- United States

- /

- Banks

- /

- NasdaqGS:LKFN

Lakeland Financial (LKFN) Margin Decline Reinforces Narratives of Stable but Modest Profitability

Reviewed by Simply Wall St

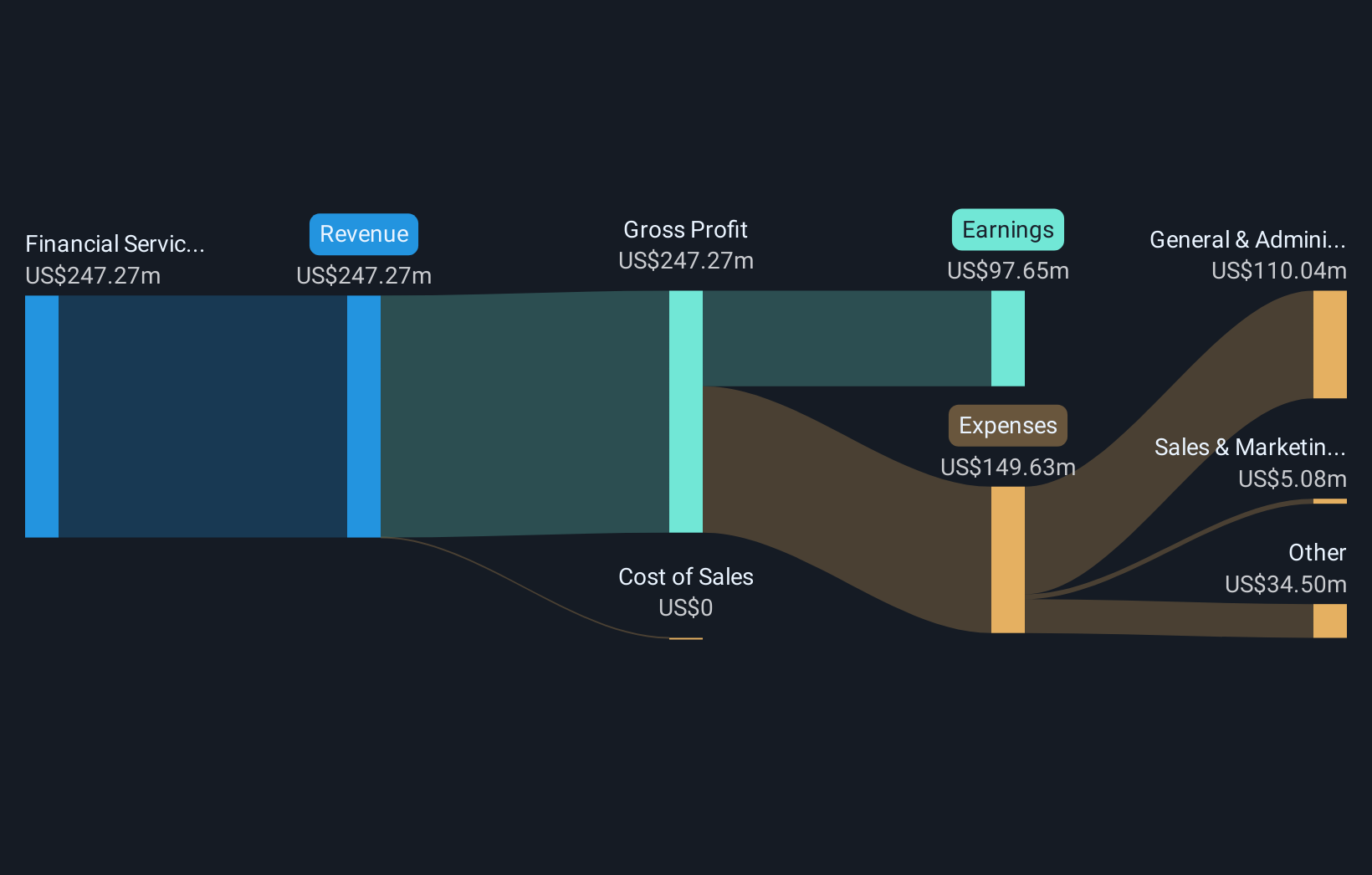

Lakeland Financial (LKFN) posted net profit margins of 39.5% for the period, marking a slight pullback from last year’s 41%. Over the last five years, the company’s earnings have grown at an average of 1.2% annually, with management now forecasting a 6.7% annual earnings growth and 7.1% revenue growth going forward, both trailing broader US market benchmarks. Investors might view these numbers as a sign of steady but modest profitability, with strong underlying quality but only moderate near-term acceleration expected.

See our full analysis for Lakeland Financial.Now, let's see how these headline numbers compare to the established narratives and expectations. Some long-held views might get reinforced, while others could be in for a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Sits Well Above Market

- Lakeland Financial is trading at $58.22, which is a considerable discount compared to its DCF fair value of $92.05.

- Testing the prevailing narrative, this valuation gap stands out because

- despite steady but only modest earnings growth (6.7% annual forecast), the stock price points to muted market enthusiasm,

- even as profit margins, although down from last year, remain elevated at 39.5%. This helps anchor what many investors see as high-quality fundamentals despite sector-wide pressures.

P/E Ratio Higher Than Industry Norm

- The current price-to-earnings ratio for Lakeland Financial comes in above both peer and industry averages, making its valuation look relatively expensive by this traditional metric.

- Evaluating this through the lens of the prevailing narrative,

- this premium could reflect ongoing confidence in the company’s earnings quality, as high profit margins and low flagged risks have kept downside concerns muted, even as sector volatility lingers,

- but it does challenge claims that Lakeland is a bargain, especially with profit growth projections lagging behind broader market benchmarks.

Earnings Growth Estimates Trail Market Pace

- Management’s forward guidance calls for 6.7% annual earnings growth and 7.1% revenue growth, both of which trail US market averages for comparable periods.

- Looking at the evidence against the prevailing narrative,

- these expectations highlight that while Lakeland is positioning itself as a stable and predictable income pick, there is little in the guidance to suggest an acceleration or breakout performance is likely,

- yet the underlying profit margin resilience continues to support a constructive outlook for investors focused on risk-adjusted returns more than rapid gains.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Lakeland Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Lakeland Financial’s forward earnings and revenue growth estimates trail the broader US market. This suggests the company's near-term upside may be limited compared to peers.

If you want to pursue faster growth, discover stronger opportunities among companies expected to deliver robust earnings expansion using high growth potential stocks screener (60 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LKFN

Lakeland Financial

Operates as the bank holding company for Lake City Bank that provides various banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives