- United States

- /

- Banks

- /

- NasdaqCM:OVLY

Does Oak Valley Bancorp (NASDAQ:OVLY) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Oak Valley Bancorp (NASDAQ:OVLY). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Oak Valley Bancorp

Oak Valley Bancorp's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Oak Valley Bancorp managed to grow EPS by 14% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

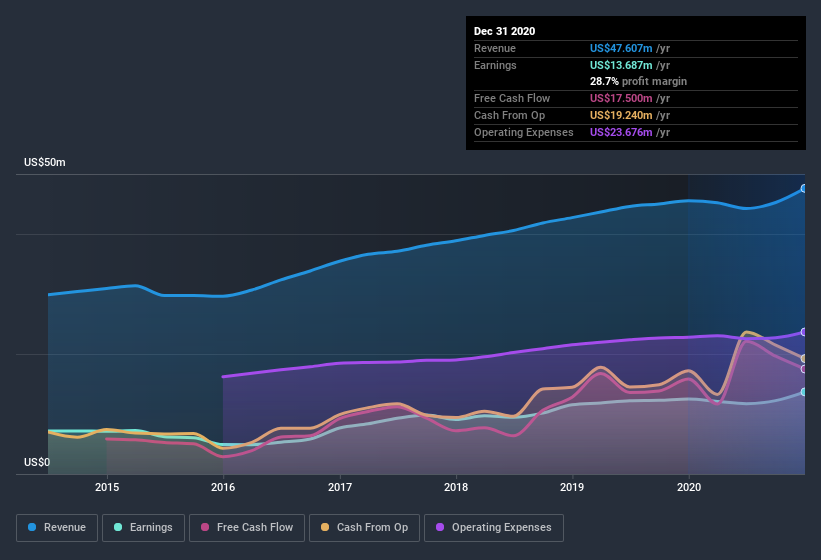

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Oak Valley Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Oak Valley Bancorp maintained stable EBIT margins over the last year, all while growing revenue 4.6% to US$48m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Oak Valley Bancorp is no giant, with a market capitalization of US$137m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Oak Valley Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Oak Valley Bancorp insiders did net -US$24k selling stock over the last year, they invested US$523k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by Independent Director H. Holder for US$155k worth of shares, at about US$15.47 per share.

The good news, alongside the insider buying, for Oak Valley Bancorp bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$26m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 19% of the company; visible skin in the game.

Should You Add Oak Valley Bancorp To Your Watchlist?

As I already mentioned, Oak Valley Bancorp is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Still, you should learn about the 1 warning sign we've spotted with Oak Valley Bancorp .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Oak Valley Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Oak Valley Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Oak Valley Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OVLY

Oak Valley Bancorp

Operates as the bank holding company for Oak Valley Community Bank that provides a range of commercial banking services to individuals and small to medium-sized businesses in the Central Valley and the Eastern Sierras.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives