- United States

- /

- Oil and Gas

- /

- NYSE:CTRA

US Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As U.S. markets experience fluctuations with the Dow Jones slipping slightly ahead of anticipated comments from Federal Reserve Chair Jerome Powell, investors are keeping a close eye on economic indicators and interest rate decisions. In this environment, dividend stocks can offer stability and income potential, making them an appealing option for those looking to navigate the current market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.86% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.51% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.65% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.41% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.61% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ohio Valley Banc (NasdaqGM:OVBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ohio Valley Banc Corp., with a market cap of $115.66 million, operates as the bank holding company for The Ohio Valley Bank Company, offering commercial and consumer banking products and services.

Operations: Ohio Valley Banc Corp.'s revenue segments include commercial and consumer banking products and services.

Dividend Yield: 3.4%

Ohio Valley Banc offers a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 35.7%, indicating dividends are well-covered by earnings. The recent dividend declaration of $0.22 per share underscores its commitment to shareholders, despite net income declines in the nine months ending September 2024. However, its yield of 3.45% is below top-tier US dividend payers, and recent charge-offs could impact future financial flexibility.

- Dive into the specifics of Ohio Valley Banc here with our thorough dividend report.

- Our valuation report unveils the possibility Ohio Valley Banc's shares may be trading at a discount.

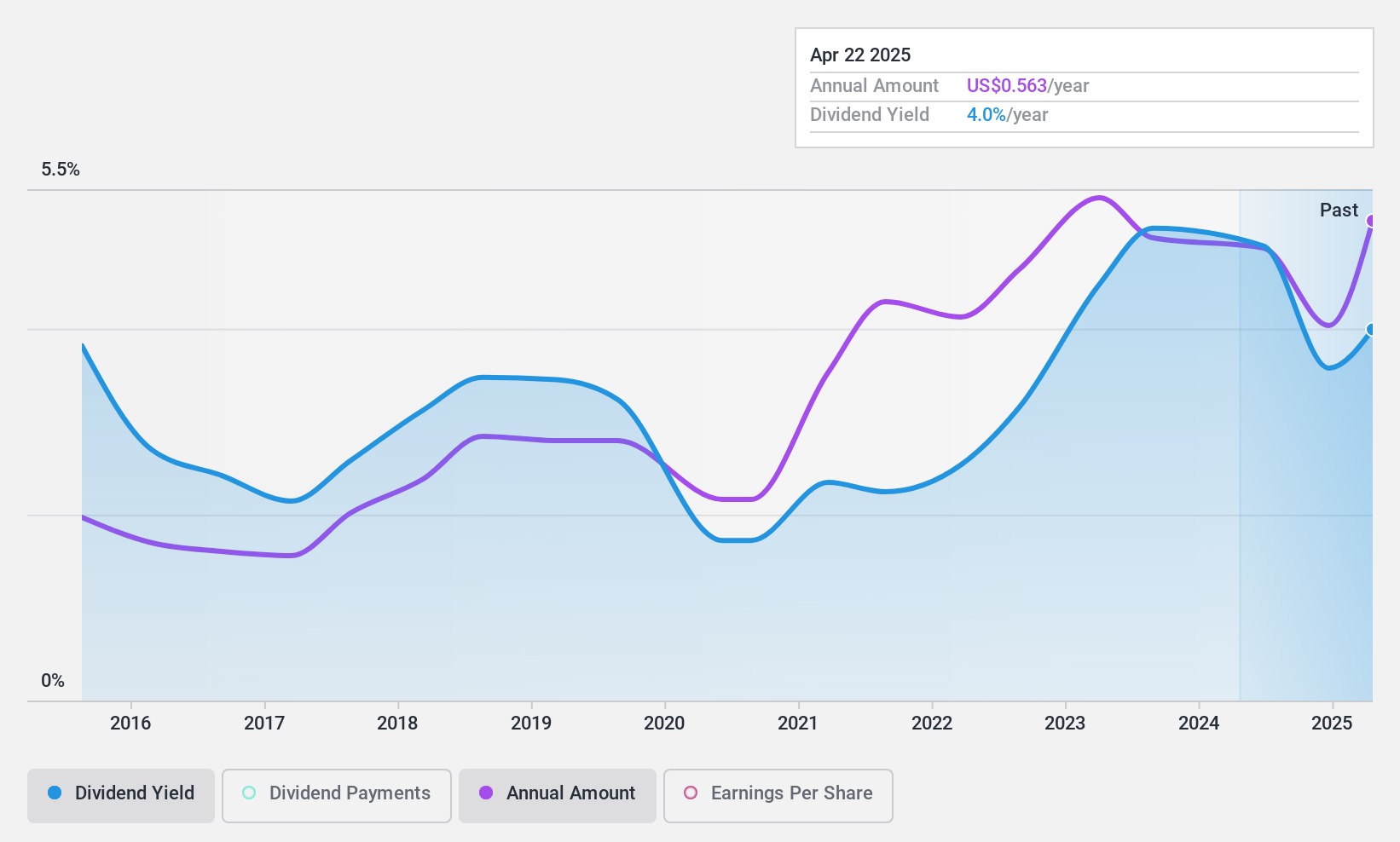

Magic Software Enterprises (NasdaqGS:MGIC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Magic Software Enterprises Ltd. offers proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services both in Israel and internationally, with a market cap of $546.48 million.

Operations: Magic Software Enterprises Ltd. generates revenue through its proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based offerings across global markets.

Dividend Yield: 4.7%

Magic Software Enterprises faces challenges with a volatile dividend history over the past decade. Despite this, its current dividend yield of 4.72% ranks it among the top 25% of US dividend payers. The payout ratio is reasonable at 70.4%, indicating dividends are covered by earnings, while a low cash payout ratio of 35.6% shows strong cash flow support. The company reaffirmed its annual revenue guidance for 2024 between US$540 million and US$550 million.

- Click here to discover the nuances of Magic Software Enterprises with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Magic Software Enterprises is trading behind its estimated value.

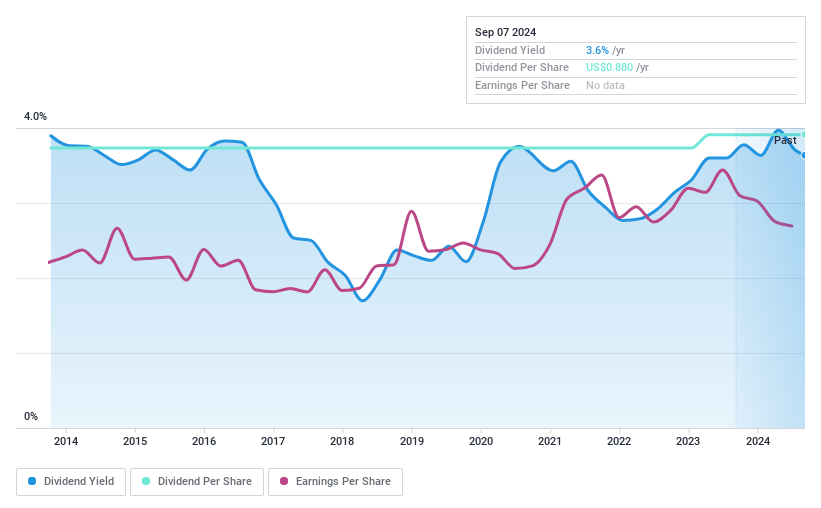

Coterra Energy (NYSE:CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of approximately $18.57 billion.

Operations: Coterra Energy Inc.'s revenue primarily comes from its natural gas and oil development, exploitation, exploration, and production segment, which generated approximately $5.50 billion.

Dividend Yield: 3.3%

Coterra Energy has a volatile dividend history, with recent payments yielding 3.5%. The payout ratio of 50% suggests dividends are supported by earnings, while a cash payout ratio of 55% indicates adequate cash flow coverage. Recent M&A activity includes acquiring assets for $3.95 billion, potentially impacting future dividend stability. Despite trading below estimated fair value and analyst price targets suggesting potential upside, profit margins have declined from last year’s levels, reflecting some financial pressure.

- Unlock comprehensive insights into our analysis of Coterra Energy stock in this dividend report.

- Our valuation report here indicates Coterra Energy may be undervalued.

Make It Happen

- Take a closer look at our Top US Dividend Stocks list of 138 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRA

Coterra Energy

An independent oil and gas company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with excellent balance sheet and pays a dividend.