- United States

- /

- Banks

- /

- NasdaqGM:LARK

Why We Think Landmark Bancorp, Inc.'s (NASDAQ:LARK) CEO Compensation Is Not Excessive At All

CEO Michael Scheopner has done a decent job of delivering relatively good performance at Landmark Bancorp, Inc. (NASDAQ:LARK) recently. As shareholders go into the upcoming AGM on 19 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Landmark Bancorp

How Does Total Compensation For Michael Scheopner Compare With Other Companies In The Industry?

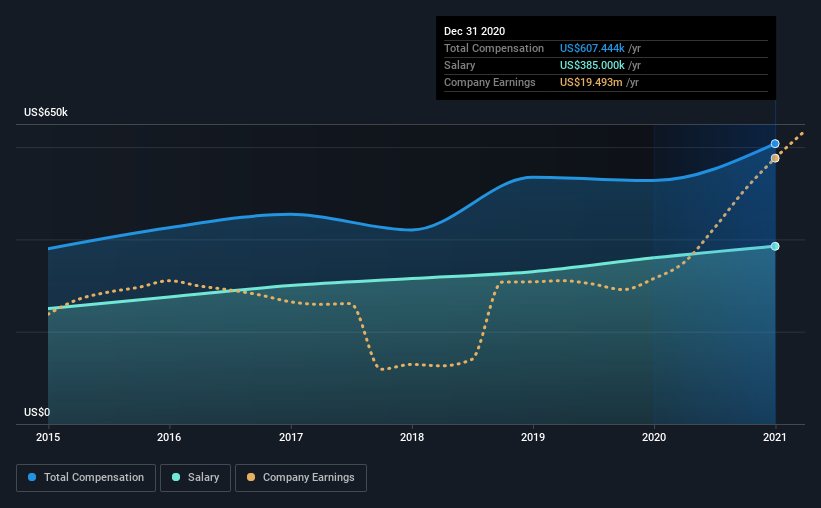

According to our data, Landmark Bancorp, Inc. has a market capitalization of US$119m, and paid its CEO total annual compensation worth US$607k over the year to December 2020. That's a notable increase of 15% on last year. We note that the salary portion, which stands at US$385.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$573k. So it looks like Landmark Bancorp compensates Michael Scheopner in line with the median for the industry. What's more, Michael Scheopner holds US$2.9m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$385k | US$360k | 63% |

| Other | US$222k | US$168k | 37% |

| Total Compensation | US$607k | US$528k | 100% |

Speaking on an industry level, nearly 42% of total compensation represents salary, while the remainder of 58% is other remuneration. It's interesting to note that Landmark Bancorp pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Landmark Bancorp, Inc.'s Growth Numbers

Landmark Bancorp, Inc.'s earnings per share (EPS) grew 71% per year over the last three years. In the last year, its revenue is up 37%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Landmark Bancorp, Inc. Been A Good Investment?

With a total shareholder return of 16% over three years, Landmark Bancorp, Inc. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Landmark Bancorp.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Landmark Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:LARK

Landmark Bancorp

Operates as the financial holding company for Landmark National Bank that provides various financial and banking services to its local communities.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives