- United States

- /

- Banks

- /

- NasdaqGS:PROV

Provident Financial Holdings (PROV) Margin Miss Reinforces Concerns Over Valuation Premium

Reviewed by Simply Wall St

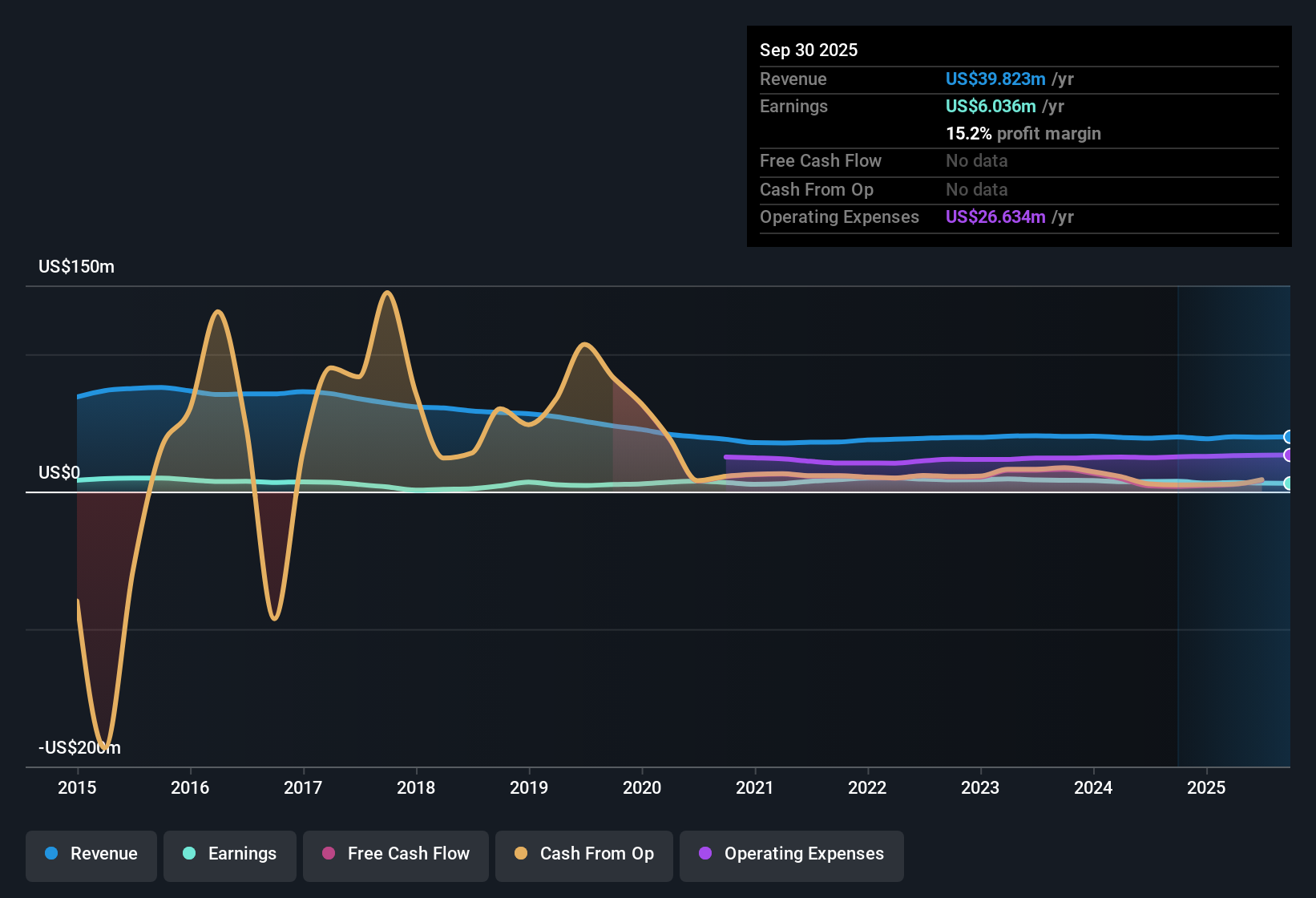

Provident Financial Holdings (PROV) posted net profit margins of 15.2% for the period, a drop from last year's 18.8%. Over the past twelve months, earnings growth turned negative, with average annual earnings declining by 2.4% over the last five years. Revenue is forecast to grow at 3.1% per year, trailing the broader US market’s predicted 10.2% annual pace, and its shares are currently trading at $15.79, a premium to both industry and peer price-to-earnings ratios, as well as above an estimated fair value of $8.51. With margins under pressure and limited growth ahead, investors may see mixed signals from the latest results, but the stock’s attractive dividend remains a potential draw for income-seekers.

See our full analysis for Provident Financial Holdings.Next up, we’ll dive into how these latest figures compare with the broader market narratives, highlighting where the numbers confirm or challenge current consensus views.

See what the community is saying about Provident Financial Holdings

Analyst Price Target Just Above Current Price

- The analyst price target stands at $16.00 per share versus the current market price of $15.79. This means the stock is trading only 1.3% below where analysts believe it should be valued today.

- According to the analysts' consensus view, this near alignment reflects their expectation that annual revenue could rise 4.8% and earnings may climb from $6.3 million now to $9.8 million by September 2028.

- However, consensus calls for a future P/E of 13.0x, which remains well above the US banks industry average of 11.2x. This price target assumes stronger profitability and margin expansion than the company has recently delivered.

See what's driving the consensus call and whether fresh results have changed the narrative with the full community perspective. 📊 Read the full Provident Financial Holdings Consensus Narrative.

P/E Ratio Premium Signals High Expectations

- Provident trades at a 17.2x P/E, meaning it is valued 54% above the US Banks industry average of 11.2x and also above the peer average of 12.4x.

- Consensus narrative recognizes this premium, noting that even if profit margins expand to 21.4% in the next three years as analysts anticipate,

- the market is effectively pricing in significant improvements in earnings quality, as the current multiple is higher than both industry and peer norms, even with structurally lower forecasted growth (3.1% versus the market’s 10.2%).

Persistent Margin Pressures Despite Asset Quality

- Net profit margins have dropped from 18.8% to 15.2% year-on-year, continuing a five-year average earnings decline of 2.4% annually.

- Consensus narrative highlights that while digitalization and strong asset quality help shield against worsening credit losses,

- the effort to improve efficiency and contain expenses has not yet reversed the pressures on core profitability, which remains below prior levels and at risk as operational expenses climb.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Provident Financial Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a fresh angle? Share your viewpoint and craft your personal take in just a few minutes. Do it your way

A great starting point for your Provident Financial Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Provident Financial Holdings faces margin pressures, slow earnings growth, and trades at a premium, which signals valuation concerns despite analyst optimism.

If you want better value for your investment, check out these 854 undervalued stocks based on cash flows and discover companies priced below their intrinsic worth with stronger upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PROV

Provident Financial Holdings

Operates as the bank holding company for Provident Savings Bank, F.S.B.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives