- United States

- /

- Banks

- /

- NasdaqGS:PWOD

Top US Dividend Stocks For August 2024

Reviewed by Simply Wall St

As of August 2024, the U.S. stock market has experienced a slight pullback after an impressive rally, with major indices like the S&P 500 and Nasdaq Composite snapping their winning streaks. Despite this minor setback, investor sentiment remains optimistic due to expectations of upcoming interest rate cuts by the Federal Reserve. In such a dynamic market environment, dividend stocks can offer stability and consistent income streams for investors seeking to navigate economic fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.09% | ★★★★★★ |

| WesBanco (NasdaqGS:WSBC) | 4.68% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.22% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.97% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.19% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.91% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.58% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.58% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.51% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.51% | ★★★★★★ |

Click here to see the full list of 185 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

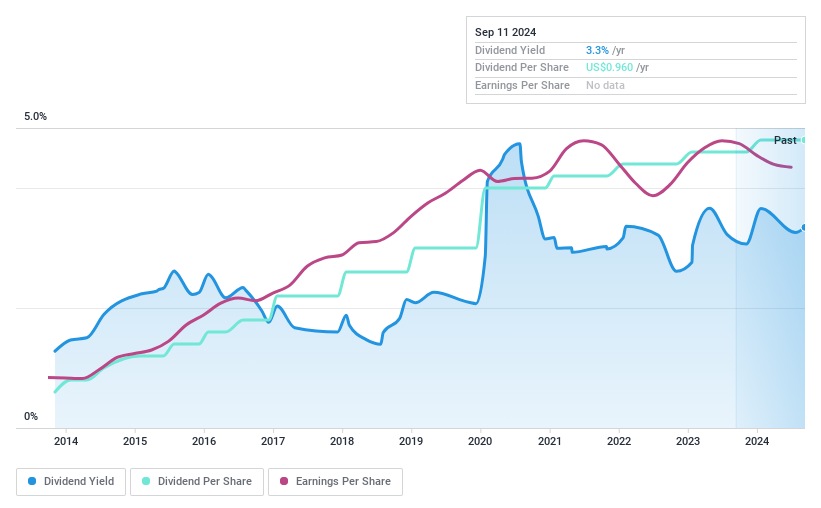

Timberland Bancorp (NasdaqGM:TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc., with a market cap of $236.11 million, operates as the bank holding company for Timberland Bank, offering various community banking services in Washington.

Operations: Timberland Bancorp, Inc. generates $74.39 million in revenue from its community banking services in Washington.

Dividend Yield: 3.2%

Timberland Bancorp offers a stable dividend yield of 3.22%, which is below the top 25% of US dividend payers but has been reliable and growing over the past decade. The company's payout ratio is low at 30.9%, indicating well-covered dividends by earnings. Recent financials show slight declines in net income and earnings per share, with a quarterly cash dividend of $0.24 declared in July 2024 alongside ongoing share repurchases totaling $5.68 million since July 2023.

- Delve into the full analysis dividend report here for a deeper understanding of Timberland Bancorp.

- The analysis detailed in our Timberland Bancorp valuation report hints at an deflated share price compared to its estimated value.

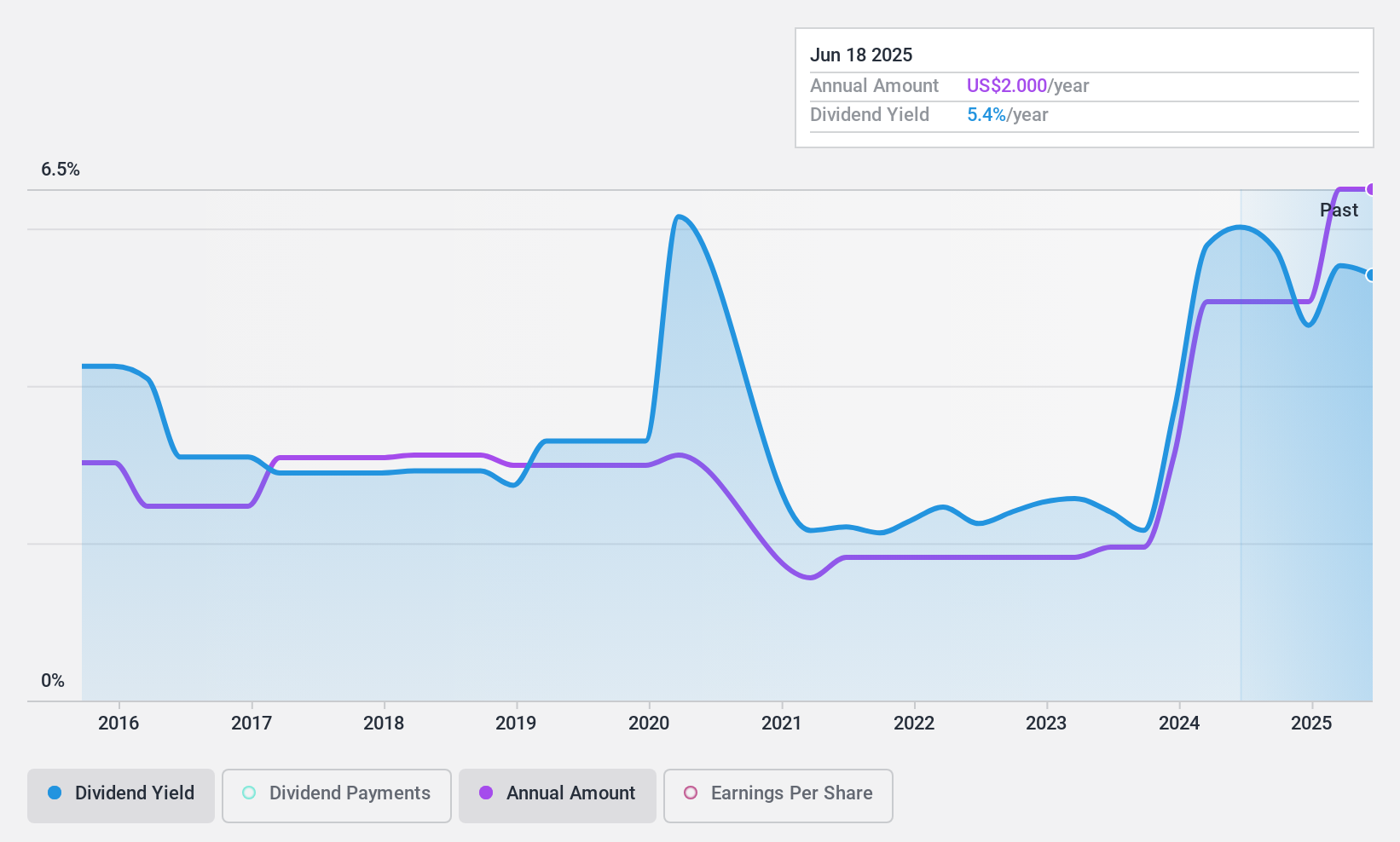

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd., with a market cap of $554.43M, offers location-based telematics services and machine-to-machine telematics products through its subsidiaries.

Operations: Ituran Location and Control Ltd. generates revenue through its location-based telematics services and machine-to-machine telematics products.

Dividend Yield: 5.5%

Ituran Location and Control reported strong earnings for Q2 2024, with revenue of US$84.87 million and net income of US$13.13 million, reflecting consistent growth. The company announced a dividend of $0.39 per share, totaling approximately US$8 million, to be paid on October 9, 2024. Despite a volatile dividend history over the past decade, current dividends are well-covered by earnings (24.7% payout ratio) and cash flows (49.7% cash payout ratio), indicating sustainability in the near term.

- Click here to discover the nuances of Ituran Location and Control with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Ituran Location and Control's current price could be quite moderate.

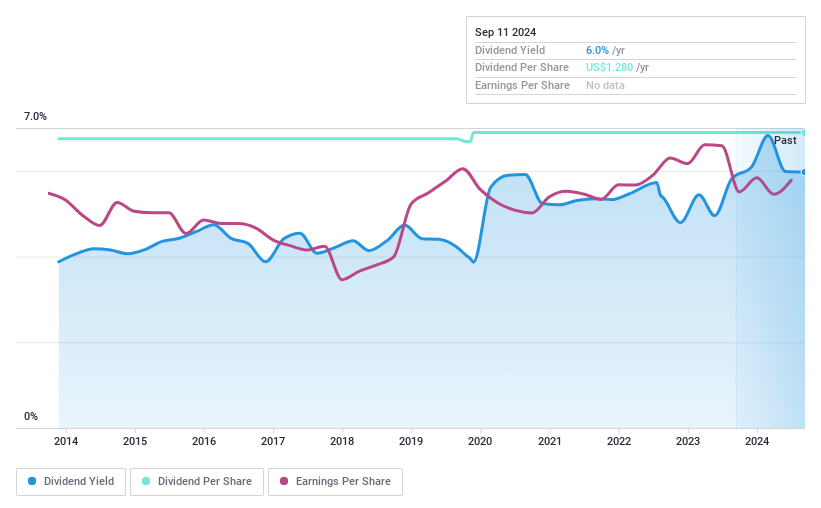

Penns Woods Bancorp (NasdaqGS:PWOD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Penns Woods Bancorp, Inc., with a market cap of $176.32 million, operates as the bank holding company for Jersey Shore State Bank, providing commercial and retail banking services to individuals, partnerships, non-profit organizations, and corporations.

Operations: Penns Woods Bancorp, Inc. generates $64.82 million from its Community Banking segment.

Dividend Yield: 5.5%

Penns Woods Bancorp's recent earnings report shows solid financial performance, with Q2 net interest income at US$14.52 million and net income of US$5.39 million, up from the previous year. The company declared a Q2 2024 dividend of $0.32 per share, maintaining a stable and reliable dividend history over the past decade with a payout ratio of 55.4%. However, it was recently dropped from multiple Russell indices and has not repurchased any shares under its buyback program announced in May 2023.

- Dive into the specifics of Penns Woods Bancorp here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Penns Woods Bancorp shares in the market.

Key Takeaways

- Take a closer look at our Top US Dividend Stocks list of 185 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PWOD

Penns Woods Bancorp

Operates as the bank holding company for Jersey Shore State Bank, which provides commercial and retail banking services to individuals, partnerships, non-profit organizations, and corporations.

Flawless balance sheet established dividend payer.