- United States

- /

- Banks

- /

- NasdaqCM:MVBF

MVB Financial (MVBF) Net Margin Drop Challenges Confidence in Quality Earnings

Reviewed by Simply Wall St

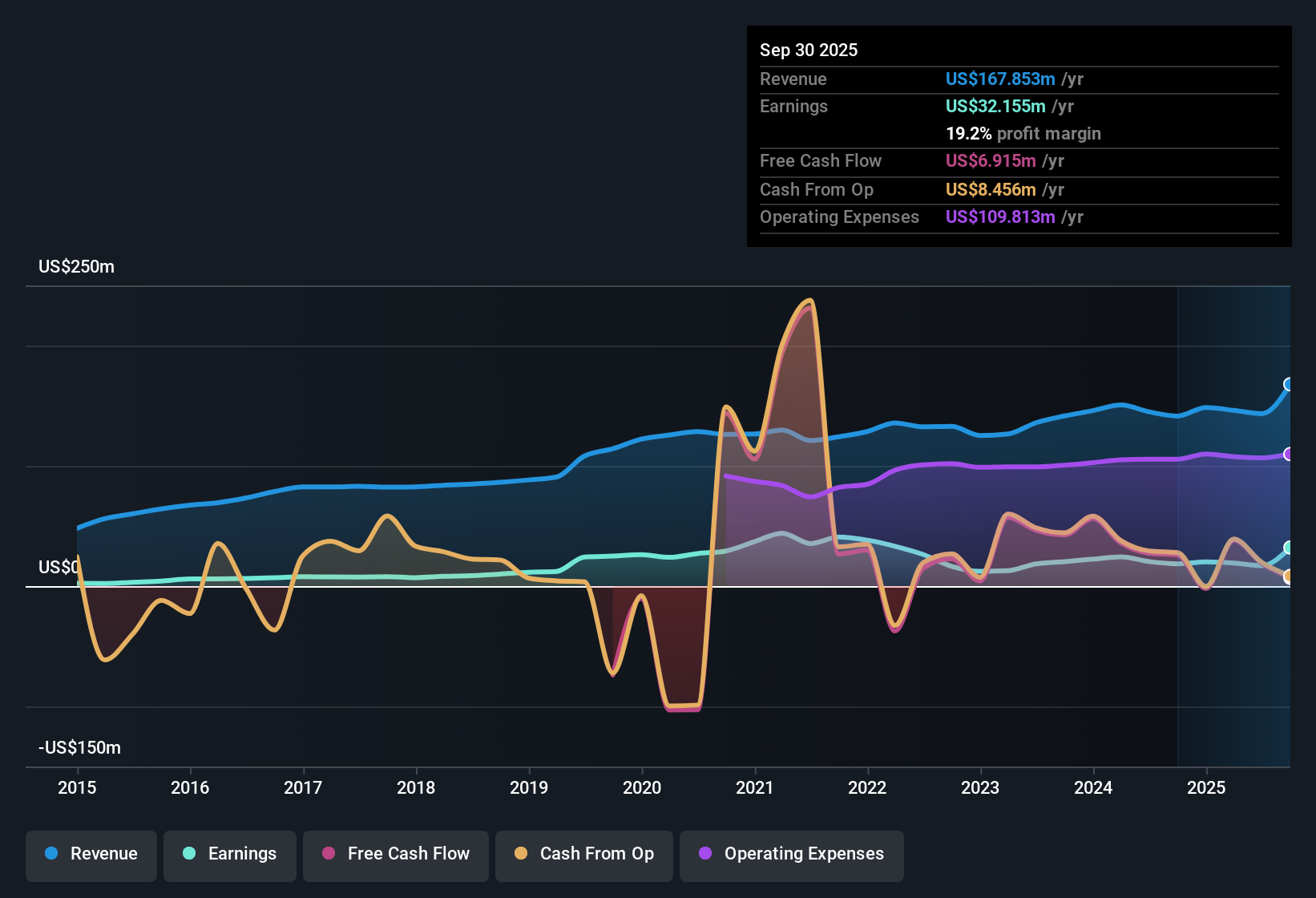

MVB Financial (MVBF) posted a mixed set of numbers in its latest update. Revenue is forecast to grow at 13.9% per year, outpacing the broader US market’s 10.3%. Profit is expected to rise by 12.1% annually, which trails the market’s 15.7%. The company’s net profit margin slipped to 11.9% from last year’s 14.1%, and earnings have declined by 18.5% per year over the past five years, with recent data showing negative growth. Despite ongoing margin pressure and recent declines in profitability, the stock is trading at $26.29, still well below its estimated fair value of $37.40 based on discounted cash flow.

See our full analysis for MVB Financial.Now, let’s see how these results compare with the leading narratives around MVBF. This will highlight both where they hold up and where the numbers may tell a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

High Quality Earnings Despite Falling Margin

- MVB Financial's net profit margin currently stands at 11.9%, which is lower than last year's 14.1%. The company is still recognized for having high quality earnings in regulatory filings.

- Two key takeaways emerge from the prevailing market analysis:

- The fact that MVB Financial is considered to have high quality earnings, even as the margin has slipped year-over-year, strongly supports the view that management is delivering reliable results despite industry headwinds.

- It is notable that investors continue to discuss the company’s fundamentals and risk profile as stable, rather than expressing alarm at the ongoing margin pressure, which might otherwise be expected to drive more negative sentiment.

Past Earnings Slide Raises Questions

- Annual earnings have declined by 18.5% per year over the last five years, and the latest set of financials reflects another period of negative growth. This reinforces that profitable expansion has been a key challenge.

- Market observers point out a few tensions here:

- While the share price is still well below DCF fair value, these continued declines in earnings raise skepticism about whether projected future growth can materialize at the pace analysts hope.

- No signs of a sharp turnaround are apparent in the current numbers, and the consistent earnings decline creates some friction with the notion that MVBF should rerate solely based on broader sector optimism or stability narratives.

Valuation Sits Between DCF, Peer and Industry Benchmarks

- The current share price of $26.29 puts MVB Financial well below its DCF fair value of $37.40. The company trades at a premium P/E of 19.7x, which is substantially higher than both US Banks sector peers (11x average) and peer group (9.7x).

- The prevailing analysis reveals a valuation gap that is difficult to ignore:

- Some observers argue the discounted price versus fair value presents an opportunity, but the premium P/E compared to nearly all peer and sector benchmarks indicates that the market is expecting above-average improvement, even if the recent numbers are mixed.

- If future profit growth does not accelerate from the current trend, this valuation mismatch could become a concern for new investors considering the stock relative to alternatives across the sector.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on MVB Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

MVB Financial’s persistent earnings decline and lack of clear turnaround raise valid concerns about the reliability of future profit growth for investors.

If you want to target companies showing steady earnings and reliable growth, use our stable growth stocks screener (2113 results) to shift your focus to consistently expanding businesses built for the long run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVBF

MVB Financial

Operates as bank holding company for MVB Bank, Inc that provides financial services to individuals and corporate clients.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives