- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Could Leadership Changes at Northwest Bancshares (NWBI) Reshape Its Governance and M&A Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Northwest Bank announced the appointment of Erin Siegfried as chief legal counsel and corporate secretary, selecting an executive with nearly three decades of corporate legal, governance, and M&A experience from major regional players and law firms.

- This transition places Siegfried in a position to influence company-wide legal strategy and governance frameworks at a time of business expansion and integration efforts.

- We'll explore how Siegfried's legal and M&A expertise could influence Northwest Bancshares’ operational execution and evolving investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Northwest Bancshares Investment Narrative Recap

Shareholders in Northwest Bancshares are typically focused on management’s ability to execute cost-saving integration of acquisitions, most recently Penns Woods, while containing risks from sluggish regional loan growth and credit quality. Erin Siegfried’s arrival as chief legal counsel strengthens Northwest’s legal and governance frameworks, but her appointment is not likely to directly impact near-term catalysts, such as successful merger integration, or immediately address the primary risk of credit deterioration in key loan portfolios. The most relevant recent announcement remains the ongoing Penns Woods integration, highlighted by management’s affirmation that full run-rate efficiencies are expected by mid-2026. This continues to be the focus for unlocking expense and margin improvements, though execution will be tested as the company balances expansion with integrating new leadership in critical roles. However, investors should be aware that higher classified loans in certain portfolio segments remain a concern, especially if credit conditions...

Read the full narrative on Northwest Bancshares (it's free!)

Northwest Bancshares' outlook anticipates $909.9 million in revenue and $249.6 million in earnings by 2028. This relies on 17.4% annual revenue growth and a $106.2 million increase in earnings from the current $143.4 million level.

Uncover how Northwest Bancshares' forecasts yield a $13.38 fair value, a 8% upside to its current price.

Exploring Other Perspectives

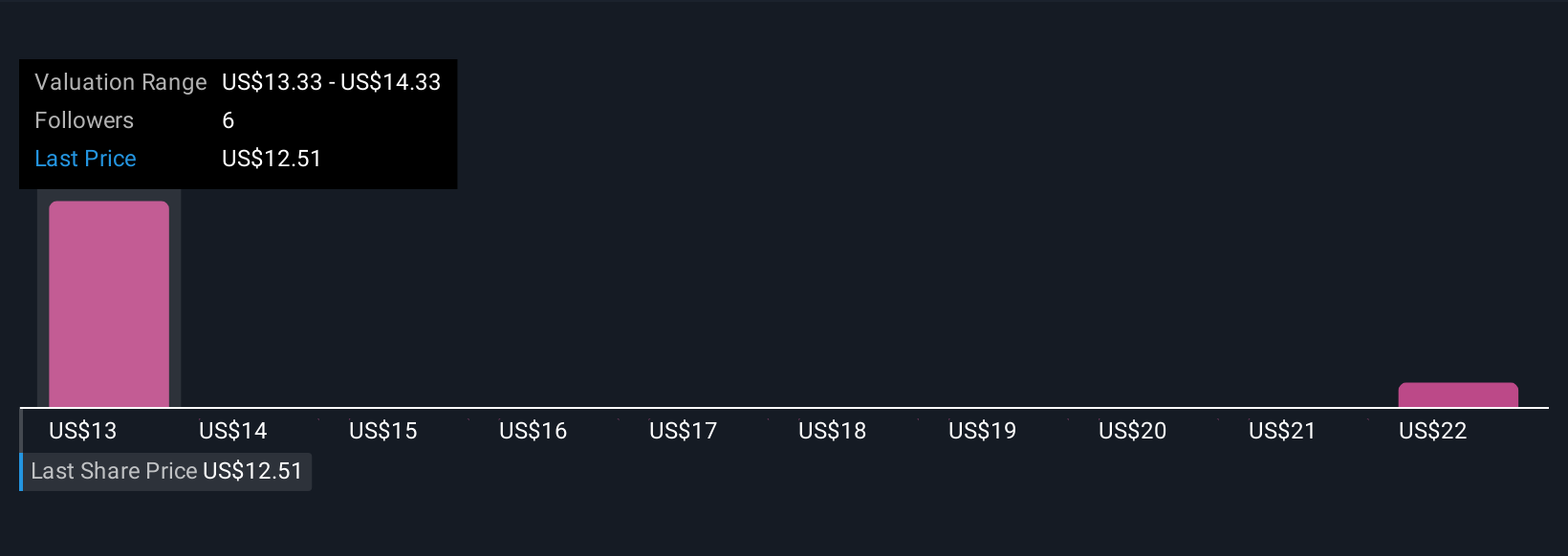

Three members of the Simply Wall St Community have issued fair value forecasts on Northwest Bancshares, ranging widely from US$13.33 to US$22.81. While these outlooks vary, focus remains on whether merger synergies will meet expectations or if integration challenges could impact results over the coming year.

Explore 3 other fair value estimates on Northwest Bancshares - why the stock might be worth as much as 85% more than the current price!

Build Your Own Northwest Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northwest Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Bancshares' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives