- United States

- /

- Banks

- /

- NasdaqCM:SBT

How Much Did Sterling Bancorp (Southfield MI)'s(NASDAQ:SBT) Shareholders Earn From Share Price Movements Over The Last Three Years?

Sterling Bancorp, Inc. (Southfield, MI) (NASDAQ:SBT) shareholders will doubtless be very grateful to see the share price up 40% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 66% in that time. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Sterling Bancorp (Southfield MI)

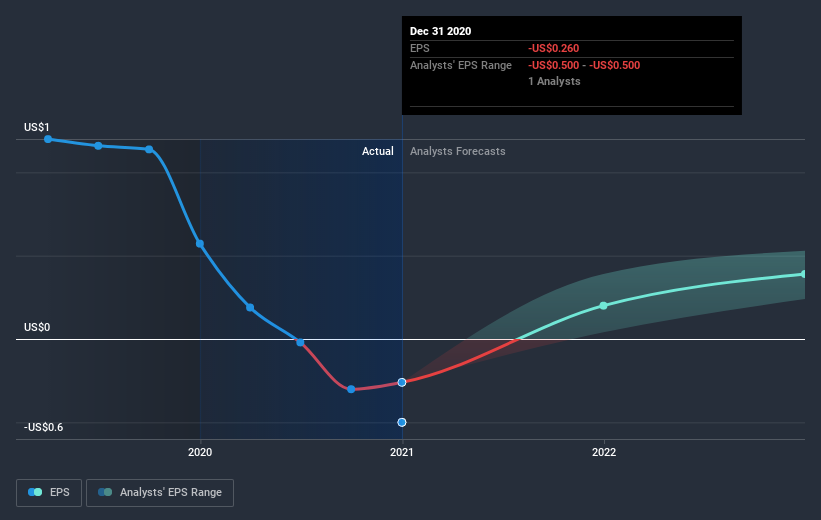

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Sterling Bancorp (Southfield MI) saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Sterling Bancorp (Southfield MI)'s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Sterling Bancorp (Southfield MI) shares, which cost holders 34%, while the market was up about 30%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 18% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Sterling Bancorp (Southfield MI) that you should be aware of.

Of course Sterling Bancorp (Southfield MI) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Sterling Bancorp (Southfield MI), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SBT

Sterling Bancorp (Southfield MI)

Operates as the unitary thrift holding company for Sterling Bank and Trust, F.S.B.

Flawless balance sheet very low.

Market Insights

Community Narratives