- United States

- /

- Banks

- /

- NYSE:OBK

One-Year Earnings Decline Not Helping Origin Bancorp's Share Price, Stock Falls Another 4.8% Last Week

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Origin Bancorp, Inc. (NASDAQ:OBNK) shareholders over the last year, as the share price declined 14%. That falls noticeably short of the market decline of around 7.7%. On the bright side, the stock is actually up 3.7% in the last three years. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Since Origin Bancorp has shed US$54m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Origin Bancorp

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

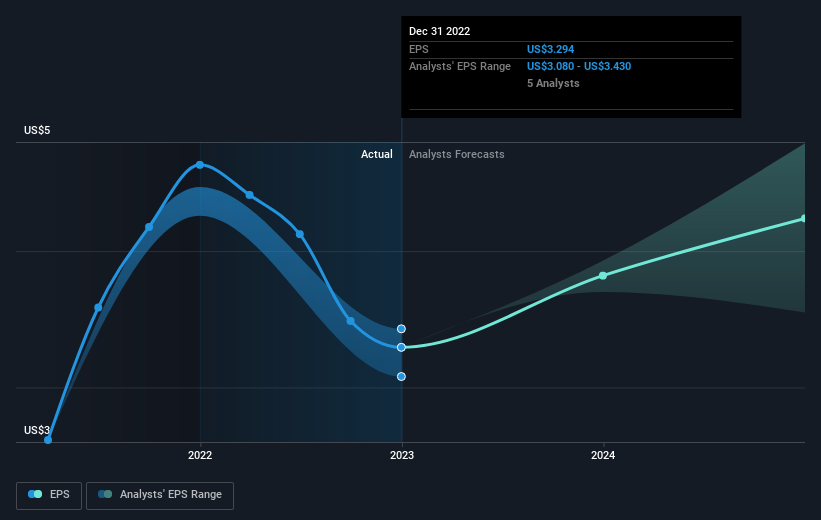

Unhappily, Origin Bancorp had to report a 29% decline in EPS over the last year. The share price fall of 14% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Origin Bancorp's key metrics by checking this interactive graph of Origin Bancorp's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Origin Bancorp shares, which performed worse than the market, costing holders 12%, including dividends. The market shed around 7.7%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 2.6% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Origin Bancorp is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet and fair value.