- United States

- /

- Banks

- /

- NasdaqGM:OVBC

Here's Why Shareholders May Want To Be Cautious With Increasing Ohio Valley Banc Corp.'s (NASDAQ:OVBC) CEO Pay Packet

Shareholders of Ohio Valley Banc Corp. (NASDAQ:OVBC) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 19 May 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Ohio Valley Banc

How Does Total Compensation For Tom Wiseman Compare With Other Companies In The Industry?

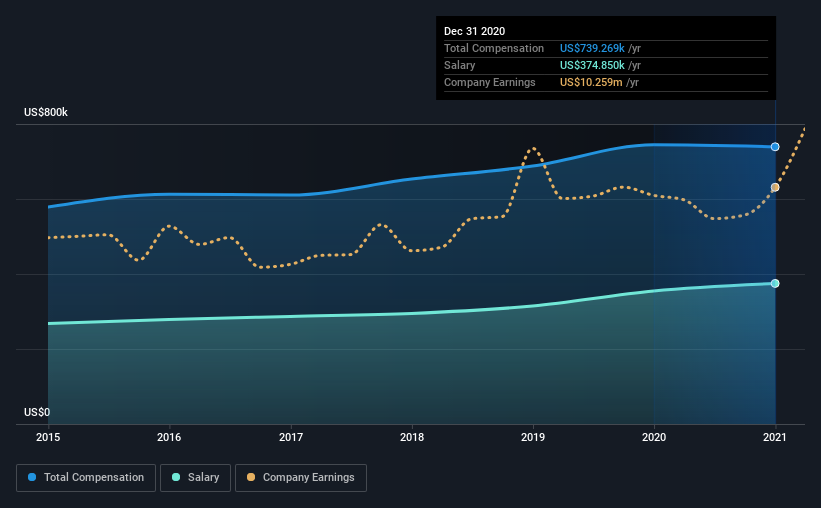

According to our data, Ohio Valley Banc Corp. has a market capitalization of US$110m, and paid its CEO total annual compensation worth US$739k over the year to December 2020. That's mostly flat as compared to the prior year's compensation. In particular, the salary of US$374.9k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$573k. From this we gather that Tom Wiseman is paid around the median for CEOs in the industry. What's more, Tom Wiseman holds US$652k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$375k | US$355k | 51% |

| Other | US$364k | US$390k | 49% |

| Total Compensation | US$739k | US$745k | 100% |

On an industry level, around 42% of total compensation represents salary and 58% is other remuneration. According to our research, Ohio Valley Banc has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Ohio Valley Banc Corp.'s Growth Numbers

Over the past three years, Ohio Valley Banc Corp. has seen its earnings per share (EPS) grow by 18% per year. Its revenue is up 7.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ohio Valley Banc Corp. Been A Good Investment?

The return of -49% over three years would not have pleased Ohio Valley Banc Corp. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Ohio Valley Banc that investors should think about before committing capital to this stock.

Switching gears from Ohio Valley Banc, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Ohio Valley Banc or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ohio Valley Banc, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:OVBC

Ohio Valley Banc

Operates as the bank holding company for The Ohio Valley Bank Company that provides commercial and consumer banking products and services.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives