- United States

- /

- Banks

- /

- NasdaqGS:LKFN

Lakeland Financial (LKFN): Exploring the Bank’s Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Lakeland Financial.

Zooming out from this week’s rebound, Lakeland Financial’s share price has had its ups and downs in 2024, with momentum fading a bit after a tough quarter. While the 1-year total shareholder return sits slightly positive at 1.65%, the stock remains well below pre-2022 levels. This underlines both upside potential and ongoing investor caution around the sector.

If you’re weighing what else is capturing attention in the market, now’s a good moment to expand your scope and discover fast growing stocks with high insider ownership

But with shares still trading at a meaningful discount to analyst price targets, is the current market overlooking Lakeland Financial’s growth prospects? Or is everything already baked into the stock price?

Price-to-Earnings of 16.7x: Is it justified?

At a price-to-earnings (P/E) ratio of 16.7x, Lakeland Financial trades well above both its peer group and sector averages, raising important questions about market expectations for profit growth.

The P/E ratio measures how much investors are paying for each dollar of a company's earnings. For banks, it often reflects expectations about future profitability, stability, and growth potential.

Despite its long-term profitability and high quality earnings, the market currently values Lakeland Financial more richly than its banking peers. Its P/E is higher than the peer average of 12.1x and also significantly above the US Banks industry average of 11.2x. However, regression analysis suggests a fair P/E multiple closer to 11.6x, which indicates that the current market valuation leaves little margin for error or underperformance.

Explore the SWS fair ratio for Lakeland Financial

Result: Price-to-Earnings of 16.7x (OVERVALUED)

However, slower than expected revenue growth or future declines in net income could challenge the case for Lakeland Financial’s current premium valuation.

Find out about the key risks to this Lakeland Financial narrative.

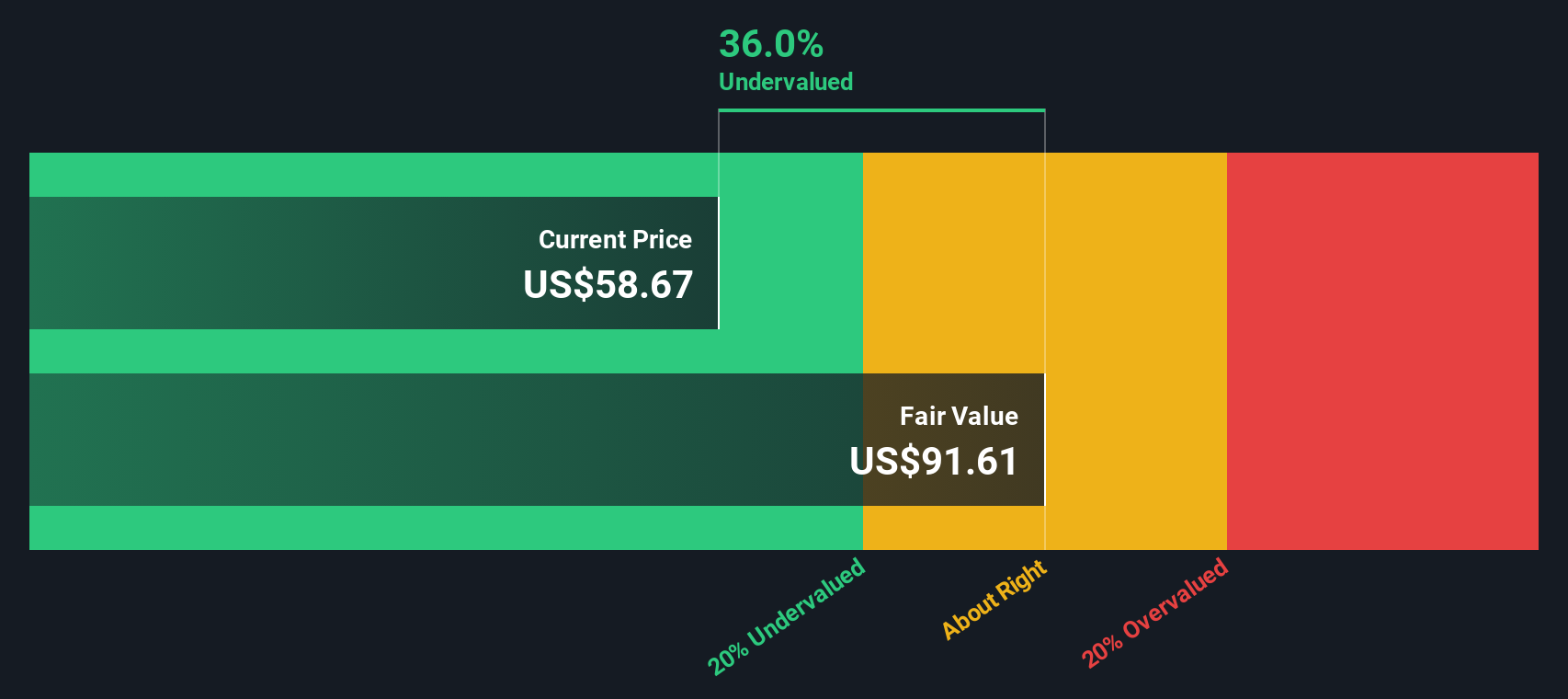

Another View: Discounted Cash Flow Signals Undervaluation

Taking a step back from earnings multiples, our DCF model offers a different perspective. According to this approach, Lakeland Financial is trading around 31.5% below its estimated fair value, which suggests there may be more room for upside than the P/E alone indicates.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lakeland Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lakeland Financial Narrative

If you have a different take on Lakeland Financial or would rather analyze the numbers on your own, you can quickly craft your own perspective in just a few minutes. Do it your way

A great starting point for your Lakeland Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizon and give yourself an edge by finding companies with potential others might be missing. These handpicked ideas on Simply Wall Street are too good to overlook:

- Grow your income by tapping into these 17 dividend stocks with yields > 3% that offer attractive yields above 3% and help strengthen your portfolio’s cash flow.

- Stay ahead in evolving sectors by targeting these 27 AI penny stocks that are fueling innovation through artificial intelligence and transforming the investment landscape.

- Benefit from solid fundamentals with these 876 undervalued stocks based on cash flows that are based on reliable cash flow metrics, giving you a strong foundation for possible value gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LKFN

Lakeland Financial

Operates as the bank holding company for Lake City Bank that provides various banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives