- United States

- /

- Banks

- /

- NasdaqGS:SASR

Sandy Spring Bancorp, Inc.'s (NASDAQ:SASR) recent 8.0% pullback adds to one-year year losses, institutional owners may take drastic measures

To get a sense of who is truly in control of Sandy Spring Bancorp, Inc. (NASDAQ:SASR), it is important to understand the ownership structure of the business. We can see that institutions own the lion's share in the company with 67% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And institutional investors endured the highest losses after the company's share price fell by 8.0% last week. The recent loss, which adds to a one-year loss of 9.2% for stockholders, may not sit well with this group of investors. Also referred to as "smart money", institutions have a lot of sway over how a stock's price moves. Hence, if weakness in Sandy Spring Bancorp's share price continues, institutional investors may feel compelled to sell the stock, which might not be ideal for individual investors.

Let's take a closer look to see what the different types of shareholders can tell us about Sandy Spring Bancorp.

See our latest analysis for Sandy Spring Bancorp

What Does The Institutional Ownership Tell Us About Sandy Spring Bancorp?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

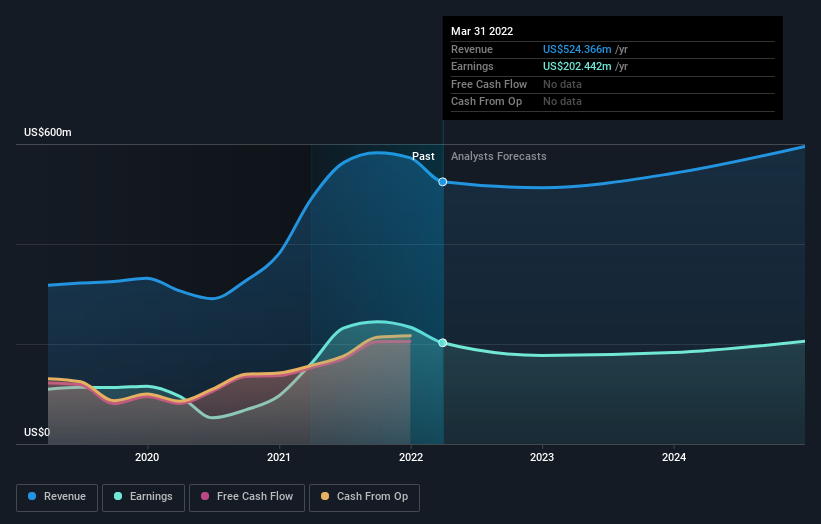

As you can see, institutional investors have a fair amount of stake in Sandy Spring Bancorp. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Sandy Spring Bancorp's historic earnings and revenue below, but keep in mind there's always more to the story.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Sandy Spring Bancorp is not owned by hedge funds. BlackRock, Inc. is currently the largest shareholder, with 9.6% of shares outstanding. With 6.4% and 5.5% of the shares outstanding respectively, T. Rowe Price Group, Inc. and The Vanguard Group, Inc. are the second and third largest shareholders.

Looking at the shareholder registry, we can see that 50% of the ownership is controlled by the top 17 shareholders, meaning that no single shareholder has a majority interest in the ownership.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Sandy Spring Bancorp

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in Sandy Spring Bancorp, Inc.. This is a big company, so it is good to see this level of alignment. Insiders own US$53m worth of shares (at current prices). It is good to see this level of investment by insiders. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, who are usually individual investors, hold a 30% stake in Sandy Spring Bancorp. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Sandy Spring Bancorp , and understanding them should be part of your investment process.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SASR

Sandy Spring Bancorp

Operates as the bank holding company for Sandy Spring Bank that provides commercial and retail banking, mortgage, private banking, and trust services to individuals and businesses in the United States.

Flawless balance sheet established dividend payer.