- United States

- /

- Banks

- /

- NasdaqGS:PACW

Read This Before Buying PacWest Bancorp (NASDAQ:PACW) For Its Dividend

Is PacWest Bancorp (NASDAQ:PACW) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

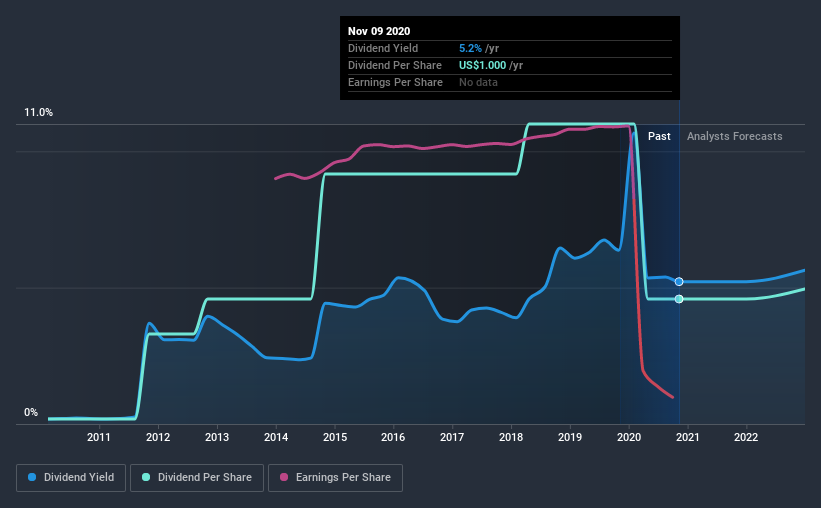

A high yield and a long history of paying dividends is an appealing combination for PacWest Bancorp. We'd guess that plenty of investors have purchased it for the income. During the year, the company also conducted a buyback equivalent to around 3.4% of its market capitalisation. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Although PacWest Bancorp pays a dividend, it was loss-making during the past year. When a financial business is loss-making and pays a dividend, the dividend is not covered by profits. Its important that investors assess the quality of the company's assets and whether it can return to generating a positive income.

We update our data on PacWest Bancorp every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. PacWest Bancorp has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was US$0.04 in 2010, compared to US$1.0 last year. Dividends per share have grown at approximately 38% per year over this time. The dividends haven't grown at precisely 38% every year, but this is a useful way to average out the historical rate of growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Over the past five years, it looks as though PacWest Bancorp's EPS have declined at around 40% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and PacWest Bancorp's earnings per share, which support the dividend, have been anything but stable.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, it's not great to see a dividend being paid despite the company being unprofitable over the last year. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. With any dividend stock, we look for a sustainable payout ratio, steady dividends, and growing earnings. PacWest Bancorp has a few too many issues for us to get interested.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for PacWest Bancorp that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading PacWest Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:PACW

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives