- United States

- /

- Banks

- /

- NYSE:SBSI

I Ran A Stock Scan For Earnings Growth And Southside Bancshares (NASDAQ:SBSI) Passed With Ease

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Southside Bancshares (NASDAQ:SBSI). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Southside Bancshares

Southside Bancshares's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Southside Bancshares managed to grow EPS by 7.8% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Southside Bancshares's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Southside Bancshares's EBIT margins were flat over the last year, revenue grew by a solid 13% to US$206m. That's a real positive.

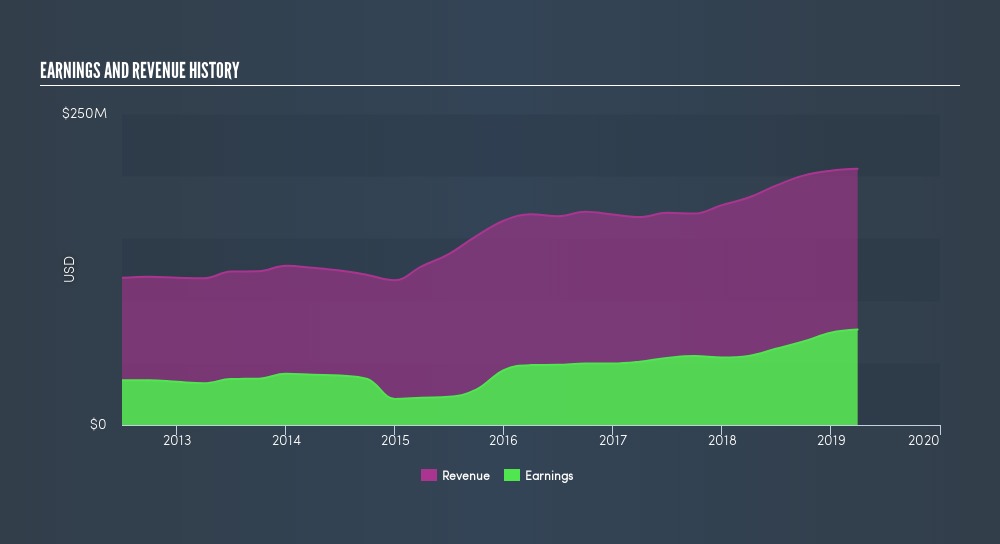

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Southside Bancshares's forecast profits?

Are Southside Bancshares Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Southside Bancshares insiders spent US$113k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the , Tony Morgan, who made the biggest single acquisition, paying US$62k for shares at about US$31.15 each.

On top of the insider buying, it's good to see that Southside Bancshares insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$71m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Lee Gibson, is paid less than the median for similar sized companies. For companies with market capitalizations between US$400m and US$1.6b, like Southside Bancshares, the median CEO pay is around US$2.7m.

Southside Bancshares offered total compensation worth US$1.6m to its CEO in the year to December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Southside Bancshares Worth Keeping An Eye On?

One positive for Southside Bancshares is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Southside Bancshares.

As a growth investor I do like to see insider buying. But Southside Bancshares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:SBSI

Southside Bancshares

Operates as the bank holding company for Southside Bank that provides various financial services to individuals, businesses, municipal entities, and nonprofit organizations.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives