- United States

- /

- Banks

- /

- NasdaqGM:CBFV

Top US Dividend Stocks To Consider In September 2024

Reviewed by Simply Wall St

As of September 2024, the U.S. stock market has shown mixed performance with the Dow Jones Industrial Average reaching a new record high while the S&P 500 and Nasdaq Composite experienced slight declines following a significant interest rate cut by the Federal Reserve. With economic conditions in flux, investors are increasingly looking towards stable income sources, making dividend stocks an attractive option. In such a dynamic environment, identifying robust dividend stocks can provide both steady income and potential for capital appreciation. Here are three top U.S. dividend stocks to consider this month.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.72% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.58% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.15% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.85% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.67% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.39% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.33% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.48% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.34% | ★★★★★★ |

Click here to see the full list of 171 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

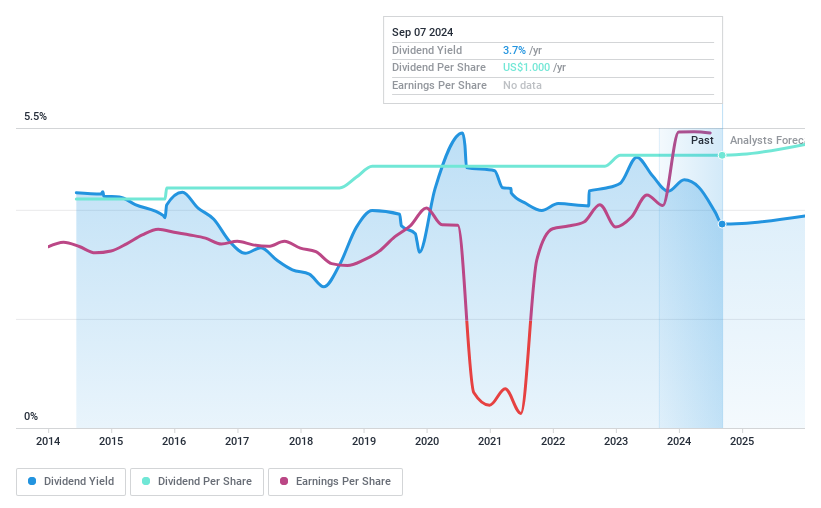

CB Financial Services (NasdaqGM:CBFV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CB Financial Services, Inc. operates as the bank holding company for Community Bank, offering a range of banking products and services to individuals and businesses in southwestern Pennsylvania, West Virginia, and Ohio, with a market cap of $151.12 million.

Operations: CB Financial Services, Inc. generates revenue primarily through its Community Bank segment ($41.13 million) and CB Financial Services, Inc. segment ($4.62 million), adjusted by net eliminations and segment adjustments totaling -$5.12 million and $26.92 million respectively.

Dividend Yield: 3.4%

CB Financial Services offers a stable dividend, with a quarterly cash payout of US$0.25 per share and a low payout ratio of 22.8%, indicating strong coverage by earnings. Despite recent net charge-offs and slight declines in net income, the company continues to expand its business operations, such as opening a new branch office in Rostraver, PA. However, its dividend yield of 3.4% is lower than the top 25% of US market payers at 4.32%.

- Dive into the specifics of CB Financial Services here with our thorough dividend report.

- According our valuation report, there's an indication that CB Financial Services' share price might be on the cheaper side.

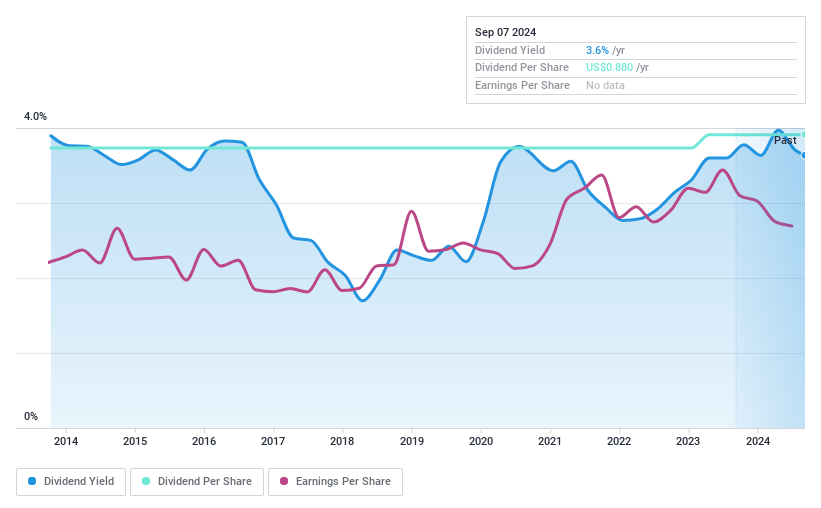

Ohio Valley Banc (NasdaqGM:OVBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ohio Valley Banc Corp. operates as the bank holding company for The Ohio Valley Bank Company, offering commercial and consumer banking products and services, with a market cap of $118.34 million.

Operations: Ohio Valley Banc Corp. generates revenue from two primary segments: $52.64 million from Banking and $3.25 million from Consumer Finance.

Dividend Yield: 3.5%

Ohio Valley Banc pays a reliable dividend of US$0.22 per share, with a stable and growing payout over the past decade. The dividend yield stands at 3.5%, lower than the top 25% of US market payers at 4.32%. With a low payout ratio of 37.3%, dividends are well covered by earnings. Recent activities include extending its buyback plan and repurchasing shares worth US$2.97 million, though it was recently dropped from several Russell indices.

- Delve into the full analysis dividend report here for a deeper understanding of Ohio Valley Banc.

- Our expertly prepared valuation report Ohio Valley Banc implies its share price may be lower than expected.

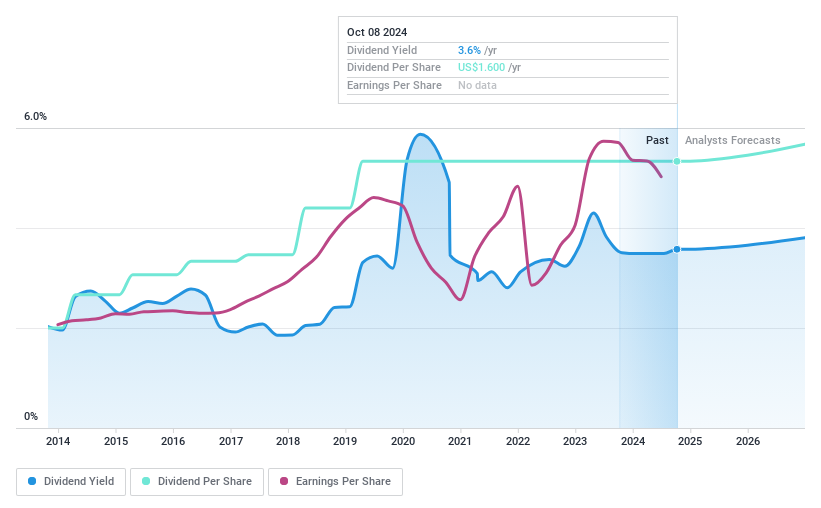

Webster Financial (NYSE:WBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Webster Financial Corporation, with a market cap of $8.23 billion, operates as the bank holding company for Webster Bank, National Association, offering a range of financial products and services to individuals, families, and businesses in the United States.

Operations: Webster Financial Corporation's revenue segments include Consumer Banking ($862.27 million), Healthcare Financial Services ($433.06 million), and Commercial Banking, including Private Banking ($1.45 billion).

Dividend Yield: 3.3%

Webster Financial's quarterly dividend of $0.40 per share reflects a stable, reliable payout history over the past decade. Despite recent earnings declines, dividends remain well covered by a low payout ratio of 34.7%. The company has also completed significant share repurchases totaling $593.89 million since 2017, enhancing shareholder value. However, its 3.33% yield is below the top quartile of US dividend payers at 4.32%.

- Take a closer look at Webster Financial's potential here in our dividend report.

- Our valuation report here indicates Webster Financial may be undervalued.

Key Takeaways

- Take a closer look at our Top US Dividend Stocks list of 171 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CBFV

CB Financial Services

Operates as the bank holding company for Community Bank that provides various banking products and services for individuals and businesses in southwestern Pennsylvania, West Virginia, and Ohio.

Flawless balance sheet with solid track record and pays a dividend.