Some Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) shareholders may be a little concerned to see that the Co-Founder & Chairman, Robert McCabe, recently sold a substantial US$630k worth of stock at a price of US$93.00 per share. However, it's crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 2.2%.

Pinnacle Financial Partners Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the insider, David Ingram, for US$7.3m worth of shares, at about US$127 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The silver lining is that this sell-down took place above the latest price (US$91.68). So it may not tell us anything about how insiders feel about the current share price. Notably David Ingram was also the biggest buyer, having purchased US$3.5m worth of shares.

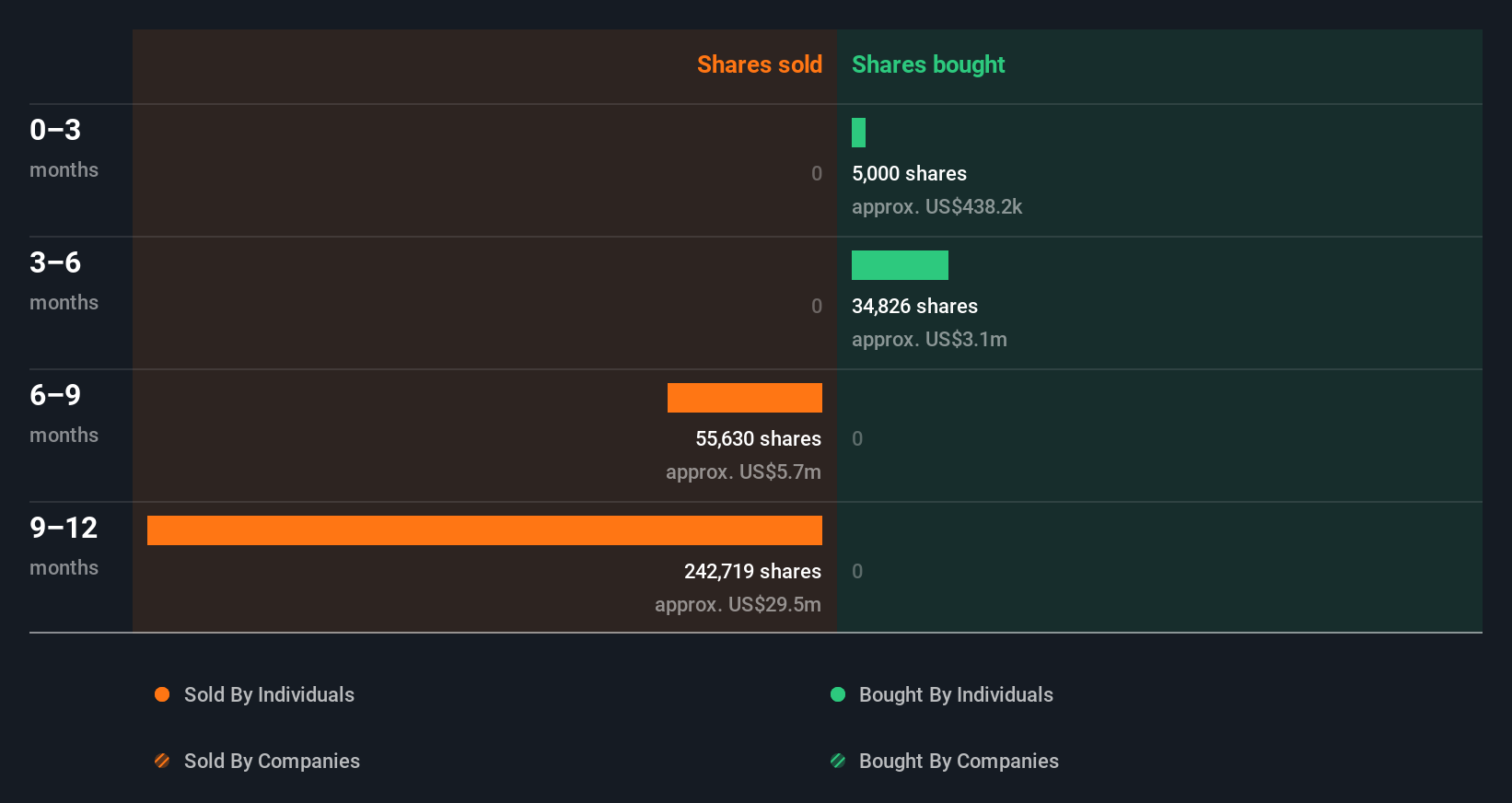

Over the last year, we can see that insiders have bought 39.83k shares worth US$3.5m. But insiders sold 305.12k shares worth US$36m. All up, insiders sold more shares in Pinnacle Financial Partners than they bought, over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

See our latest analysis for Pinnacle Financial Partners

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership Of Pinnacle Financial Partners

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Pinnacle Financial Partners insiders own 1.7% of the company, currently worth about US$118m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Pinnacle Financial Partners Insiders?

The stark truth for Pinnacle Financial Partners is that there has been more insider selling than insider buying in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. But since Pinnacle Financial Partners is profitable and growing, we're not too worried by this. It is good to see high insider ownership, but the insider selling leaves us cautious. Therefore, you should definitely take a look at this FREE report showing analyst forecasts for Pinnacle Financial Partners.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PNFP

Pinnacle Financial Partners

Operates as the bank holding company for Pinnacle Bank that provides various banking products and services to individuals, businesses, and professional entities in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.