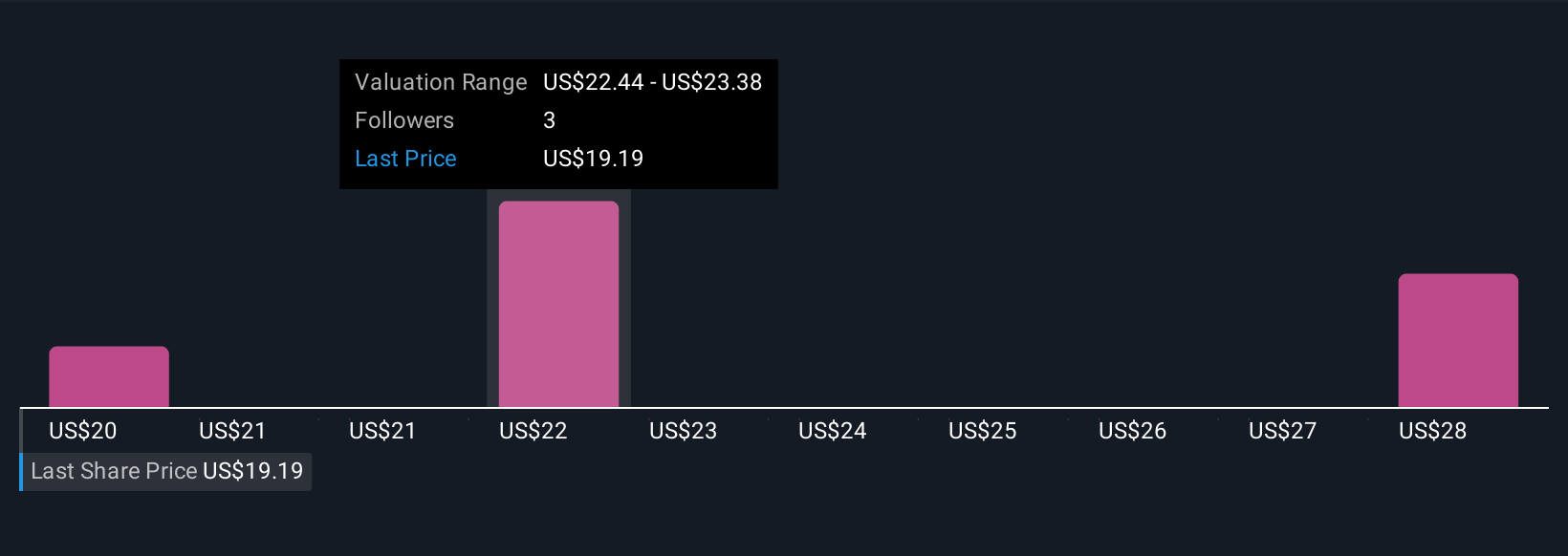

Simply Wall St Community members have submitted fair value estimates for Simmons First National ranging from US$17.02 to US$29.22, based on three separate forecasts. With ongoing concerns about commercial real estate exposure, you can see that market participants hold sharply different views on future performance, explore these varied perspectives for a deeper understanding.

Explore 3 other fair value estimates on Simmons First National - why the stock might be worth as much as 68% more than the current price!

Build Your Own Simmons First National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simmons First National research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Simmons First National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simmons First National's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFNC

Simmons First National

Operates as the bank holding company for Simmons Bank that provides banking and other financial products and services to individuals and businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives