- United States

- /

- Banks

- /

- NasdaqGM:KFFB

Why It Might Not Make Sense To Buy Kentucky First Federal Bancorp (NASDAQ:KFFB) For Its Upcoming Dividend

Kentucky First Federal Bancorp (NASDAQ:KFFB) is about to trade ex-dividend in the next 4 days. This means that investors who purchase shares on or after the 28th of January will not receive the dividend, which will be paid on the 16th of February.

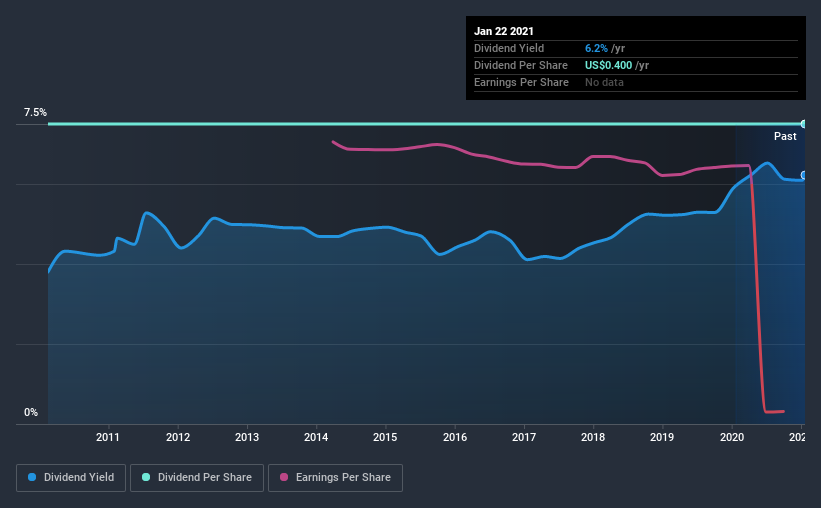

Kentucky First Federal Bancorp's upcoming dividend is US$0.10 a share, following on from the last 12 months, when the company distributed a total of US$0.40 per share to shareholders. Based on the last year's worth of payments, Kentucky First Federal Bancorp has a trailing yield of 6.2% on the current stock price of $6.427. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Kentucky First Federal Bancorp

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Kentucky First Federal Bancorp lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable.

Click here to see how much of its profit Kentucky First Federal Bancorp paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Kentucky First Federal Bancorp reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. It looks like the Kentucky First Federal Bancorp dividends are largely the same as they were 10 years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

We update our analysis on Kentucky First Federal Bancorp every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

From a dividend perspective, should investors buy or avoid Kentucky First Federal Bancorp? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Worse, the general trend in its earnings looks negative in recent years. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

With that being said, if you're still considering Kentucky First Federal Bancorp as an investment, you'll find it beneficial to know what risks this stock is facing. Our analysis shows 3 warning signs for Kentucky First Federal Bancorp that we strongly recommend you have a look at before investing in the company.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Kentucky First Federal Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kentucky First Federal Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:KFFB

Kentucky First Federal Bancorp

Operates as the holding company for First Federal Savings and Loan Association of Hazard, Kentucky, and Frankfort First Bancorp, Inc.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success