- United States

- /

- Banks

- /

- NasdaqGS:LKFN

How Investors Are Reacting To Lakeland Financial (LKFN) Earnings Growth and Improved Credit Quality

Reviewed by Sasha Jovanovic

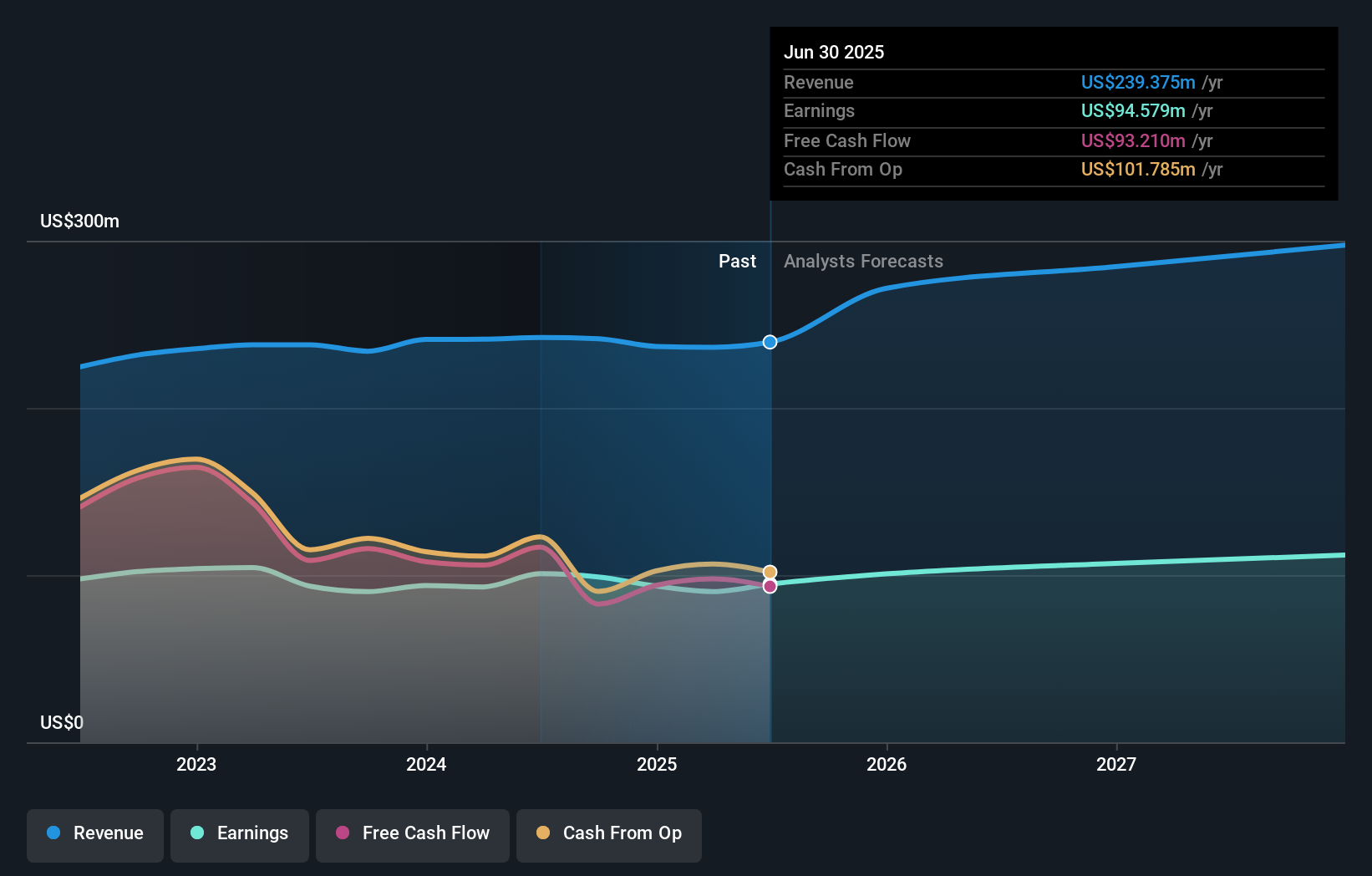

- Lakeland Financial Corporation reported third quarter 2025 results that included net interest income of US$56.07 million and net income of US$26.4 million, both higher than a year earlier, along with a significantly improved ratio of net charge offs to average loans.

- An interesting aspect is that the company achieved earnings growth and credit quality improvement while affirming a quarterly dividend of US$0.50 per share.

- We'll explore how Lakeland Financial’s rebound in net charge offs helps shape perceptions of its risk profile and overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Lakeland Financial's Investment Narrative?

For anyone interested in Lakeland Financial, the key story has often centered on stability, steady income growth, and dividend consistency. The recent rebound in net charge offs, falling from US$28.9 million last quarter to just US$384,000, largely resets concerns about rapid credit deterioration that spooked markets previously. That positive shift comes alongside higher year-on-year earnings and continued dividend payments, suggesting the company’s risk profile may be less severe than the market feared. Still, short-term catalysts, like improved credit metrics and solid loan growth, could lift sentiment if sustained, despite modestly lagging return metrics and premium valuations against peer banks. The price action leading up to this news was weak, but given current analysis and price trends, the latest report could be seen as stabilizing rather than transformational. In the bigger picture, ongoing credit events and competitive pressures remain the riskiest factors to watch.

On the other hand, the full impact of previous charge offs lingers as a point investors should keep in view.

Exploring Other Perspectives

Explore another fair value estimate on Lakeland Financial - why the stock might be worth just $91.61!

Build Your Own Lakeland Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lakeland Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lakeland Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lakeland Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LKFN

Lakeland Financial

Operates as the bank holding company for Lake City Bank that provides various banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives