- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

Republic Bancorp (RBCA.A): Assessing Valuation After Strong Q3 Earnings and Net Interest Income Growth

Reviewed by Kshitija Bhandaru

Republic Bancorp (RBCA.A) released its third quarter earnings, reporting an increase in both net interest income and net income compared to last year. The results exceeded Wall Street estimates. This comes at a time when investors are closely watching regional banks amid industry concerns.

See our latest analysis for Republic Bancorp.

Republic Bancorp’s shares have navigated a choppy year, with a resilient 1-year total shareholder return of 8.8 percent even as short-term price swings tracked regional banking volatility. The past 90 days saw some pressure on the share price, but its strong three- and five-year total returns of 76 percent and 138 percent show long-term momentum holding firm as investors weigh sector risks against the latest robust earnings.

If news around regional banks has you looking beyond the headlines, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Republic Bancorp trading close to its analyst price target and boasting solid long-term returns, investors are left wondering if the current valuation reflects all the recent good news or if there is still a buying window before future growth is fully priced in.

Price-to-Earnings of 10.9x: Is it justified?

Republic Bancorp trades at a price-to-earnings ratio of 10.9x, putting its shares roughly in line with industry averages but just above the estimated fair multiple for the stock. With a last closing price of $70.99, this signals the market is pricing in steady profitability and possibly a small premium for consistency or sector resilience.

The price-to-earnings (P/E) ratio compares a company’s share price to its per-share earnings. This is a key metric for banks, reflecting both recent profitability and future expectations. For a regional bank like Republic Bancorp, it measures how much investors are willing to pay for every dollar of earnings, especially as sector dynamics shift.

Right now, Republic Bancorp’s P/E sits slightly above its fair value estimate of 10x. This suggests the market is cautiously optimistic, assigning a premium over what regression models say is justified. However, when compared with the broader US Banks industry P/E of 11.2x and the peer average of 11x, Republic’s multiple appears sensible. This positions Republic between a median and premium valuation, neither a deep bargain nor expensive outlier.

Explore the SWS fair ratio for Republic Bancorp

Result: Price-to-Earnings of 10.9x (ABOUT RIGHT)

However, slowing annual net income growth and recent share price declines could challenge the case for continued upside if headwinds persist.

Find out about the key risks to this Republic Bancorp narrative.

Another View: Discounted Cash Flow Perspective

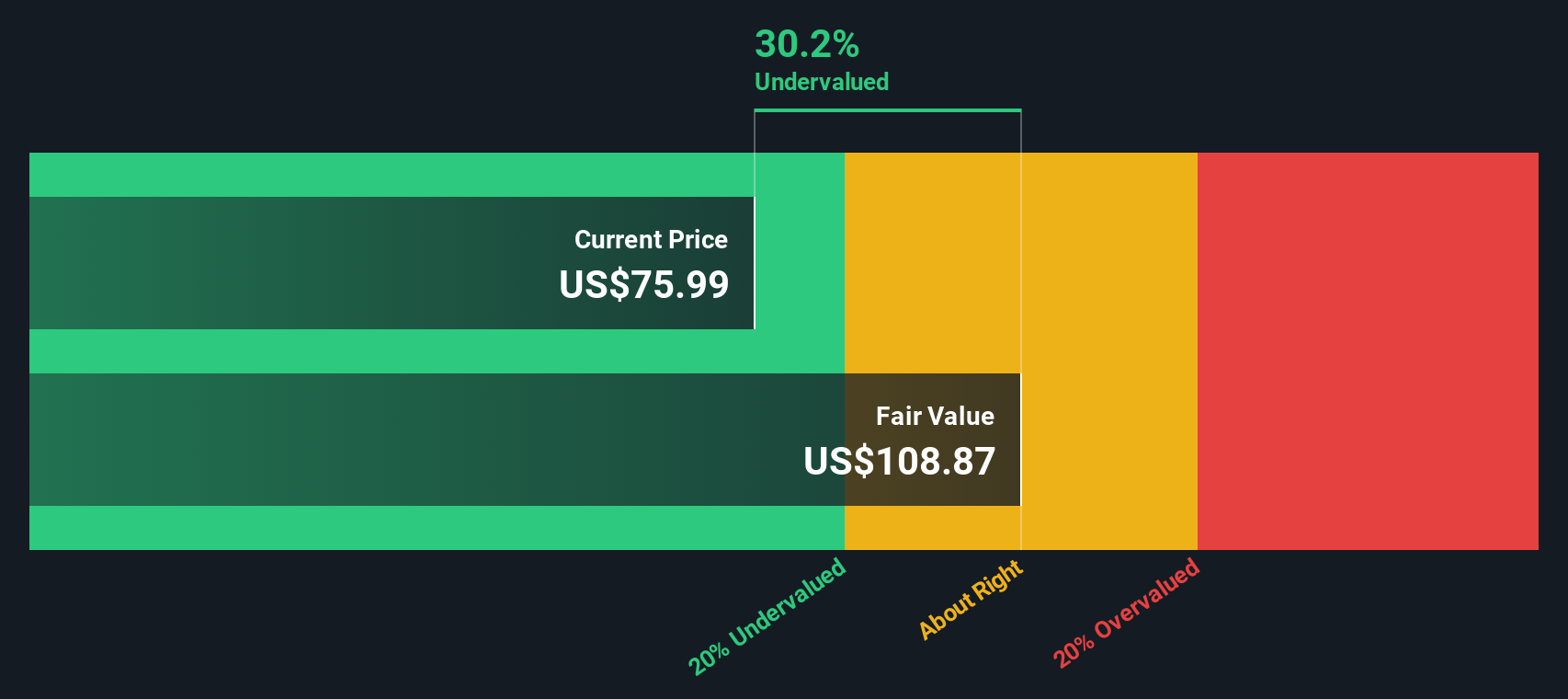

Looking beyond the price-to-earnings ratio, our DCF model takes a long-term view of Republic Bancorp’s cash flows. By this method, the shares appear significantly undervalued, trading about 37% below our estimated fair value of $112.15. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Republic Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Republic Bancorp Narrative

If you see the numbers differently or want to dig deeper, you can use our tools to analyze the fundamentals and build your narrative in under three minutes. Do this all at your own pace: Do it your way.

A great starting point for your Republic Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next high-potential opportunity slip away. Use the Simply Wall Street Screener to pinpoint fast-rising stocks and unlock fresh angles for your portfolio.

- Capture potential with these 3601 penny stocks with strong financials, uncovering promising small companies delivering outsized returns before the crowd catches on.

- Spark your portfolio’s growth by harnessing these 24 AI penny stocks, as they power the future with breakthroughs in artificial intelligence across multiple industries.

- Benefit from steady income streams by targeting these 18 dividend stocks with yields > 3%, featuring businesses handing out robust yields and dependable shareholder rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives