- United States

- /

- Banks

- /

- NasdaqGS:NBTB

A Look at NBT Bancorp’s (NBTB) Valuation Following Renewed Sector Concerns Over Loan Quality

Reviewed by Kshitija Bhandaru

After several regional banks reported substantial loan charge-offs and new collateral challenges, investors are paying closer attention to potential risks at other banks, including NBT Bancorp (NBTB). The latest disclosures have put loan quality under increased scrutiny.

See our latest analysis for NBT Bancorp.

NBT Bancorp’s share price has slipped 6.1% over the past month as worries about rising charge-offs ripple through the regional banking sector, but it is worth noting that its total shareholder return is still up more than 61% over the last five years. This suggests that long-term holders have weathered recent volatility.

If the latest regional banking headlines have you rethinking your next move, this is a great time to broaden your approach and discover fast growing stocks with high insider ownership.

But with NBT Bancorp’s shares down recently and trading at a noticeable discount to analyst targets, investors have to ask themselves: Is this a compelling entry point, or is the market already bracing for more challenging days ahead?

Most Popular Narrative: 20% Undervalued

Compared to the last close price of $40.15, the most widely followed narrative sets NBT Bancorp's fair value 20% higher. This difference in outlook reflects substantial optimism around the company's growth plans and financial trajectory.

Ongoing investment in digital banking platforms and seamless integration of over 25,000 new digital banking and debit card users positions NBT to reach new customer segments, improve operating efficiencies, and support net margin expansion.

What hidden assumptions drive this high target? The forecast hinges on bold projections not just for digital growth, but for future profits and margins that no regional peer is openly touting. Want to see the numbers behind this call?

Result: Fair Value of $50.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent slow growth in NBT Bancorp's core markets and slower than expected digital adoption could undermine expectations for long-term margin expansion and revenue growth.

Find out about the key risks to this NBT Bancorp narrative.

Another View: Is the Market Missing Something?

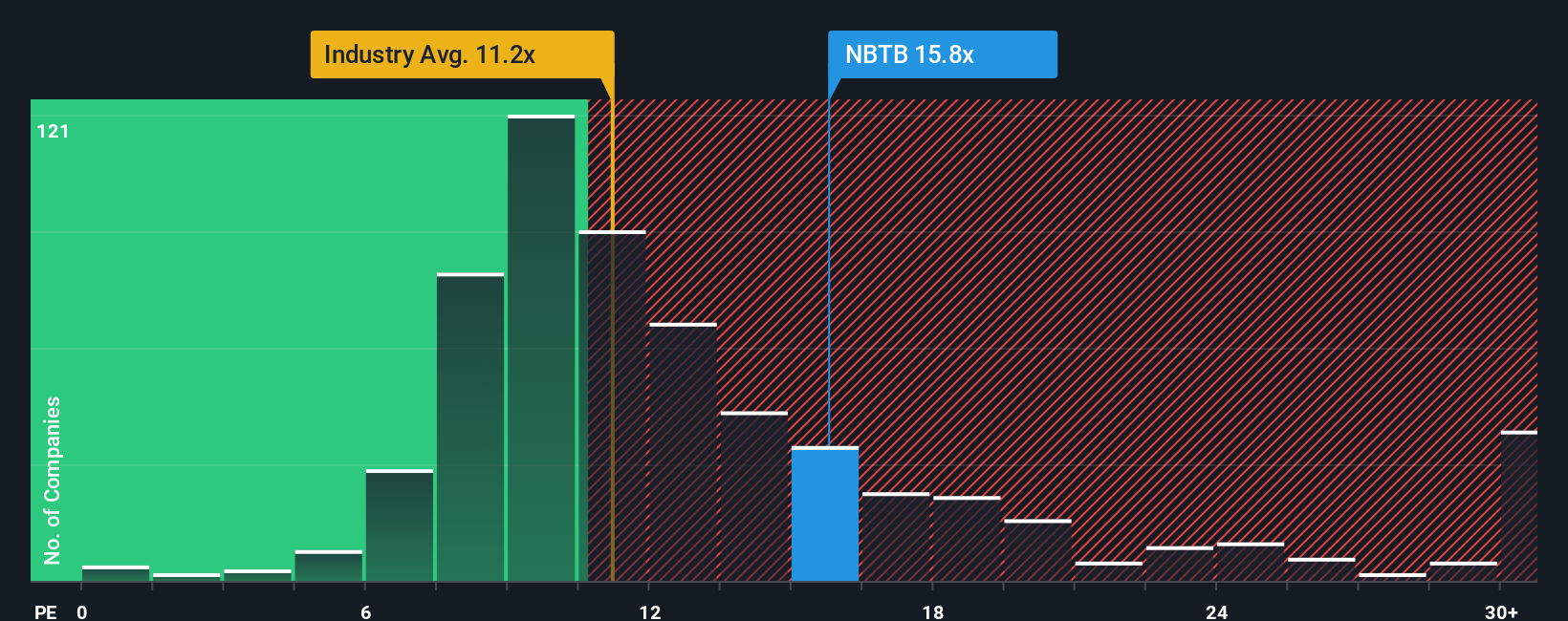

While our earlier fair value estimate relies on optimistic analyst forecasts, a reality check using the price-to-earnings ratio sparks debate. NBT Bancorp is trading at 15.8x earnings, which is higher than the US Banks industry average of 11.2x but lower than the peer average of 17x. Interestingly, the fair ratio points to 17.4x, which is above the current level. This gap suggests the stock could be cheap if the fair ratio is met, but it is not without valuation risk. Could this be a hidden opportunity, or does the market see something the numbers miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NBT Bancorp Narrative

If you think your perspective differs or want to dig into the numbers yourself, you can craft your own view of NBT Bancorp’s outlook in just a few minutes, Do it your way.

A great starting point for your NBT Bancorp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio. Seize fresh opportunities that others might be missing. Let the Simply Wall Street Screener help you unlock unique stocks worth your attention.

- Pursue robust income streams by reviewing these 18 dividend stocks with yields > 3% that offer attractive yields above 3% and consistent payouts.

- Fuel your growth strategy by checking out these 24 AI penny stocks shaping tomorrow's economy through groundbreaking AI advancements and smart automation.

- Position yourself ahead of market trends as you uncover these 79 cryptocurrency and blockchain stocks at the forefront of digital finance and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives