- United States

- /

- Banks

- /

- NasdaqGS:OCFC

OceanFirst Financial (OCFC) Shifts Mortgage Operations to Boost Efficiency—What Does It Signal for Future Growth?

Reviewed by Sasha Jovanovic

- Earlier this week, OceanFirst Financial Corp. announced several developments, including its Board declaring a US$0.20 per share quarterly dividend, the completion of a multi-year share repurchase program, updated earnings guidance for 2026, and a reported net income of US$17.3 million for the prior quarter.

- A material takeaway is the company’s decision to outsource residential mortgage origination, which is expected to improve cost efficiency and support long-term earnings growth amid ongoing commercial loan expansion.

- We'll explore how OceanFirst Financial's operational shift in its residential mortgage business could affect its investment narrative moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

OceanFirst Financial Investment Narrative Recap

To own OceanFirst Financial, shareholders need confidence in the company’s ability to deliver sustained loan growth, improve cost efficiency, and protect asset quality despite a competitive regional banking environment. The recent move to outsource residential mortgage origination is intended to improve operating leverage, which may support the growth narrative, but does not materially change near-term risks around commercial banker productivity and deposit cost pressures.

Of the latest announcements, the new share repurchase program, authorizing buybacks of up to 3,000,000 shares, stands out as most immediately relevant for shareholders watching capital allocation. While this signals ongoing commitment to returning value, its effect on short-term catalysts like commercial loan expansion and deposit growth may remain limited given the primary earnings drivers lie in core banking operations.

However, investors should be aware of the potential for margin compression if deposit cost competition intensifies and...

Read the full narrative on OceanFirst Financial (it's free!)

OceanFirst Financial's outlook anticipates $536.1 million in revenue and $124.4 million in earnings by 2028. This reflects a 12.5% annual revenue growth rate and an earnings increase of $42.7 million from the current earnings of $81.7 million.

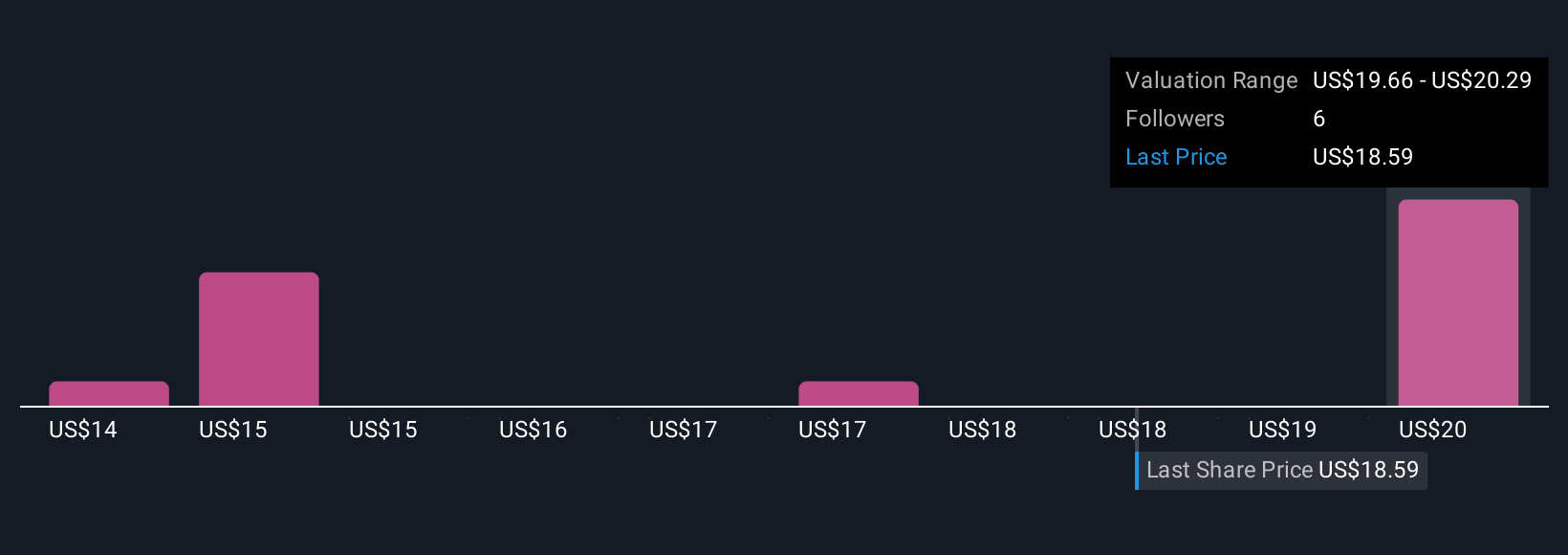

Uncover how OceanFirst Financial's forecasts yield a $20.29 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community ranged from US$14.00 to US$20.29, reflecting a broad spread of individual outlooks. As commercial loan productivity and deposit trends remain the primary catalysts and risks, these contrasting views highlight the importance of considering multiple perspectives on OceanFirst’s future performance.

Explore 4 other fair value estimates on OceanFirst Financial - why the stock might be worth 25% less than the current price!

Build Your Own OceanFirst Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanFirst Financial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free OceanFirst Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanFirst Financial's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives