- United States

- /

- Banks

- /

- NasdaqGS:PFBC

Here's Why We Think Preferred Bank (NASDAQ:PFBC) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Preferred Bank (NASDAQ:PFBC), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Preferred Bank

Preferred Bank's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Preferred Bank has managed to grow EPS by 29% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

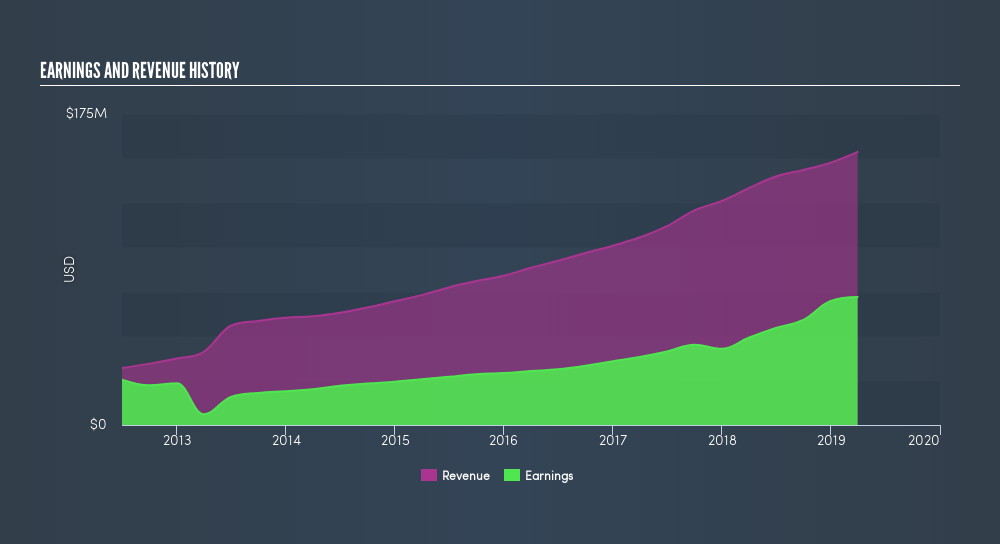

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Preferred Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Preferred Bank maintained stable EBIT margins over the last year, all while growing revenue 15% to US$154m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Preferred Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Preferred Bank Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company, if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Preferred Bank insiders have a significant amount of capital invested in the stock. Given insiders own a small fortune of shares, currently valued at US$61m, they have plenty of motivation to push the business to succeed. That holding amounts to 8.5% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Is Preferred Bank Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Preferred Bank's strong EPS growth. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Preferred Bank is trading on a high P/E or a low P/E, relative to its industry.

Although Preferred Bank certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this freelist of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PFBC

Preferred Bank

Provides various banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, professionals, and high net worth individuals.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives