- United States

- /

- Banks

- /

- NasdaqGS:OCFC

OceanFirst Financial (OCFC): Examining Valuation After Fed Comments Boost Bank Stock Optimism

Reviewed by Simply Wall St

Shares of OceanFirst Financial (OCFC) climbed sharply after the New York Fed President signaled that additional interest rate adjustments could be on the horizon. Investors responded positively, viewing potential rate cuts as a tailwind for banks.

See our latest analysis for OceanFirst Financial.

With banking stocks back in focus after the Fed’s comments, OceanFirst Financial is showing some renewed energy. The share price has advanced 6.5% over the past week, hinting at building momentum, although the one-year total shareholder return remains negative. Despite the ups and downs, long-term holders have seen robust gains over five years, which puts the recent move in perspective.

If you’re curious to see what other growth stories are out there, this is a great opportunity to expand your search and discover fast growing stocks with high insider ownership

With shares rebounding and optimism on rate cuts growing, the big question now is whether OceanFirst Financial is actually undervalued after its recent rally or if the market has already priced in future growth potential.

Most Popular Narrative: 14.8% Undervalued

Compared to OceanFirst Financial’s last close of $18.32, the most popular narrative sets a fair value at $21.50. This suggests the current rally could have further room to run based on anticipated future earnings strength.

Ongoing digital initiatives and technology investments, including fintech partnerships, are enhancing operating leverage by reducing the incremental cost to serve and driving engagement with younger, tech-savvy demographics. This could potentially increase fee-based income and improve net margins over time.

Curious what assumptions power that bold upside? The real secret is in the bank’s forecast for digital growth and margin gains. These are numbers that could surprise you. Find out what’s behind this valuation spark and why analysts are seeing a shift in the earnings engine.

Result: Fair Value of $21.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some analysts caution that lingering commercial real estate risks or delays in margin normalization could challenge the optimistic outlook for OceanFirst Financial.

Find out about the key risks to this OceanFirst Financial narrative.

Another View: Multiple-Based Valuation Raises Questions

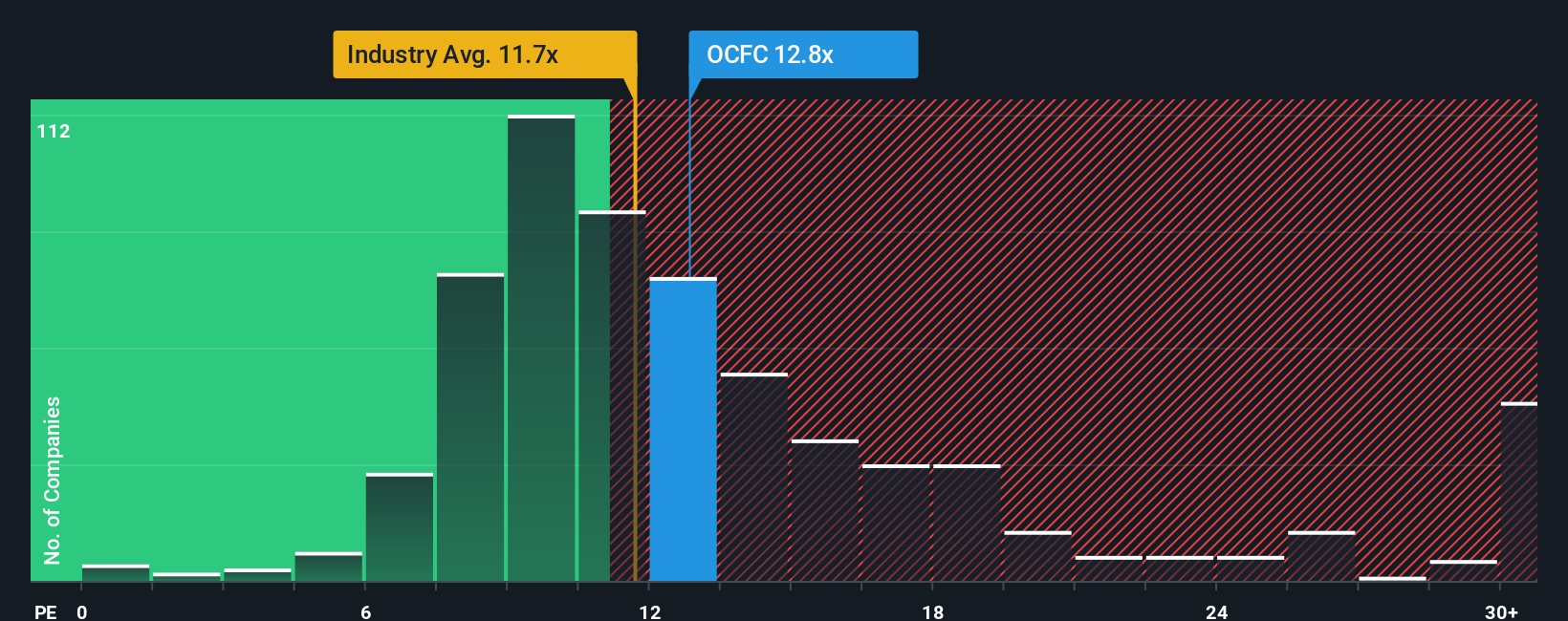

Looking at OceanFirst Financial through the lens of its price-to-earnings ratio, the picture is a bit more complex. While the company's 14x ratio is below the US market average of 18.1x, it is higher than the US Banks industry average of 11.2x and close to its fair ratio of 14.1x. This means investors are paying a premium compared to peers but not to the overall market, which introduces some valuation risk if banking sector challenges persist. Could this premium hold up if competition intensifies, or will the market push the shares toward a lower benchmark?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OceanFirst Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OceanFirst Financial Narrative

If you see the story differently or want a deeper look under the hood, you can easily develop your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding OceanFirst Financial.

Looking for More High-Potential Investment Ideas?

Stay ahead and give yourself an edge by tracking investment themes with breakout momentum. Don’t let these unique opportunities pass you by—it is your move.

- Accelerate your search for rapid growth by spotting untapped upside in these 924 undervalued stocks based on cash flows before the market catches on.

- Secure future cash flow by targeting passive income with these 14 dividend stocks with yields > 3% yielding over 3% annually.

- Capitalize on cutting-edge breakthroughs by targeting next-generation innovations across these 30 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026