- United States

- /

- Banks

- /

- NasdaqCM:PLBC

Plumas Bancorp (PLBC) Margin Decline Challenges Bullish Growth Narrative Despite Discounted Valuation

Reviewed by Simply Wall St

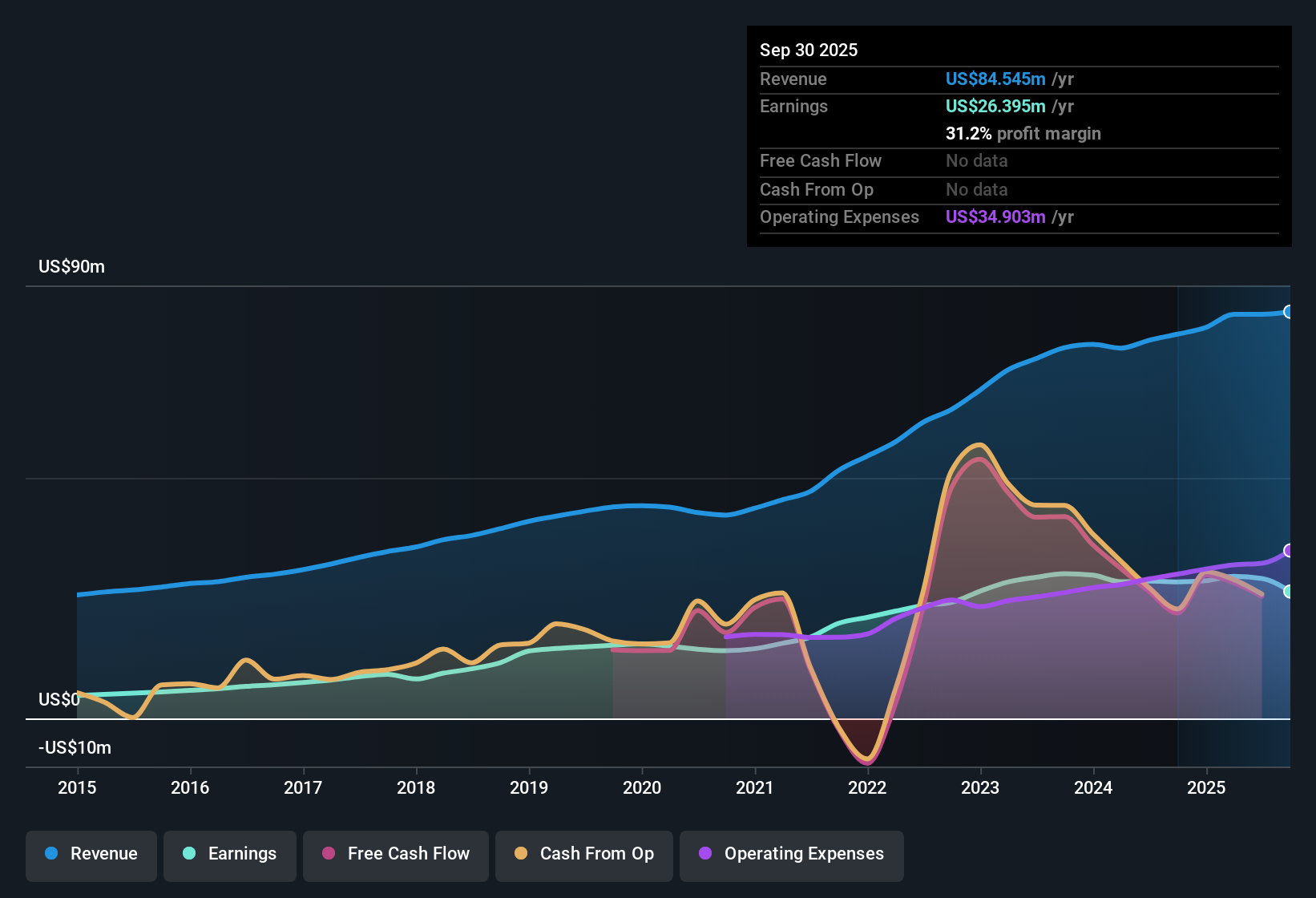

Plumas Bancorp (PLBC) posted revenue growth forecasts of 14.2% per year, topping the US market’s 10% outlook, and projected annual EPS gains of 19.7%, also above the national average of 15.5%. While the company has averaged 12.6% annual earnings growth over the past five years, it hit negative EPS growth in the most recent year, and profit margins have slipped to 31.2% from 35.5% last year. With shares trading at $42.8, which is well under the estimated fair value of $159.54 and below analyst price targets, investors have reasons to be upbeat about the valuation. However, near-term earnings volatility and margin declines warrant attention.

See our full analysis for Plumas Bancorp.The next step is putting these results into context by weighing them against the key narratives that drive sentiment among investors and analysts.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Retreat from Recent Highs

- Plumas Bancorp's profit margins have dipped to 31.2%, down from 35.5% in the prior year, marking a notable slip in efficiency even as the five-year annual earnings growth averaged 12.6%.

- What’s surprising is that, despite this margin compression, the prevailing market view focuses on PLBC's resilience as a community bank and sees it as relatively stable, anchored by:

- Above-market projected earnings growth of 19.7% per year, suggesting robust underlying momentum.

- A reputation for conservative management and disciplined lending practices, as regional peers struggle with sector headwinds.

Valuation Discount Stands Out Against Peers

- The shares trade at $42.80, meaningfully below both the only permitted analyst target ($55.00) and the much higher DCF fair value of $159.54. The price-to-earnings ratio of 11.3x sits just under the US Banks industry average of 11.7x but above the peer average of 9x.

- Bulls highlight that this combination of a value discount plus high-quality earnings makes PLBC appealing even after recent profit margin declines, as:

- Shares are positioned to benefit if margins recover or sector sentiment improves, potentially narrowing the gap to both analyst targets and DCF-based valuations.

- Investor focus is likely to remain on the company's discounted price and outperformance of sector growth expectations, especially if near-term volatility eases.

Risk Profile: No Major New Concerns Flagged

- EDGAR’s summary notes that no significant risks or new concerns are highlighted for Plumas Bancorp, leaving the reward case centered on positive growth projections and valuation upside rather than defensive stability.

- The prevailing market view asserts that Plumas’ steady fundamentals and quality earnings support its defensive reputation, particularly:

- Because the current price bakes in recent earnings volatility, so risk-averse investors may see little additional downside unless industry-wide shocks emerge.

- Periodic margin pressure is not unusual among community banks, and stable risk indicators make the long-term case more compelling than short-term trading moves.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Plumas Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite its above-market growth forecasts, Plumas Bancorp faces earnings volatility and profit margin declines. These factors raise questions about the consistency of its future performance.

If you want reliable compounding instead, use stable growth stocks screener (2096 results) to find companies demonstrating stable earnings and revenue growth through market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLBC

Plumas Bancorp

Operates as the bank holding company for the Plumas Bank that provides various banking products and services for small and middle market businesses and individuals in California, Nevada, and Oregon.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives