- United States

- /

- Banks

- /

- NasdaqGS:NBTB

NBT Bancorp (NBTB): Reassessing Value After Powell’s Rate Cut Signal at Jackson Hole

Reviewed by Simply Wall St

Dovish comments from Fed Chair Jerome Powell at the Jackson Hole symposium have sent ripples across the banking sector, and NBT Bancorp (NBTB) is no exception. With hints that the Federal Reserve could soon move toward lowering interest rates, the recent optimism among investors is hard to miss. For regional banks like NBT Bancorp, this potential policy pivot is especially timely and signals a friendlier landscape for both lending and borrowing. This is a dynamic that often translates into healthier profit margins for banks.

It has been an eventful ride for NBT Bancorp lately. After a somewhat disappointing start to the year, the stock perked up with a gain over the past month in response to shifting expectations for monetary policy. That said, NBT Bancorp’s longer-term returns are a study in contrasts: three- and five-year shareholders have seen solid gains, but the past year has been tougher, as concerns over rates and broader financial sector woes weighed on sentiment. The rebound following Powell’s remarks could mark a turning point, or it could simply be a pause in a longer adjustment period.

With the stock recovering some ground on renewed rate cut hopes, the question is whether there is now an attractive entry point, or if the market is already anticipating a brighter future for NBT Bancorp.

Most Popular Narrative: 10.5% Undervalued

According to community narrative, NBT Bancorp is considered undervalued by 10.5%, with a fair value grounded in robust assumptions about future earnings and revenue growth. This valuation relies on expectations for expansion and strategic moves that set the stage for continued financial improvement.

Expansion into the Western New York and Buffalo markets through the Evans Bancorp acquisition is likely to drive incremental loan and deposit growth and diversify the balance sheet. This is expected to lead to higher top-line revenue and improved earnings stability. Ongoing investment in digital banking platforms, along with the integration of more than 25,000 new digital banking and debit card users, positions NBT to reach new customer segments, improve operating efficiencies, and support net margin expansion.

Want to uncover the growth story fueling this bullish outlook? This community narrative is built on ambitious forecasts for both revenues and margins, featuring assumptions that might surprise you. There are key economic bets and bold profit projections at work. Interested in what powers the fair value call? Explore the full narrative to review the numbers and strategy that could shape NBT Bancorp’s next chapter.

Result: Fair Value of $50.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower digital adoption and heavy exposure to commercial lending could undermine margin stability, even as NBT Bancorp pursues new growth strategies.

Find out about the key risks to this NBT Bancorp narrative.Another View: What Do Other Methods Say?

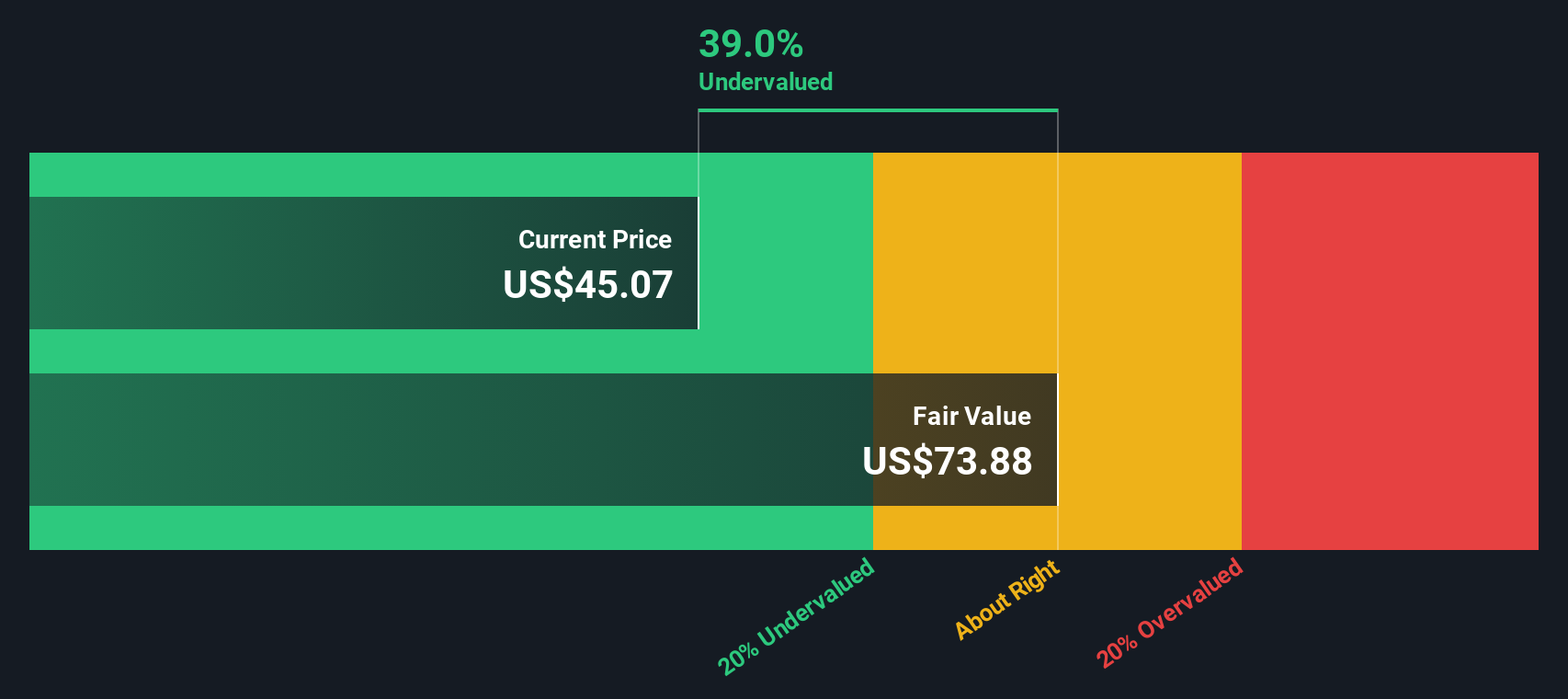

Looking at a different approach, our DCF model suggests the stock is trading well below its calculated fair value. This presents a challenge to more cautious, market-based valuation metrics. Which side of the story do you believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NBT Bancorp Narrative

If you see the story differently or want your own perspective based on the data, you can put together an independent narrative in just a few minutes. So why not do it your way?

A great starting point for your NBT Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not let great opportunities slip by just because you stopped with a single stock. Find your next potential winner using new angles on the market, each designed to help you get ahead of the crowd. Here are three standout ways to put Simply Wall Street to work for you now:

- Focus on consistent cash flows and spot hidden bargains by jumping straight into undervalued stocks based on cash flows to look for stocks that may be undervalued.

- Enhance your portfolio’s stability by exploring companies with solid payouts through dividend stocks with yields > 3%, where you will find stocks with yields above 3%.

- Stay ahead in the AI sector and discover new growth opportunities by using AI penny stocks to browse promising artificial intelligence-focused companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives