- United States

- /

- Banks

- /

- NasdaqCM:MBCN

Middlefield Banc Corp. (NASDAQ:MBCN) Passed Our Checks, And It's About To Pay A US$0.20 Dividend

Readers hoping to buy Middlefield Banc Corp. (NASDAQ:MBCN) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Middlefield Banc's shares on or after the 30th of August, you won't be eligible to receive the dividend, when it is paid on the 13th of September.

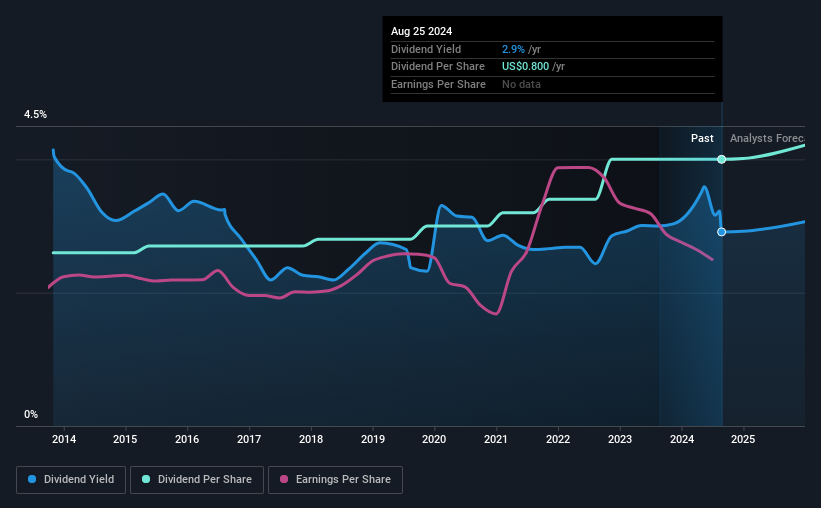

The company's next dividend payment will be US$0.20 per share, on the back of last year when the company paid a total of US$0.80 to shareholders. Looking at the last 12 months of distributions, Middlefield Banc has a trailing yield of approximately 2.9% on its current stock price of US$27.48. If you buy this business for its dividend, you should have an idea of whether Middlefield Banc's dividend is reliable and sustainable. So we need to investigate whether Middlefield Banc can afford its dividend, and if the dividend could grow.

View our latest analysis for Middlefield Banc

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Middlefield Banc paid out a comfortable 41% of its profit last year.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's not encouraging to see that Middlefield Banc's earnings are effectively flat over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Middlefield Banc has lifted its dividend by approximately 4.4% a year on average.

Final Takeaway

Is Middlefield Banc worth buying for its dividend? Middlefield Banc has seen its earnings per share stagnate in recent years, although the company reinvests more than half of its profits in the business, which could bode well for its future prospects. Middlefield Banc ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

On that note, you'll want to research what risks Middlefield Banc is facing. Case in point: We've spotted 1 warning sign for Middlefield Banc you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MBCN

Middlefield Banc

Operates as the bank holding company for The Middlefield Banking Company that provides various commercial banking services to small and medium-sized businesses, professionals, small business owners, and retail customers in northeastern and central Ohio.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026