- United States

- /

- Banks

- /

- NasdaqCM:RBKB

With EPS Growth And More, Rhinebeck Bancorp (NASDAQ:RBKB) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Rhinebeck Bancorp (NASDAQ:RBKB), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Rhinebeck Bancorp

How Fast Is Rhinebeck Bancorp Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a wedge-tailed eagle on the wind, Rhinebeck Bancorp's EPS soared from US$0.57 to US$0.76, in just one year. That's a impressive gain of 33%.

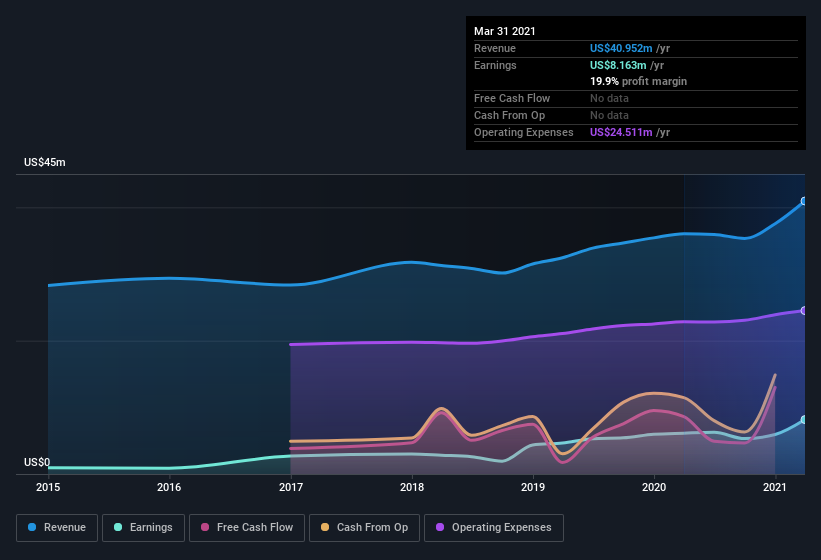

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Rhinebeck Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Rhinebeck Bancorp maintained stable EBIT margins over the last year, all while growing revenue 14% to US$41m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Rhinebeck Bancorp is no giant, with a market capitalization of US$112m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Rhinebeck Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Rhinebeck Bancorp were both selling and buying shares; but happily, as a group they spent US$157k more on stock, than they netted from selling it. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. It is also worth noting that it was Independent Director Steven Howell who made the biggest single purchase, worth US$68k, paying US$6.88 per share.

Is Rhinebeck Bancorp Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Rhinebeck Bancorp's strong EPS growth. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. So on this analysis I believe Rhinebeck Bancorp is probably worth spending some time on. Now, you could try to make up your mind on Rhinebeck Bancorp by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Rhinebeck Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Rhinebeck Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:RBKB

Rhinebeck Bancorp

Operates as the bank holding company for Rhinebeck Bank that provides banking and financial products and services to consumer and commercial customers in the Hudson Valley region of New York.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026