- United States

- /

- Banks

- /

- NasdaqGS:NBTB

Did Sector-Wide Loan Quality Concerns Just Shift NBT Bancorp's (NBTB) Investment Narrative?

Reviewed by Sasha Jovanovic

- Recently, several regional banks including NBT Bancorp experienced increased investor concern after Zions Bancorp disclosed a US$50 million charge-off and Western Alliance Bancorp reported collateral issues with a borrower.

- This spotlight on loan quality and credit risk across the sector has intensified worries about banks' vulnerability to potential loan losses and diminishing profitability, especially during periods of elevated interest rates and declining commercial real estate values.

- We'll now assess how heightened sector-wide loan quality concerns prompted by peer disclosures may influence NBT Bancorp's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

NBT Bancorp Investment Narrative Recap

For investors to remain shareholders in NBT Bancorp, they need to believe that the company's expansion into new markets and its shift towards digital banking can offset the risks tied to elevated credit concerns and reliance on slower-growing regions. The recent sector-wide attention on loan quality, following peer disclosures of charge-offs and collateral issues, has added short-term uncertainty, but there’s no indication so far that these developments have materially changed NBT’s central catalysts or its most significant risk, potential credit losses in a challenging commercial lending environment.

The most relevant recent announcement is NBT’s Q2 2025 earnings report, which showed loan net charge-offs of US$2.36 million, down from US$3.70 million a year earlier. This provides current context for credit risk discussions, especially as investors watch for any signs that wider sector concerns might be reflected in the bank’s asset quality or earnings going forward.

But while the overall headline risk has risen, investors should be aware that a single significant credit event at the local level can still...

Read the full narrative on NBT Bancorp (it's free!)

NBT Bancorp's outlook anticipates $998.8 million in revenue and $353.3 million in earnings by 2028. This implies annual revenue growth of 19.1% and an earnings increase of $219.9 million from current earnings of $133.4 million.

Uncover how NBT Bancorp's forecasts yield a $50.17 fair value, a 23% upside to its current price.

Exploring Other Perspectives

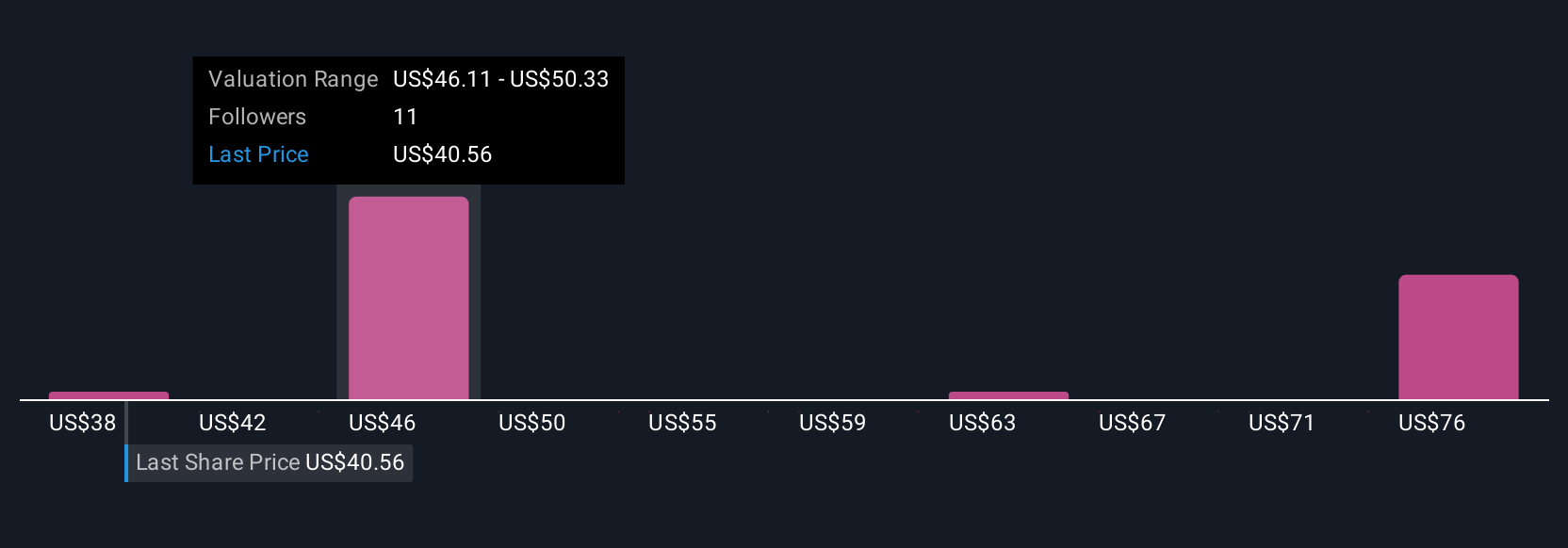

Four Simply Wall St Community members offered fair value estimates for NBT Bancorp between US$37.67 and US$71.42, reflecting wide differences in future expectations. With loan quality risk at the forefront, your outlook may shift as new information emerges, explore several viewpoints before deciding.

Explore 4 other fair value estimates on NBT Bancorp - why the stock might be worth as much as 75% more than the current price!

Build Your Own NBT Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NBT Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NBT Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NBT Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives