- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Does Recent Expansion Make Northwest Bancshares a Fair Value Opportunity in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Northwest Bancshares stock? You are not alone. With its recent price moves and shifting market sentiment, investors are eyeing whether this steady regional bank is about to turn a corner or remain in its holding pattern. Over the past week, the share price nudged up by 1.3%, adding to the feeling that change could be on the horizon, even after a fairly flat month and a mild dip so far this year.

Looking further back, the performance paints a nuanced picture. The one-year return is down by 1.2%. However, taking a three-year view, the stock has eked out a 0.9% gain, which is modest yet enough to keep long-term holders engaged. Those who invested five years ago are sitting on gains of 56.7%, a reminder that patience with regional banks has sometimes paid off in substantial ways.

Recent news for Northwest Bancshares has mostly centered around its continued expansion into new community banking markets and conservative balance sheet management. These factors influence how investors judge its risk and growth profile. Such developments have supported its reputation as a stable choice in uncertain times, which could explain the renewed interest this month despite lackluster broader performance.

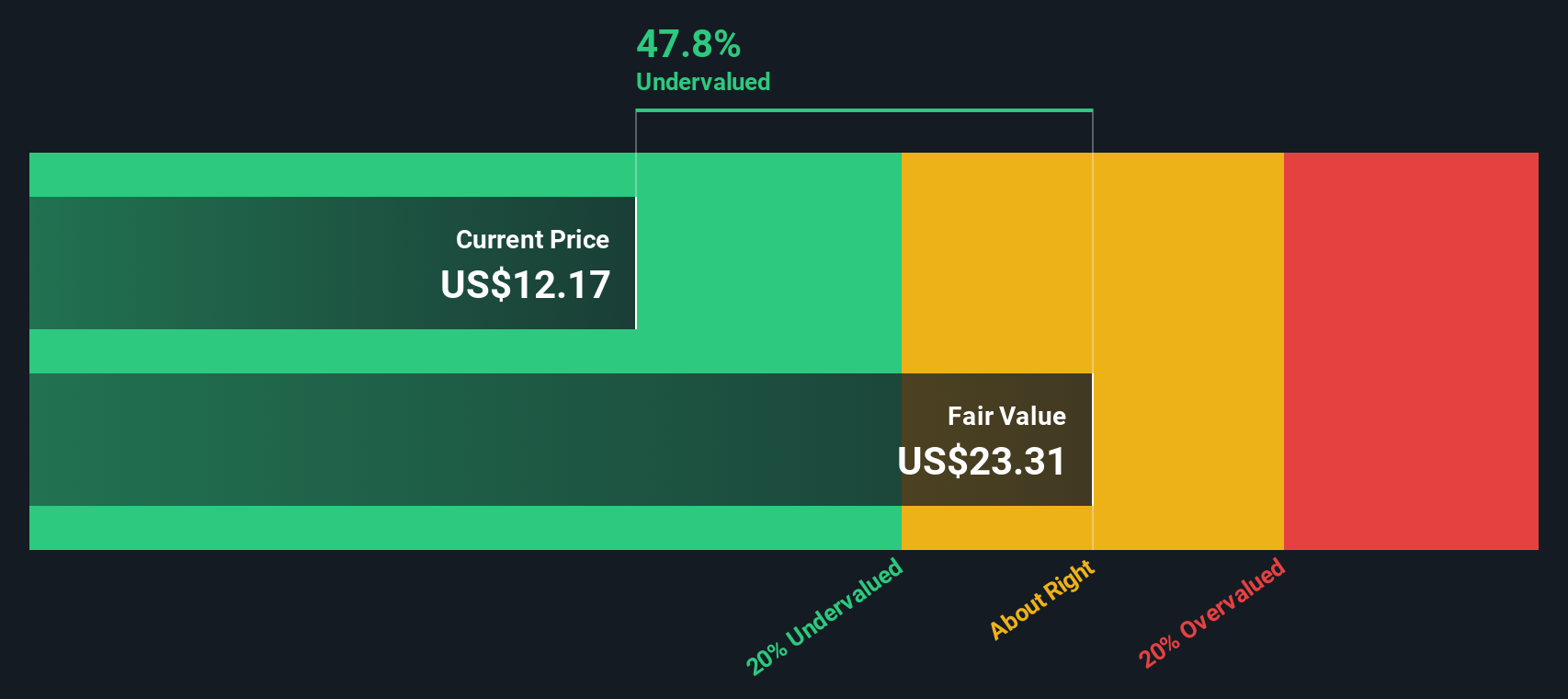

On the valuation front, Northwest Bancshares is currently undervalued in four out of six key checks, giving it a value score of 4. Next, we will walk through those valuation methods and what makes the stock look attractive, followed by an even more insightful approach to judging its true worth.

Why Northwest Bancshares is lagging behind its peers

Approach 1: Northwest Bancshares Excess Returns Analysis

The Excess Returns model evaluates a company's value by comparing the returns it generates on invested equity capital to its cost of equity. This approach emphasizes how efficiently Northwest Bancshares deploys its capital to create value above the minimum required by shareholders.

For Northwest Bancshares, the reported Book Value stands at $12.84 per share. Analysts estimate a Stable EPS of $1.25 per share, based on weighted future Return on Equity projections from four analysts. The company's average Return on Equity is 9.50%. Its Cost of Equity, which is the minimum expected return for shareholders, is $0.89 per share. After accounting for the cost of equity, the Excess Return per share is $0.36. Looking ahead, the Stable Book Value is projected at $13.13 per share, with estimates also weighted from analyst consensus.

Based on these projections and the excess returns earned over the cost of equity, the model estimates Northwest Bancshares' intrinsic value at $22.81 per share. With the current price reflecting a discount of 45.2% to this valuation, the stock appears meaningfully undervalued according to this method.

Result: UNDERVALUED

Our Excess Returns analysis suggests Northwest Bancshares is undervalued by 45.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Northwest Bancshares Price vs Earnings

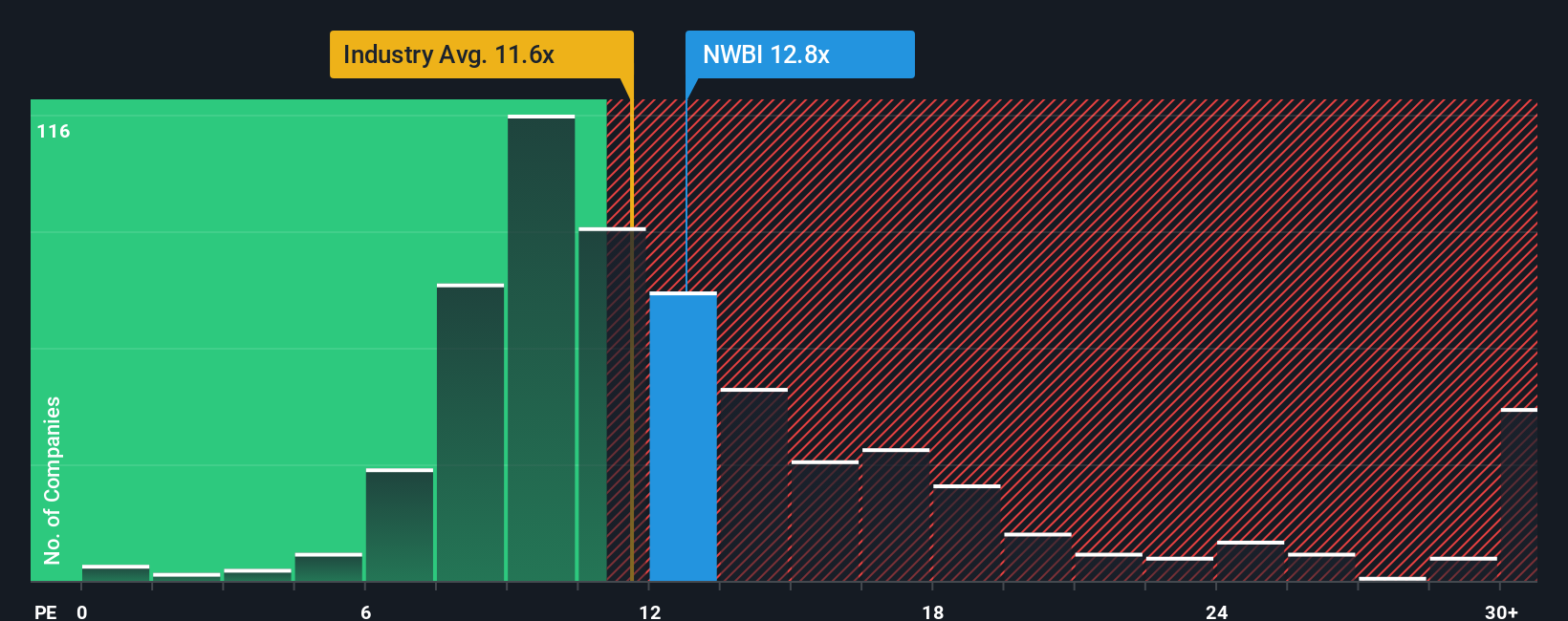

For consistently profitable companies like Northwest Bancshares, the Price-to-Earnings (PE) ratio is a widely used and effective valuation yardstick. It tells investors how much they are paying for each dollar of a company's earnings and is a quick way to compare valuation across companies in the same industry.

However, what counts as a "normal" or "fair" PE ratio varies by growth expectations and risk. Higher expected earnings growth or lower risk justifies a higher PE, while sluggish growth or extra risk demands a discount.

Northwest Bancshares currently trades at a PE of 12.76x. That is a bit above the industry average PE of 11.24x but below the average of its peer group at 16.54x. This puts it roughly in the middle lane compared to its closest competitors.

Rather than only comparing with peers and industry averages, Simply Wall St looks a step further by calculating a “Fair Ratio.” This proprietary metric weighs not just industry trends, but also company-specific factors like earnings growth, profit margin, market cap, and risk. For Northwest Bancshares, the Fair Ratio comes in at 14.46x. Because it considers growth rates, profitability, and risk specific to Northwest Bancshares rather than just assuming the industry sets the standard, it offers a more tailored benchmark.

With Northwest Bancshares' current PE of 12.76x below the Fair Ratio of 14.46x, the stock looks undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Northwest Bancshares Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story for a company: the logic, forecast, and expectations you believe will shape its future. By building a Narrative, you do more than just crunch numbers; you connect Northwest Bancshares’ business story with actual financial forecasts and use those assumptions to estimate a fair value.

Narratives are available right now on the Simply Wall St Community page, making them an accessible and dynamic tool that millions of investors already use to clarify their decisions. With Narratives, you can compare your calculated Fair Value with the current market Price, helping you decide if now is the time to buy, hold, or sell based on your own outlook. Narratives automatically update anytime key information such as quarterly results or news comes in, ensuring your view remains relevant as conditions change.

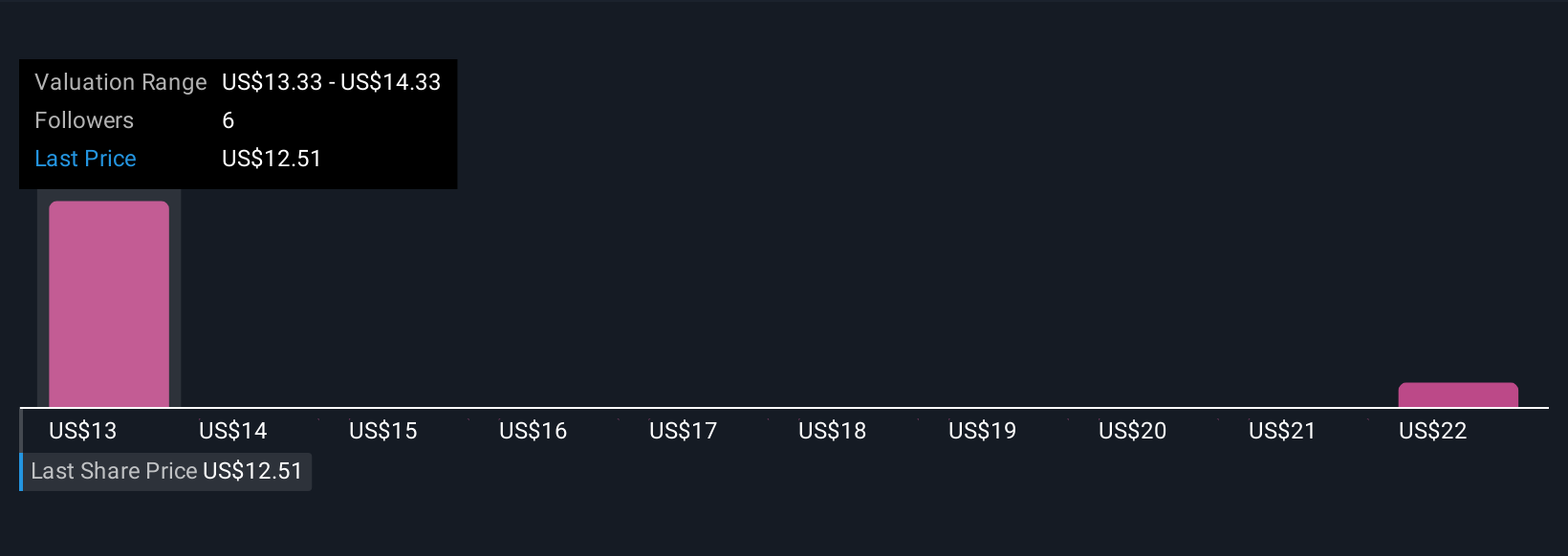

For example, two investors looking at Northwest Bancshares might use the same news and forecasts, but one calls it undervalued at $22.81 per share while another sees fair value closer to $13.38. This shows how Narratives empower you to invest according to your unique conviction.

Do you think there's more to the story for Northwest Bancshares? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives