- United States

- /

- Banks

- /

- NasdaqGS:ONB

A Look at Old National Bancorp's (ONB) Valuation Following Q3 Earnings and Analyst Target Revisions

Reviewed by Simply Wall St

Old National Bancorp (ONB) just posted its third-quarter results, showing solid growth in net interest income and net income year-over-year. The update comes as the bank navigates new guidance and the impacts of acquisitions.

See our latest analysis for Old National Bancorp.

After a strong run earlier in the year, Old National Bancorp’s latest quarterly update, along with modest analyst adjustments and a recently completed share buyback, has done little to fend off the recent cooling in its share price. The stock’s 1-year total shareholder return stands at 9.3%, showing long-term investors have still come out comfortably ahead even as momentum has faded in recent weeks.

If you’re searching for fresh opportunities as market sentiment shifts, now could be the right moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares currently trading at a sizable discount to analyst price targets but growth outlooks tempered by recent guidance, investors are left to consider whether Old National Bancorp is undervalued or if the market has already priced in its future potential.

Most Popular Narrative: 20.9% Undervalued

With Old National Bancorp’s fair value estimate sitting notably higher than its last close, the stage is set for a potential re-rating if projected catalysts play out. The current price reflects skepticism, but the narrative projects a different story grounded in recent business moves and future earnings power.

Strategic investment in digital banking infrastructure, highlighted by recent technology hires and ongoing upgrades, is enabling ONB to scale services efficiently, enhance client experience, and capitalize on the sector-wide shift toward digital and data-driven banking. This is expected to drive greater noninterest income, improve net margins, and increase client retention over time.

Wondering what’s fueling these high expectations? The future valuation centers around a transformation strategy, bold digital investments, and optimistic forecasts for recurring income. Want to know the assumptions and financial leaps behind this bullish case? Uncover the details that underpin this narrative’s ambitious fair value.

Result: Fair Value of $25.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Old National Bancorp's continued exposure to commercial real estate as well as the uncertainty of further regulatory changes.

Find out about the key risks to this Old National Bancorp narrative.

Another View: The Market’s Current Multiple

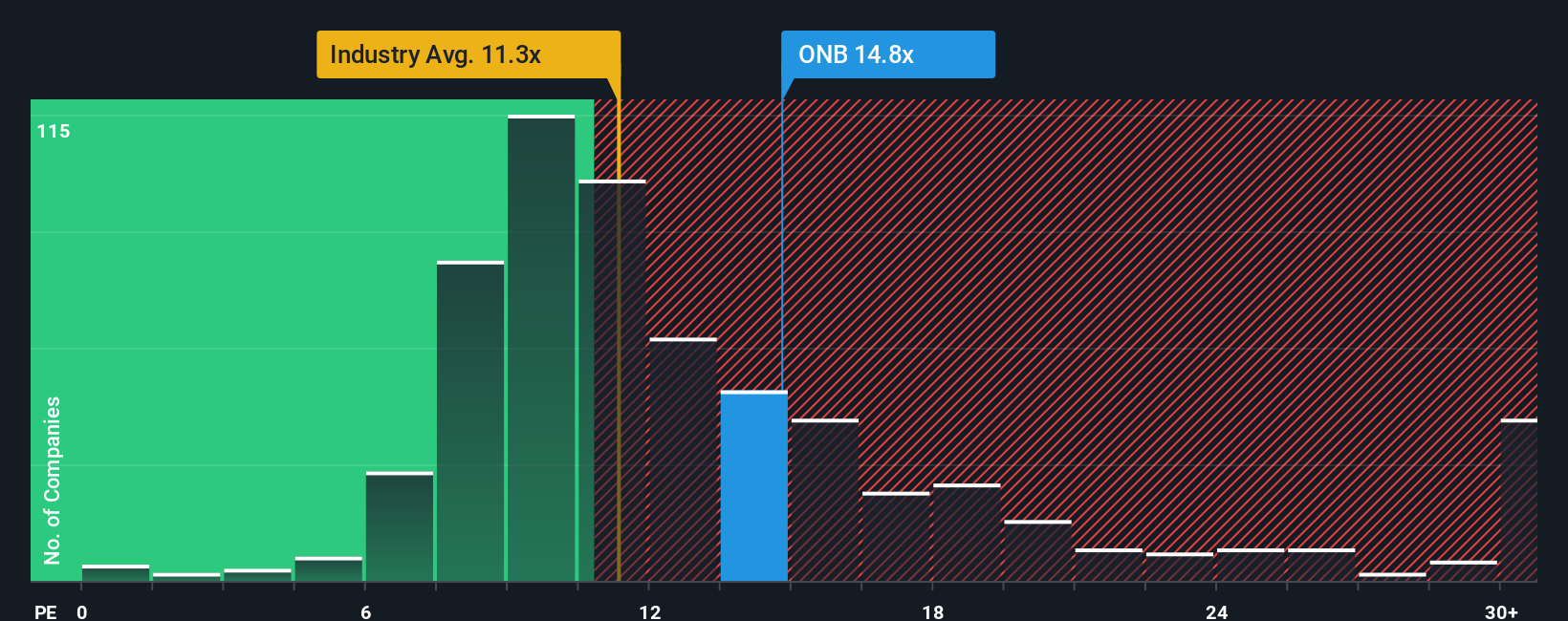

Looking from another angle, Old National Bancorp’s price-to-earnings ratio stands at 13.5x, which is higher than both the US Banks industry average of 11.2x and its direct peer group at 12.7x. Yet, the fair ratio points to a level closer to 17.9x, suggesting the current premium is modest compared to long-term potential. This raises an important question: Is the market underestimating the bank's next leg of growth, or are there risks not fully accounted for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old National Bancorp Narrative

If you favour forging your own perspective or want to dig into the numbers yourself, it’s easy to craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Old National Bancorp research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open, and Simply Wall Street’s powerful Screener helps you uncover opportunities you might have missed. Branch out and boost your portfolio now. These ideas may not be available for long.

- Capture income potential by targeting companies offering solid returns when you review these 21 dividend stocks with yields > 3% rewarding investors with attractive yields above 3%.

- Ride the wave of medical innovation through these 34 healthcare AI stocks accelerating transformations in diagnostics, patient care, and biotech breakthroughs.

- Ride momentum in digital assets by tapping into these 81 cryptocurrency and blockchain stocks and uncovering stocks fueling the blockchain and cryptocurrency evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides consumer and commercial banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives