- United States

- /

- Banks

- /

- NasdaqGM:PNBK

Patriot National Bancorp (NASDAQ:PNBK investor three-year losses grow to 88% as the stock sheds US$23m this past week

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of Patriot National Bancorp, Inc. (NASDAQ:PNBK) investors who have held the stock for three years as it declined a whopping 88%. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 21%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

If the past week is anything to go by, investor sentiment for Patriot National Bancorp isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Patriot National Bancorp isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Patriot National Bancorp saw its revenue shrink by 26% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 23% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

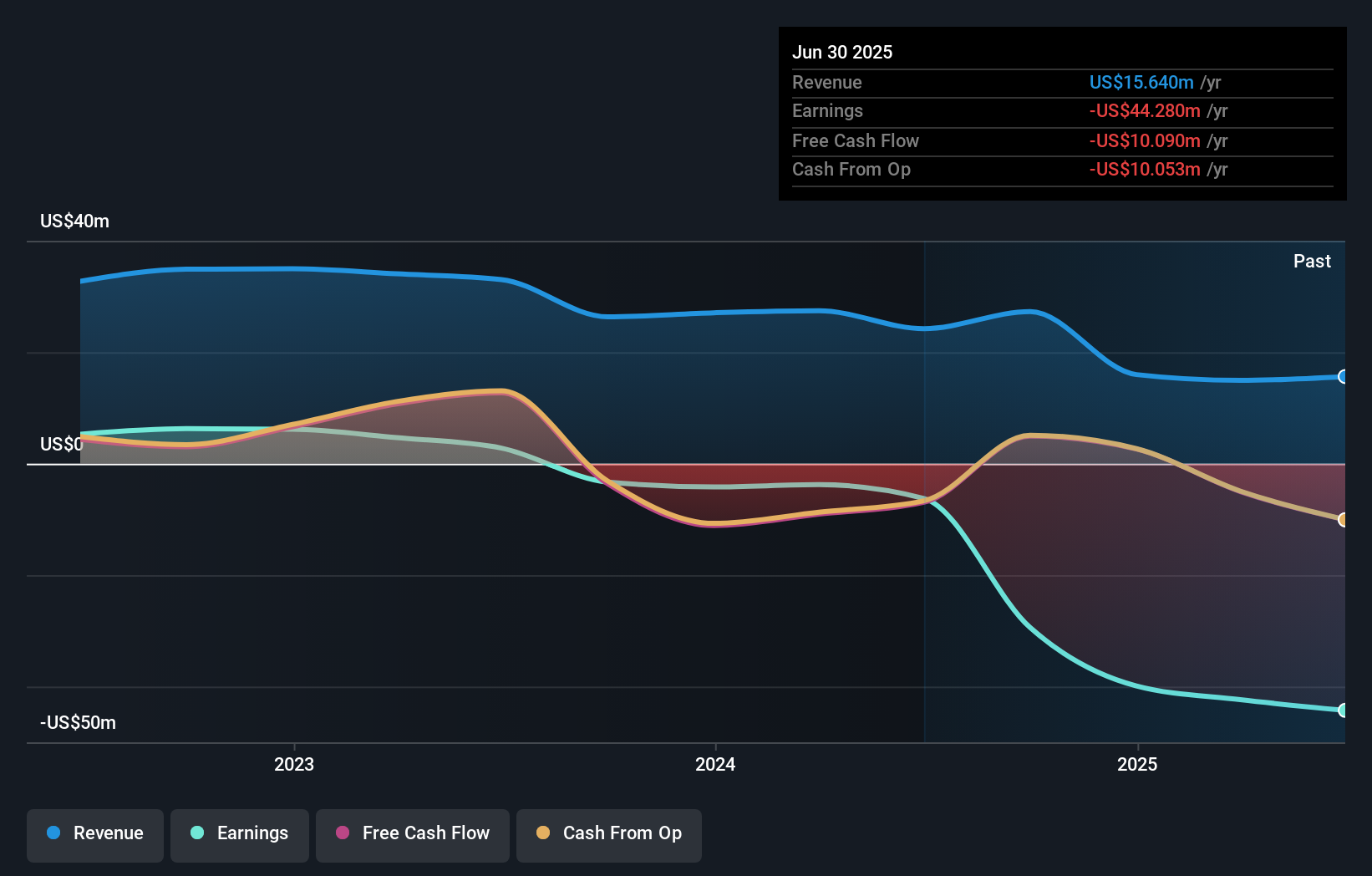

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Patriot National Bancorp's earnings, revenue and cash flow.

A Different Perspective

Patriot National Bancorp shareholders are down 21% for the year, but the market itself is up 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Patriot National Bancorp is showing 2 warning signs in our investment analysis , you should know about...

Patriot National Bancorp is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PNBK

Patriot National Bancorp

Operates as the holding company for Patriot Bank, N.A.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives