- United States

- /

- Banks

- /

- NasdaqGM:OVBC

Ohio Valley Banc (OVBC) Profit Margins Improve, Reinforcing Value Narrative for Investors

Reviewed by Simply Wall St

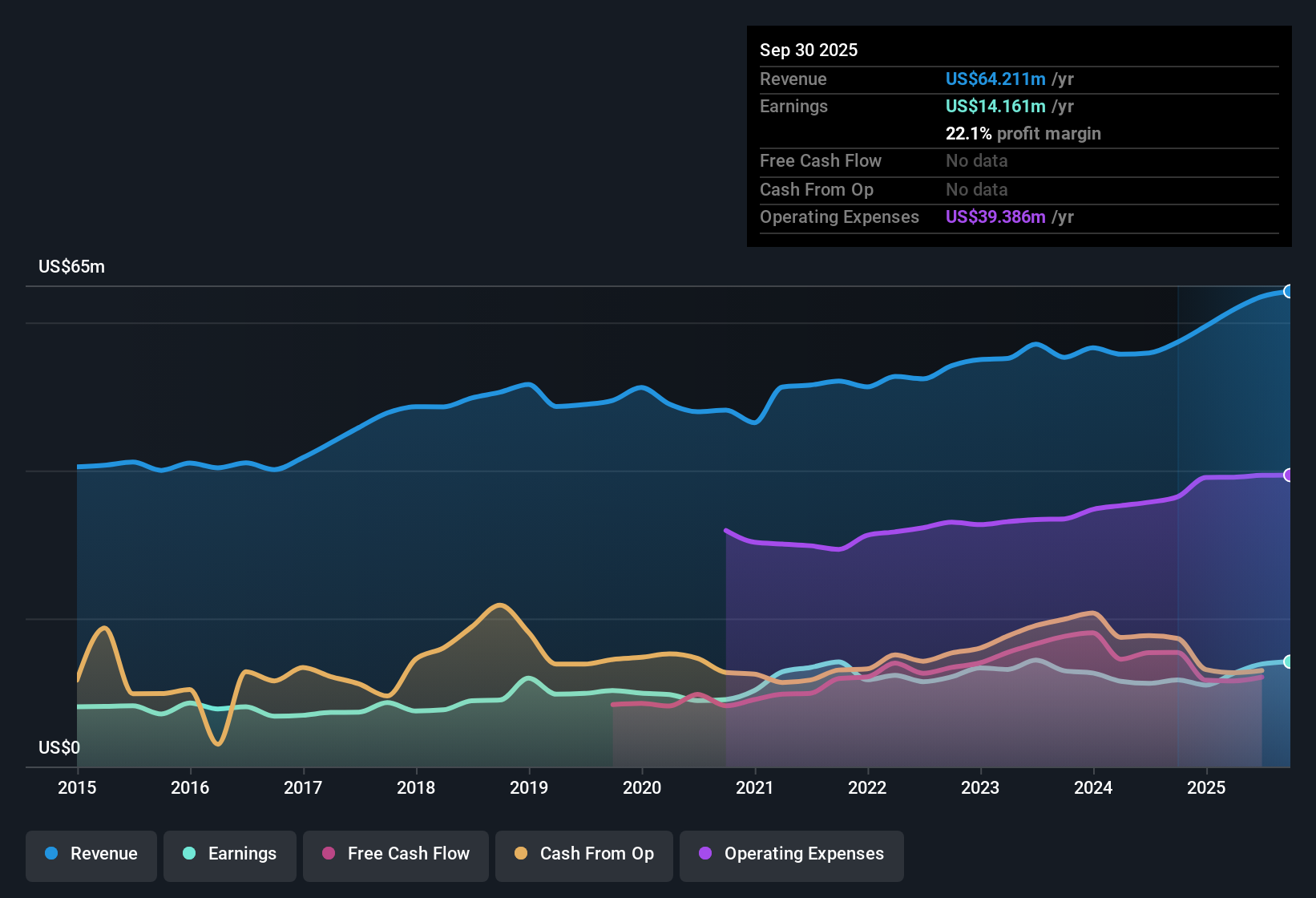

Ohio Valley Banc (OVBC) reported net profit margins of 22.1%, an improvement over last year’s 20.4%, and earnings jumped 21% year-over-year, far outpacing its five-year average growth rate of just 2.1%. With shares trading at $35.50 and a price-to-earnings ratio of 11.8x, the stock sits below the peer group’s average. It is also trading at a discount to an internal fair value estimate of $45.96. These results, paired with steady profit increases and an attractive combination of value and dividend signals, set a constructive tone for investors evaluating the latest numbers.

See our full analysis for Ohio Valley Banc.Now let's see how these headline figures stack up against the prevailing narratives. Some commonly held views may hold up, while others could be challenged by the latest data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Beat Last Year's Mark

- Net profit margins reached 22.1%, topping last year's 20.4%. This signals that the company is extracting more bottom-line profit from its revenue base than it did previously.

- Strong margin expansion supports those who argue that higher profitability reflects operational discipline and a competitive edge.

- The margin increase stands out against the company’s steady upward profit trend, reinforcing arguments for sustainable earnings power.

- No flagged risks in the latest disclosures further support the view that performance improvement is not coming at the expense of hidden issues.

P/E Ratio Offers Value Versus Peers

- Ohio Valley Banc’s price-to-earnings ratio of 11.8x is below the peer average of 13.8x, placing it in a discount range that value-oriented investors seek.

- A favorable valuation narrative emerges when the stock trades at a lower multiple than others in its group, especially as profit margins rise.

- The current share price of $35.50 is also well below the DCF fair value of $45.96, presenting two valuation signals that encourage a constructive outlook.

- No flagged risks or red flags in the numbers add a layer of comfort for those considering the lower valuation.

Rewards Stack Up With No Noted Risks

- The company meets all three of its rewards criteria: it is considered good value, has an attractive dividend, and is growing its profits and revenue according to risk/reward screens.

- This combination of strong financial checkpoints places the emphasis on growth potential without the burden of flagged risks affecting sentiment.

- The absence of disclosed risks is unusual in the sector, reinforcing investor claims that OVBC’s positive outlook is based not just on current results, but also on its ability to avoid common pitfalls.

- With both value and yield present, positive arguments for the stock’s appeal have a solid foundation in this reporting cycle.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ohio Valley Banc's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite margin expansion and valuation upside, Ohio Valley Banc’s long-term average growth remains modest. The company lags peers that deliver more consistent and steady gains.

If you want continuous progress and less uncertainty, check out stable growth stocks screener (2120 results) to discover companies maintaining reliable earnings and revenue expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OVBC

Ohio Valley Banc

Operates as the bank holding company for The Ohio Valley Bank Company that provides commercial and consumer banking products and services.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives