- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

Republic Bancorp (RBCA.A): Assessing Valuation After Strong Revenue Growth and Loan Book Gains

Reviewed by Simply Wall St

Republic Bancorp (RBCA.A) has been grabbing attention lately after reporting impressive revenue growth and steady strength in its loan book. These updates, while perhaps easy to overlook in a crowded market, matter to investors for good reason. Strong fundamentals can shift how the market values a bank, and a pattern of robust top-line growth with disciplined lending often signals management is executing well. This raises the question of whether the company’s future earnings might be headed higher.

In the broader context, Republic Bancorp’s momentum is hard to ignore. The share price is up over 21% this year, outpacing many of its regional banking peers. That climb has not happened overnight either, as steady gains have stacked up over the month and the past three months as well. Management’s ability to deliver on growth in a challenging banking environment stands out, especially following last year’s turbulence in the sector. Meanwhile, long-term investors have seen the stock deliver more than eightfold returns over the last five years.

With the stock continuing to move higher, investors face an important question: does this rally mean there is more value left to capture, or has the market already priced in Republic Bancorp’s growth story?

Price-to-Earnings of 12x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Republic Bancorp appears expensive relative to both its peer group and the wider US banking sector. The company's P/E stands at 12x and surpasses the average ratios of peers (11.6x), the industry (11.5x), and its estimated fair P/E of 9.5x.

The P/E ratio is a widely used metric to assess whether a stock is valued appropriately relative to its earnings. A higher ratio often suggests that investors expect above-average growth or superior profitability. For banks, market participants pay close attention to this figure because it can reflect confidence in the company’s ability to generate earnings going forward.

In Republic Bancorp’s case, the data suggests the market could be assigning a premium based on recent growth, even though forecasts indicate that earnings may decline over the next three years. This raises questions about whether such a valuation is justified, especially since the stock trades at a premium to its sector averages and its own fair value estimate.

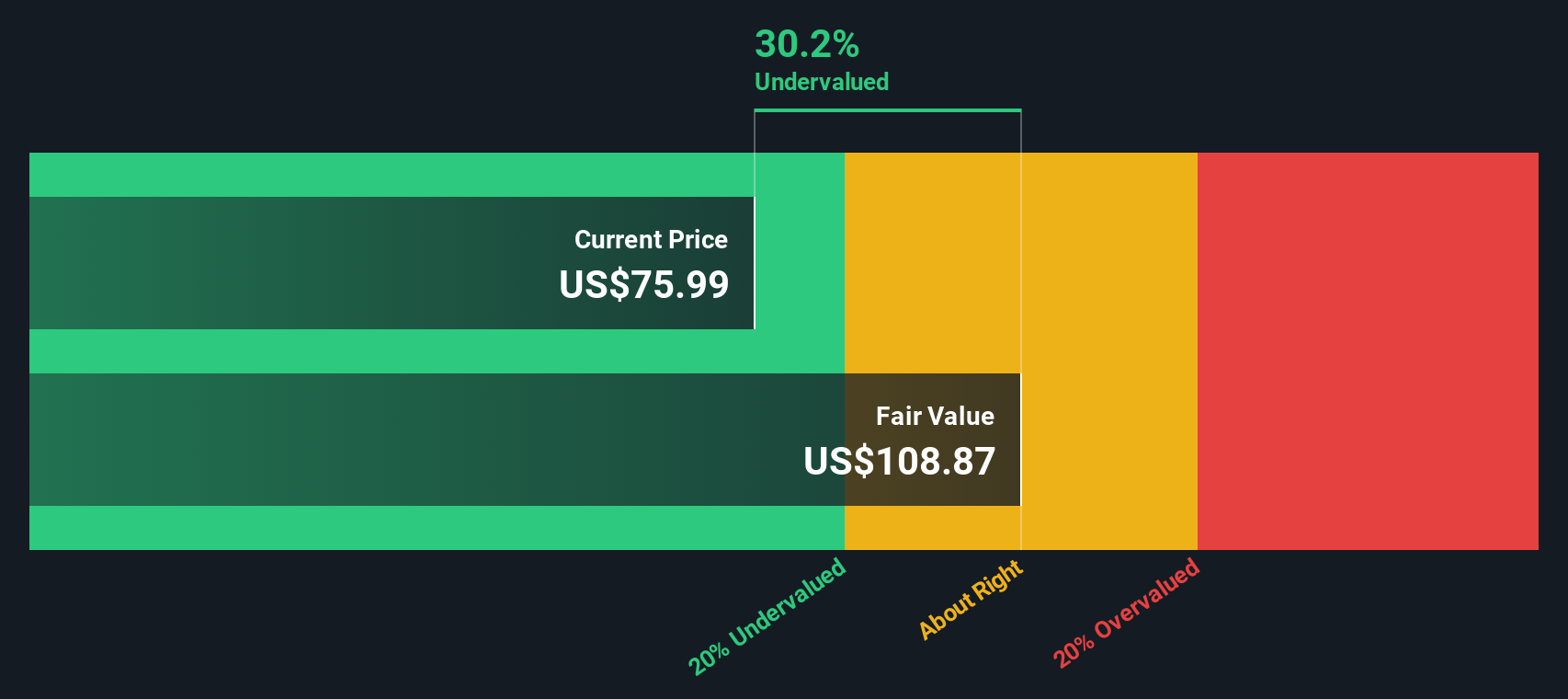

Result: Fair Value of $108.87 (UNDERVALUED)

See our latest analysis for Republic Bancorp.However, slowing net income growth and the potential for market volatility could challenge Republic Bancorp’s ability to deliver on future earnings expectations.

Find out about the key risks to this Republic Bancorp narrative.Another View: What Does the SWS DCF Model Say?

Looking at Republic Bancorp through the lens of our DCF model paints a different picture. This approach suggests the stock is undervalued according to future cash flows, which raises fresh questions about which method offers the fuller story for investors.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Republic Bancorp Narrative

If you think a different story exists or prefer digging into the numbers yourself, you can build your own analysis in just a few minutes, so do it your way.

A great starting point for your Republic Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Portfolio Opportunities?

Don’t stop at just one stock story. Give your investment approach a boost by tapping into other promising themes right now on Simply Wall Street. With the right screeners, you can uncover hidden gems and strategies you may have otherwise missed. Take action before the market moves without you!

- Maximize your income potential by focusing on companies offering dividend stocks with yields > 3%. These companies consistently outpace the average payout and can increase your portfolio’s yield.

- Discover high-growth trends by following leaders in AI penny stocks, where artificial intelligence innovation is influencing the future of various industries.

- Explore value opportunities with strong fundamentals by examining penny stocks with strong financials. These options often show a record of financial strength and resilience even in challenging markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives