- United States

- /

- Banks

- /

- NasdaqCM:ORRF

Orrstown Financial Services (ORRF): Profit Margin Surge Reinforces Bullish Value Narratives

Reviewed by Simply Wall St

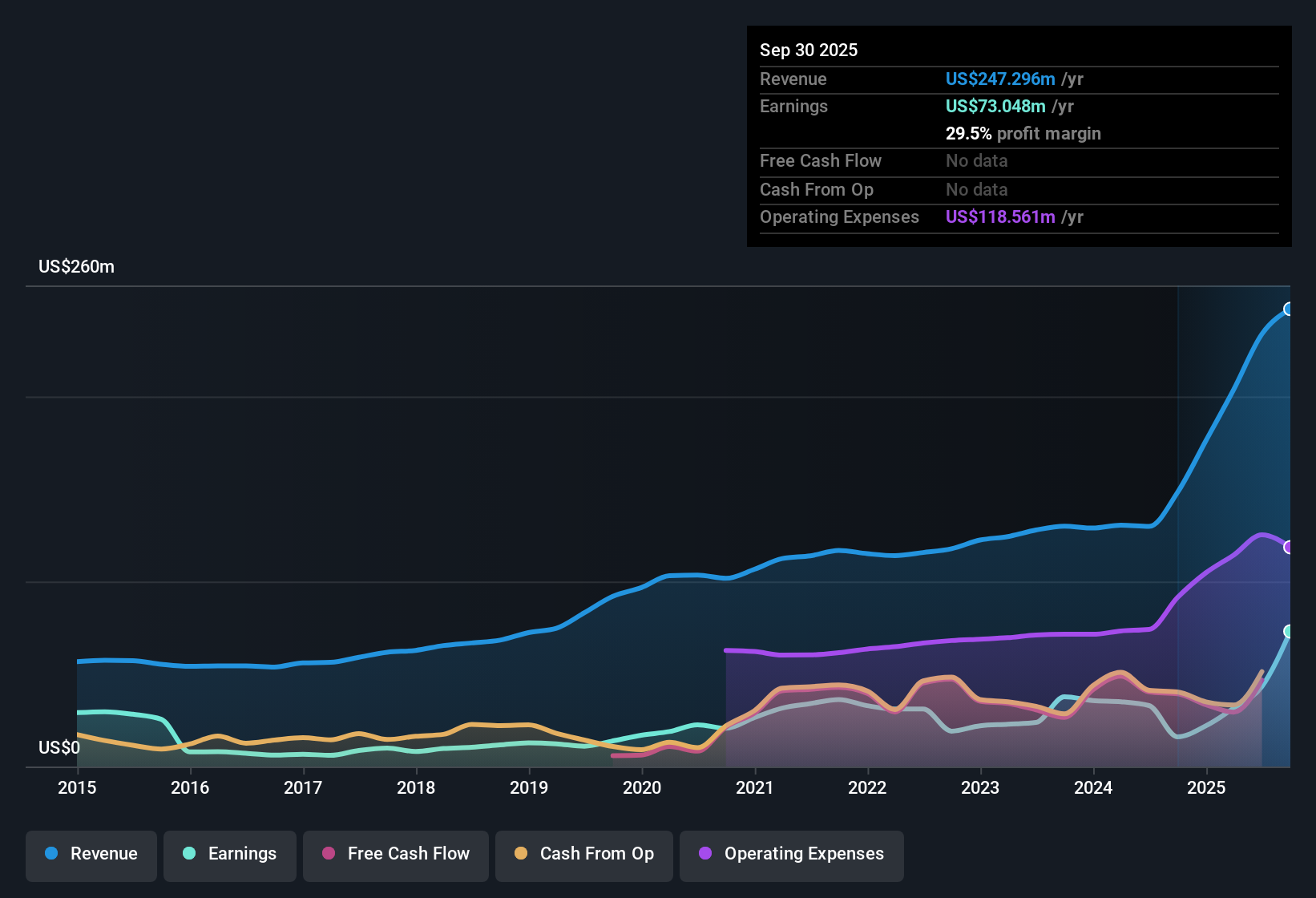

Orrstown Financial Services (ORRF) has delivered eye-catching numbers this year, with net profit margins jumping to 29.5% from last year’s 10.8% and earnings surging 356.3% over the past twelve months, outpacing the company’s already solid five-year CAGR of 8.9%. While the company trades at a compelling 9.3x price-to-earnings ratio, which is well below both peer and industry averages, revenue is expected to decline by 8.2% annually over the next three years, and forecast earnings growth of 6.8% lags the US market average of 15.5%. Despite the near-term growth outlook softening, Orrstown’s strong historical profit metrics, attractive dividend, and low valuation multiples have kept sentiment constructive around its valuation.

See our full analysis for Orrstown Financial Services.The next section weighs these results against key narratives, showing where Wall Street and the community may see eye to eye, and where perceptions may start to shift.

See what the community is saying about Orrstown Financial Services

Loan Pipeline Drives Net Interest Income

- Recent filings show that commercial loan growth, supported by new hires in key markets, is expected to sustain a strong lending pipeline and boost net interest income in the near term.

- According to the analysts' consensus narrative, this lending momentum, together with wealth management and fee-based business expansion, is anticipated to raise overall income and efficiency.

- Continued investment in digital banking and process improvements is seen as a key lever for improving cost control and further expanding net margins.

- Consensus views highlight the durability of Orrstown’s earnings even as the regional bank sector faces competitive and consolidation-related headwinds.

- The latest earnings support analyst claims that Orrstown’s targeted commercial growth strategies are delivering higher-quality income streams and setting up the company for sustained profitability in a changing banking landscape.

📈 Read the full Orrstown Financial Services Consensus Narrative.

Profit Margin Expansion Amid Cost Pressures

- While net profit margins have climbed to 29.5% from 10.8% last year, a jump that exceeds the company’s historical average, management acknowledges that ongoing investments in technology, compliance, and talent may keep expenses elevated and test operational leverage.

- The consensus narrative notes that margin expansion looks achievable if reduced merger-related and consulting costs materialize as planned in the coming periods.

- Advances in digital banking platforms and process improvements are flagged as critical factors for boosting efficiency, even if industry competition and high operating costs persist.

- Skeptics will be watching whether these operational gains are sufficient to offset anticipated downward pressure on revenue and sticky expense levels over the next several years.

Valuation Remains Attractive Versus Peers

- With shares trading at $34.84 and a price-to-earnings ratio of 9.3x, both below the US banks industry average of 11.2x and the peer average of 14x, Orrstown’s relative value stands out. DCF fair value is estimated at $75.01.

- Analysts' consensus view emphasizes that the valuation reflects a discount against both peers and sector norms, but requires confidence that earnings can grow to $147.2 million by September 2028, even as revenue is projected to shrink 8.2% per year.

- They note that the analyst price target for the stock is $40.00, which is about 15% above the current share price. This supports the case for patient investors focused on normalized earnings power and capital efficiency.

- The consensus highlights that stability in profit margins and asset quality are key to unlocking the full upside, especially given competitive funding and revenue headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Orrstown Financial Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something new in the figures? Share your perspective and build your own story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Orrstown Financial Services.

See What Else Is Out There

Revenue is projected to decline while earnings growth lags the broader market, which makes sustainability of profit margins and future upside less certain.

If you want more consistent expansion, check out stable growth stocks screener (2091 results) to find companies reliably growing revenues and earnings, built for all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORRF

Orrstown Financial Services

Operates as the financial holding company for Orrstown Bank that provides commercial banking and financial advisory services to retail, commercial, non-profit, and government clients in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives