- United States

- /

- Banks

- /

- NasdaqGS:RVSB

Why It Might Not Make Sense To Buy Riverview Bancorp, Inc. (NASDAQ:RVSB) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Riverview Bancorp, Inc. (NASDAQ:RVSB) is about to go ex-dividend in just three days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Thus, you can purchase Riverview Bancorp's shares before the 2nd of January in order to receive the dividend, which the company will pay on the 14th of January.

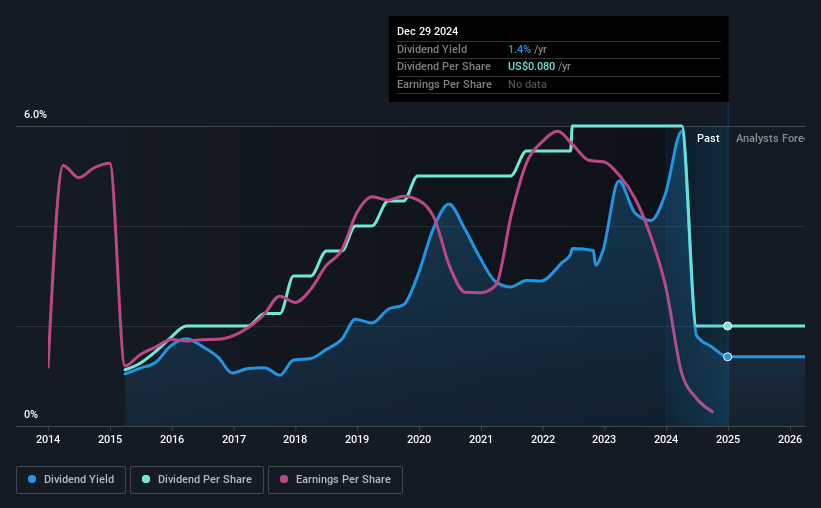

The company's next dividend payment will be US$0.02 per share, on the back of last year when the company paid a total of US$0.08 to shareholders. Looking at the last 12 months of distributions, Riverview Bancorp has a trailing yield of approximately 1.4% on its current stock price of US$5.78. If you buy this business for its dividend, you should have an idea of whether Riverview Bancorp's dividend is reliable and sustainable. So we need to investigate whether Riverview Bancorp can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Riverview Bancorp

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Riverview Bancorp paid out a disturbingly high 335% of its profit as dividends last year, which makes us concerned there's something we don't fully understand in the business.

Generally, the higher a company's payout ratio, the more the dividend is at risk of being reduced.

Click here to see how much of its profit Riverview Bancorp paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Riverview Bancorp's earnings per share have plummeted approximately 43% a year over the previous five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Riverview Bancorp has delivered an average of 5.9% per year annual increase in its dividend, based on the past 10 years of dividend payments. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Riverview Bancorp is already paying out 335% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

The Bottom Line

Is Riverview Bancorp worth buying for its dividend? Not only are earnings per share shrinking, but Riverview Bancorp is paying out a disconcertingly high percentage of its profit as dividends. Generally we think dividend investors should avoid businesses in this situation, as high payout ratios and declining earnings can lead to the dividend being cut. Riverview Bancorp doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

Although, if you're still interested in Riverview Bancorp and want to know more, you'll find it very useful to know what risks this stock faces. To help with this, we've discovered 1 warning sign for Riverview Bancorp that you should be aware of before investing in their shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RVSB

Riverview Bancorp

Operates as a bank holding company for Riverview Bank that provides commercial banking services to small and medium size businesses, professionals, and wealth building individuals.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.