- United States

- /

- Banks

- /

- NasdaqGS:RBB

RBB Bancorp (RBB) Margin Miss Challenges Bull Narratives on Profit Recovery Prospects

Reviewed by Simply Wall St

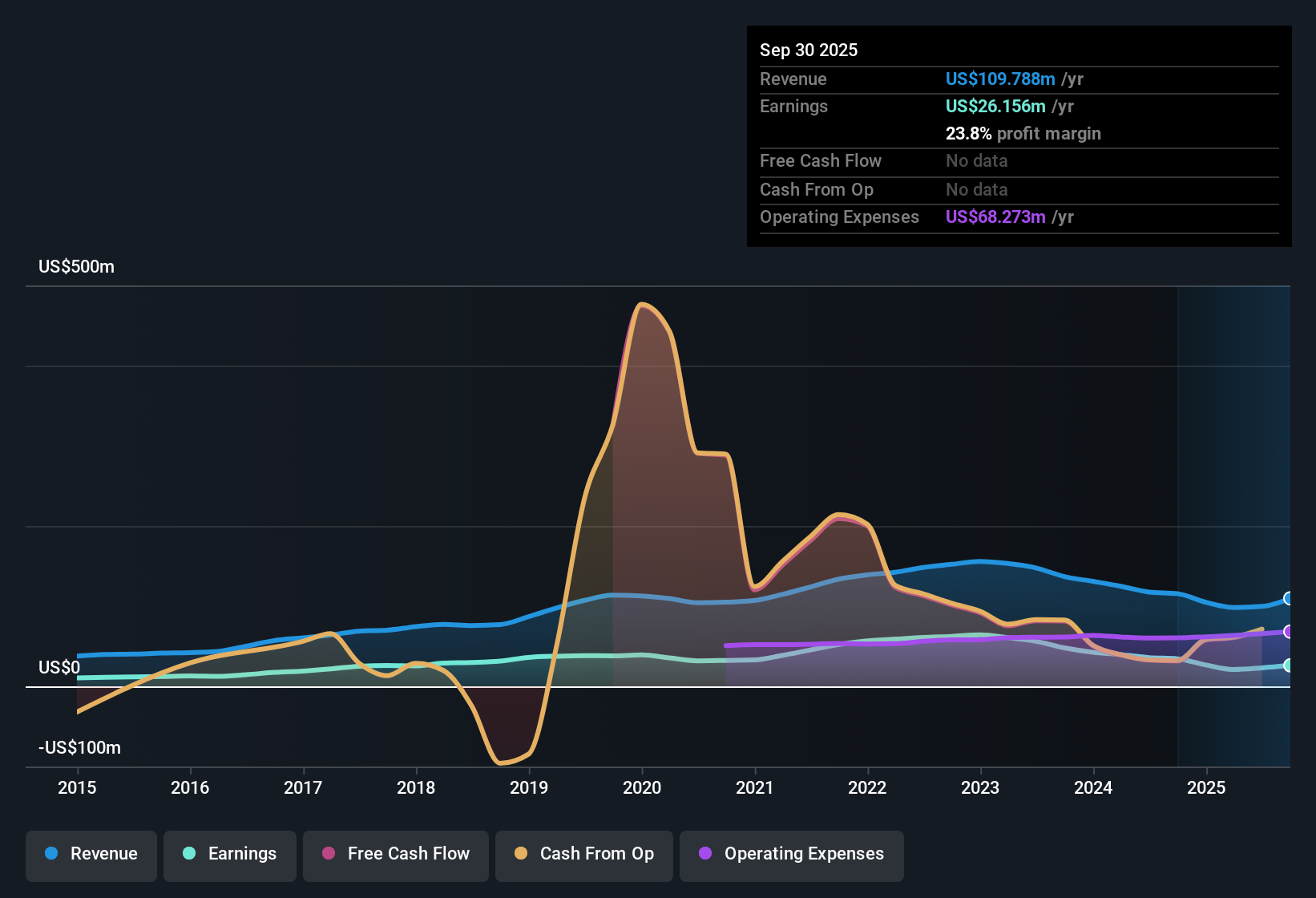

RBB Bancorp (RBB) reported a net profit margin of 23.8%, below last year’s 29.7%, with annual earnings declining by 9.6% per year over the past five years. Looking forward, analysts forecast a dramatic turnaround with earnings growth of 24.1% per year and revenue growth of 15.6% per year, both outpacing the US market average. These projections arrive as investors weigh peer-relative value and a flagged risk for dividend sustainability.

See our full analysis for RBB Bancorp.The next section will break down how these latest results compare with the market’s consensus and community narratives, identifying which expectations hold up and which are due for a rethink.

See what the community is saying about RBB Bancorp

Profit Margin Pins Hopes on Tight Cost Control

- RBB’s net profit margin has narrowed to 23.8%, falling from last year’s 29.7%. This contrasts with the forecast that margins could rebound to 26.3% in three years.

- According to the analysts' consensus view, future margin expansion depends heavily on digitization and disciplined lending, with two important caveats:

- Ongoing investments in digital banking are identified as a driver of efficiency and scalability. However, the increase in compensation and technology expenses may offset these benefits if not tightly managed.

- Profit margin recovery could be undermined if competitive deposit costs and expense discipline pressures persist, particularly as the bank faces aggressive lending and geographic concentration risks.

It is notable how closely margin recovery hinges on balancing technology investment against tighter cost ratios. Analysts see this as a major factor for future profitability. 📊 Read the full RBB Bancorp Consensus Narrative.

Lending Aggression Raises Credit Quality Flags

- The bank’s loan-to-deposit ratio now exceeds 100%, reflecting an assertive push for loan growth that leaves little room for funding slack.

- Consensus narrative stresses that while robust minority and immigrant lending drives core revenue expansion, increasing criticized and substandard loans could force higher loss provisions if regional real estate falters:

- This aggressive stance in key markets like New York and California exposes the bottom line to greater swings from local economic shocks if property values soften or defaults rise.

- Even with prudent asset quality controls, elevated credit pressures may challenge net income if losses spike, especially given the already tight margin context.

Peer Value Stands Out Despite Sector Discount

- RBB trades at a Price-to-Earnings ratio of 12.3x, cheaper than the peer average of 14.3x but higher than the US Banks industry’s 11.3x. Its current share price of $18.80 sits just below both the analyst target of $20.40 and the DCF fair value of $18.59.

- Analysts' consensus view highlights two drivers that keep the valuation attractive relative to peers:

- Forecast double-digit annual growth in both revenue (15.6%) and earnings (24.1%) supports the case for a premium, provided execution keeps pace with demographic tailwinds and digital gains.

- However, the relatively modest premium to sector averages means the upside is limited unless RBB Bancorp can convincingly deliver margin recovery and withstand deposit competition.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for RBB Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something the story missed? Share your own take and shape a personal narrative in just a few minutes: Do it your way

A great starting point for your RBB Bancorp research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

RBB Bancorp’s earnings outlook relies on tight cost control and margin recovery, but risks remain from aggressive lending and growing credit quality pressures.

If you prefer steady performance over volatility, focus on companies consistently expanding earnings and revenue. Discover potential opportunities with stable growth stocks screener (2087 results) built for more reliable growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBB

RBB Bancorp

Operates as the bank holding company for Royal Business Bank that provides various banking products and services to the Chinese-American, Korean-American, and other Asian-American communities.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives