- United States

- /

- Banks

- /

- NasdaqGS:MCBS

MetroCity Bankshares (MCBS) Net Profit Margins Top Expectations, Reinforcing Quality Earnings Narrative

Reviewed by Simply Wall St

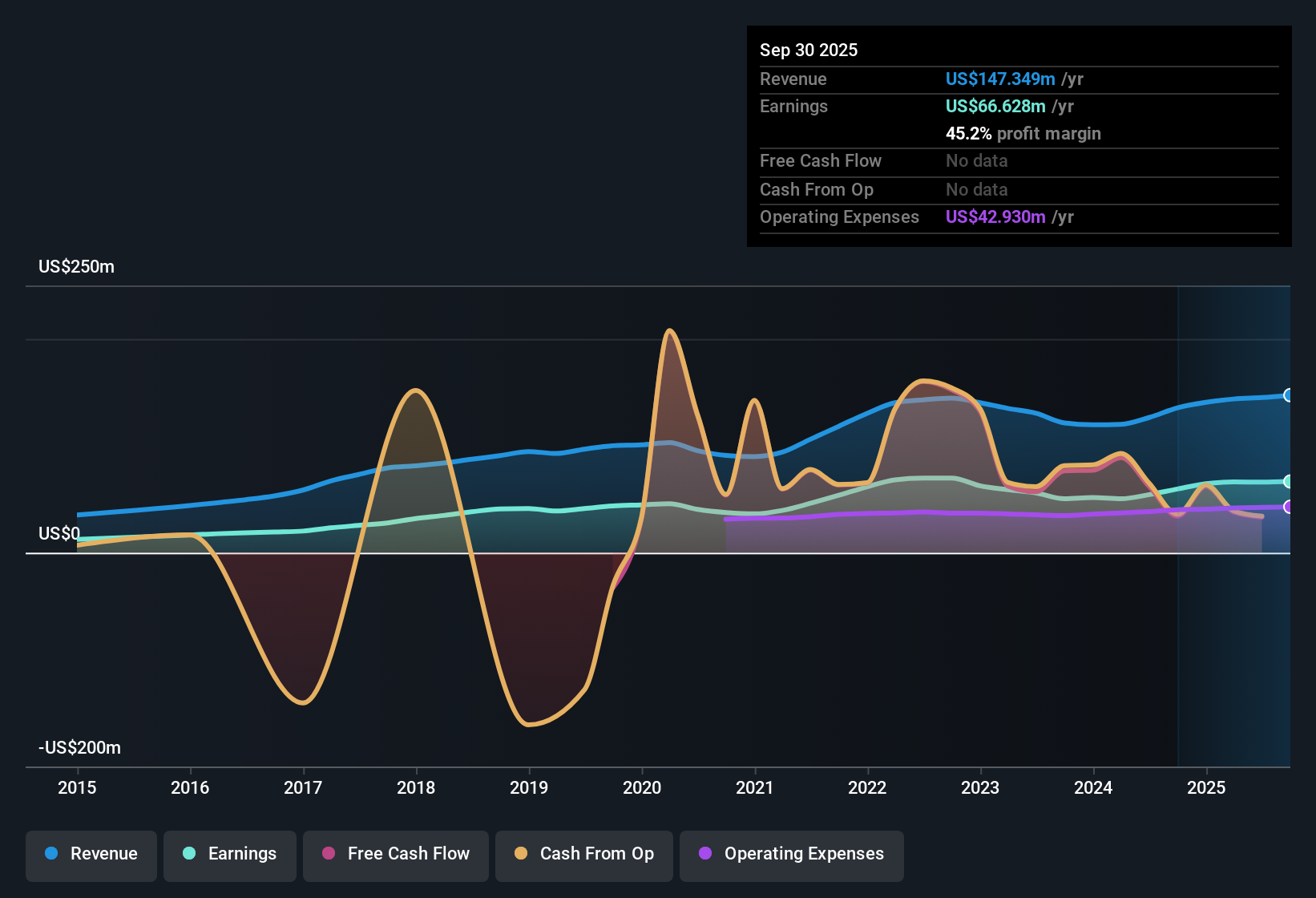

MetroCity Bankshares (MCBS) delivered net profit margins of 45.5% for the year, up from 43% a year ago. Annual earnings growth reached 21.6%. Over a five-year stretch, the company’s earnings have maintained a solid expansion, averaging 7.3% growth per year, and are marked as high quality. With no material risks identified and shares trading at $26.33, well below the estimated fair value of $46.68, investors are likely to see both the consistently strong margins and discounted valuation as key positives in the latest results.

See our full analysis for MetroCity Bankshares.Now, let's see how the latest earnings stack up against the market narratives and whether the results reinforce or challenge the community’s expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Reach Multi-Year High

- MetroCity Bankshares’s net profit margin climbed to 45.5% for the recent year, continuing a streak of high-quality earnings over five years in which annual growth averaged 7.3%.

- Market observers note that such a robust and sustained margin keeps MCBS positioned as a stable operator, especially in a segment where regional banks have faced scrutiny over rising rates.

- This margin exceeds many peers, lending credibility to the view that the company’s operational discipline translates into durable cash flow and investor confidence.

- While the narrative acknowledges broader industry challenges, MCBS’s consistency stands out and reinforces its image as a steady presence among regional banks.

Price-To-Earnings Ratio Under Industry Average

- The company’s P/E ratio of 10.2x is lower than the US Banks industry average of 11.2x and also trails its own peer group’s 11.8x, pointing to an attractive valuation relative to sector benchmarks.

- Prevailing analysis indicates that MCBS, trading below sector multiples, may provide investors with a margin of safety commonly associated with undervalued banking plays.

- This valuation view is further supported by the absence of material risk disclosures, suggesting that the discount is not a response to underlying company issues.

- Analysts and market participants find it notable that the share price offers value in a market where many banks struggle to justify premium valuations.

DCF Fair Value Far Exceeds Current Price

- With shares at $26.33, the gap between the market price and the DCF fair value of $46.68 is significant, indicating that the stock trades at a meaningful discount to its calculated worth.

- This substantial spread prompts the view that, unless sector-wide or company-specific risks arise, there is potential for price appreciation if investor recognition increases or new catalysts appear.

- Stable earnings growth and healthy profit margins, as mentioned above, support the premise that the current price does not fully reflect MCBS’s underlying performance.

- Prevailing commentary notes that low trading volume and subdued retail interest could keep the price in a range for now, but the fair value gap remains a compelling argument for long-term holders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on MetroCity Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite MCBS’s attractive valuation, low trading volumes and limited retail interest mean the share price may struggle to realize its full upside in the near term.

If you want to focus on stocks with more consistent traction and reliable upward trends, check out stable growth stocks screener (2084 results) that highlight companies delivering steady performance across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCBS

MetroCity Bankshares

Operates as the bank holding company for Metro City Bank that provides banking products and services in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives