- United States

- /

- Banks

- /

- NasdaqGS:PNFP

With EPS Growth And More, Pinnacle Financial Partners (NASDAQ:PNFP) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Pinnacle Financial Partners (NASDAQ:PNFP), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Pinnacle Financial Partners

How Fast Is Pinnacle Financial Partners Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Pinnacle Financial Partners has grown EPS by 12% per year. That growth rate is fairly good, assuming the company can keep it up.

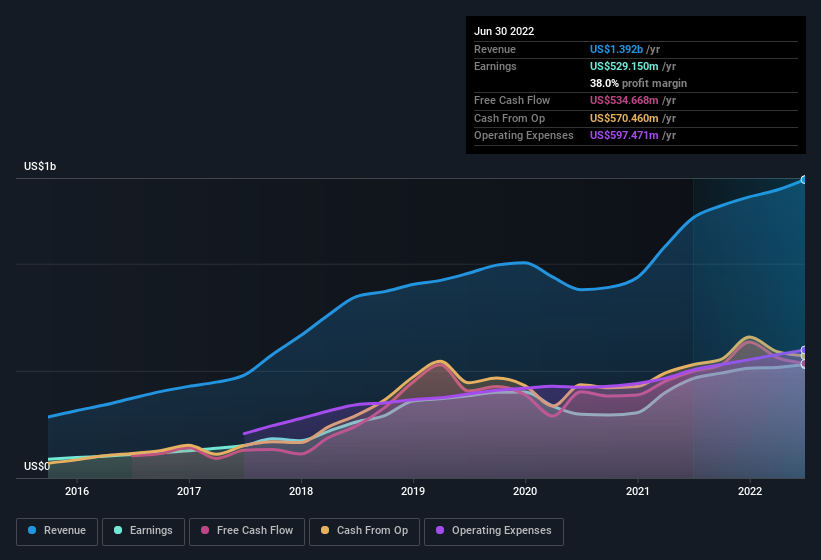

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Pinnacle Financial Partners' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Pinnacle Financial Partners remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to US$1.4b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Pinnacle Financial Partners' future EPS 100% free.

Are Pinnacle Financial Partners Insiders Aligned With All Shareholders?

Since Pinnacle Financial Partners has a market capitalisation of US$6.3b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$136m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between US$4.0b and US$12b, like Pinnacle Financial Partners, the median CEO pay is around US$8.4m.

The Pinnacle Financial Partners CEO received US$6.8m in compensation for the year ending December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Pinnacle Financial Partners To Your Watchlist?

One important encouraging feature of Pinnacle Financial Partners is that it is growing profits. Earnings growth might be the main attraction for Pinnacle Financial Partners, but the fun does not stop there. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. What about risks? Every company has them, and we've spotted 1 warning sign for Pinnacle Financial Partners you should know about.

Although Pinnacle Financial Partners certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PNFP

Pinnacle Financial Partners

Operates as the bank holding company for Pinnacle Bank that provides various banking products and services to individuals, businesses, and professional entities in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives