- United States

- /

- Banks

- /

- NasdaqGS:ONB

A Look at Old National Bancorp’s (ONB) Valuation Following Strong Earnings and Dividend Commitments

Reviewed by Simply Wall St

Old National Bancorp (ONB) has just posted quarterly results that beat expectations, with revenue coming in 4.5% higher than forecast. For investors, that kind of outperformance stands out, especially since banks are navigating everything from economic uncertainty to competition from tech-driven newcomers. In addition to earnings, Old National’s commitment to both its common and preferred stock dividends sends a clear signal that management is prioritizing shareholder returns and confidence, even as the broader environment keeps shifting.

This latest report arrives in a year where Old National Bancorp’s stock has moved up 19% and momentum has been picking up, particularly over the summer months. Compared with the longer term, the stock’s multiyear return has been strong, suggesting the company’s strategy has gained traction even as interest rates and market sentiment have shifted. Announcements of steady dividends and solid operational metrics only add to the story, reflecting stability at a time when not every regional bank can tout the same.

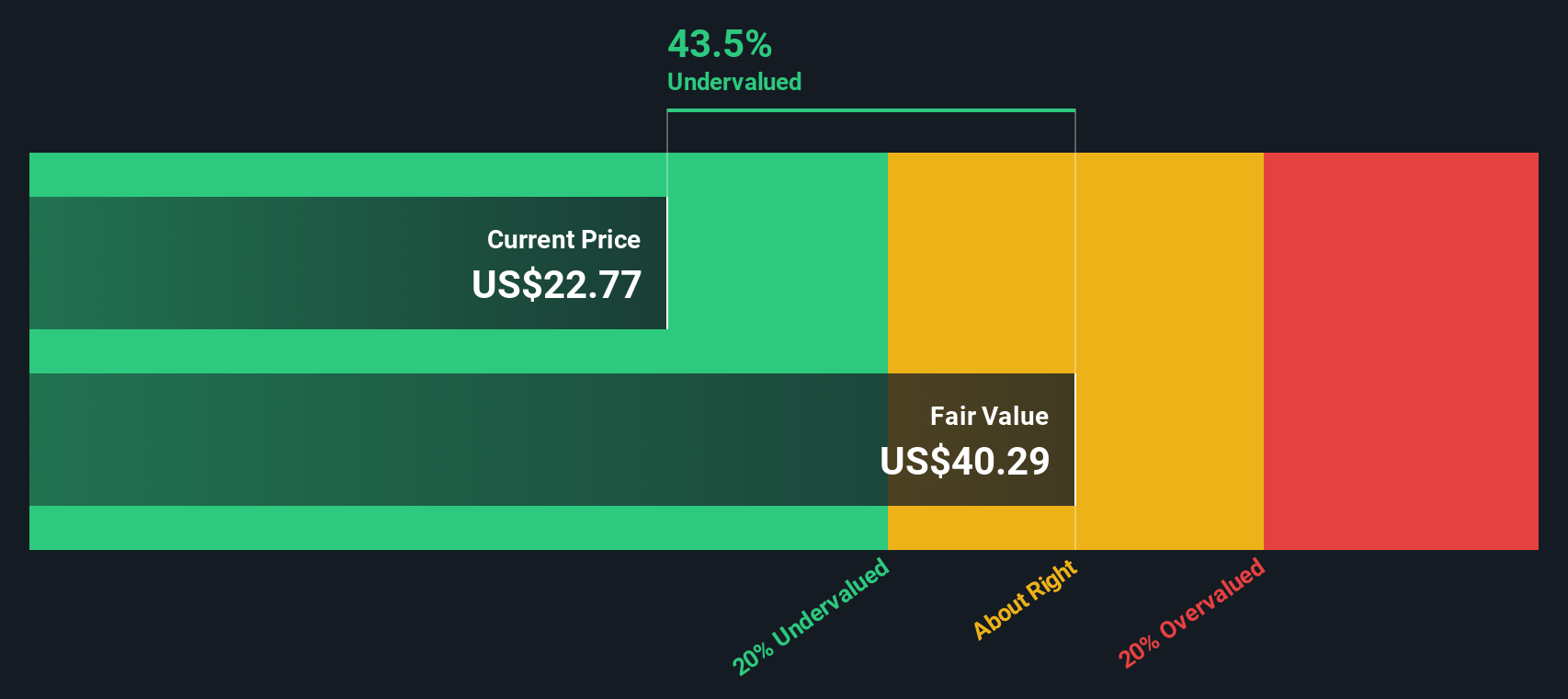

With earnings outperforming and the stock building momentum, the real question is whether Old National Bancorp is trading at an attractive value or if the market has already factored in the next phase of growth.

Most Popular Narrative: 13.5% Undervalued

According to community narrative, Old National Bancorp is viewed as materially undervalued based on projected long-term earnings growth, robust operational integration, and enhanced digital infrastructure. Analysts anticipate significant upside potential as a result of ongoing expansion initiatives and technological investments.

Strategic investment in digital banking infrastructure, highlighted by recent technology hires and ongoing upgrades, is enabling ONB to scale services efficiently, enhance client experience, and capitalize on the sector-wide shift toward digital and data-driven banking. This is expected to drive greater noninterest income, improve net margins, and increase client retention over time.

Ready to uncover what’s fueling this bold undervaluation call? Analysts are betting on major financial moves and a digital edge. The numbers behind the narrative reveal some remarkable forecasts for higher profitability, accelerated growth, and a future business mix that might surprise even market veterans. Curious which critical assumptions set up this price target? Dive in to reveal the hidden drivers behind Old National Bancorp’s fair value calculation.

Result: Fair Value of $26.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing exposure to commercial real estate and limited geographic diversification could hinder execution and challenge ONB’s growth outlook if market conditions deteriorate.

Find out about the key risks to this Old National Bancorp narrative.Another View

While analyst forecasts suggest undervaluation, our DCF model tells a similar story and points to value based on future cash flows. Does this method confirm optimism, or could hidden risks still tip the balance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Old National Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Old National Bancorp Narrative

If you want to dig deeper or reach a different conclusion, you can easily build your own narrative in just a few minutes, and do it your way.

A great starting point for your Old National Bancorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Why stop at one idea when you can spot other compelling investments? Take action now and use the features trusted by investors who don’t settle for ordinary. If you want to level up your next move, these screens put you ahead of the crowd. Select your advantage and seize it today:

- Unlock stability and watch your income grow with dividend stocks with yields > 3%, featuring companies providing dividend yields over 3% and a history of reliable payouts.

- Spot tomorrow’s tech leaders by tapping into AI penny stocks, where AI-driven disruptors show strong fundamentals and cutting-edge innovations.

- Tap into growth potential the crowd often overlooks. Find undervalued stocks grounded in robust cash flows using undervalued stocks based on cash flows and seize opportunities others miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides consumer and commercial banking services in the United States.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives