- United States

- /

- Banks

- /

- NasdaqGS:INDB

Independent Bank (INDB): Evaluating Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Independent Bank.

Looking beyond this week’s dip, Independent Bank’s share price has quietly rebounded over the year with a 9.2% year-to-date climb, despite a nearly flat total shareholder return over twelve months. Recent trading momentum appears steady but not electrifying, which suggests investors may still be weighing the bank’s growth prospects against lingering market risks.

If you’re curious where else steady growth could meet insider optimism, it’s a great moment to discover fast growing stocks with high insider ownership

With Independent Bank shares trading nearly 20% below analyst price targets and with annual growth in both revenue and net income, is the stock an undervalued opportunity or has the market already accounted for the next stage of growth?

Most Popular Narrative: 16.6% Undervalued

Independent Bank’s widely followed fair value estimate stands at $82.75, well above the last close of $69.01. Expectations for substantial growth and operational improvements underpin this perspective, hinting at ongoing optimism despite near-term uncertainty.

Ongoing U.S. population migration to secondary and smaller metropolitan areas, alongside strong small business formation in core markets, positions Independent Bank to benefit from outsized loan and deposit growth from community banking and small business lending, positively impacting long-term revenue and fee income.

Look beneath the surface for more than just optimism driving this number. What is contributing to these expectations? Consider aggressive business expansion, margin improvement, and bold revenue forecasts that challenge industry norms. The key point is that only a handful of critical assumptions separate the current price from that target. See what those could mean for the future.

Result: Fair Value of $82.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing commercial real estate exposure and integration risks from recent acquisitions could present challenges for the growth outlook and put pressure on future profitability.

Find out about the key risks to this Independent Bank narrative.

Another View: Market Comparisons Paint a Cautious Picture

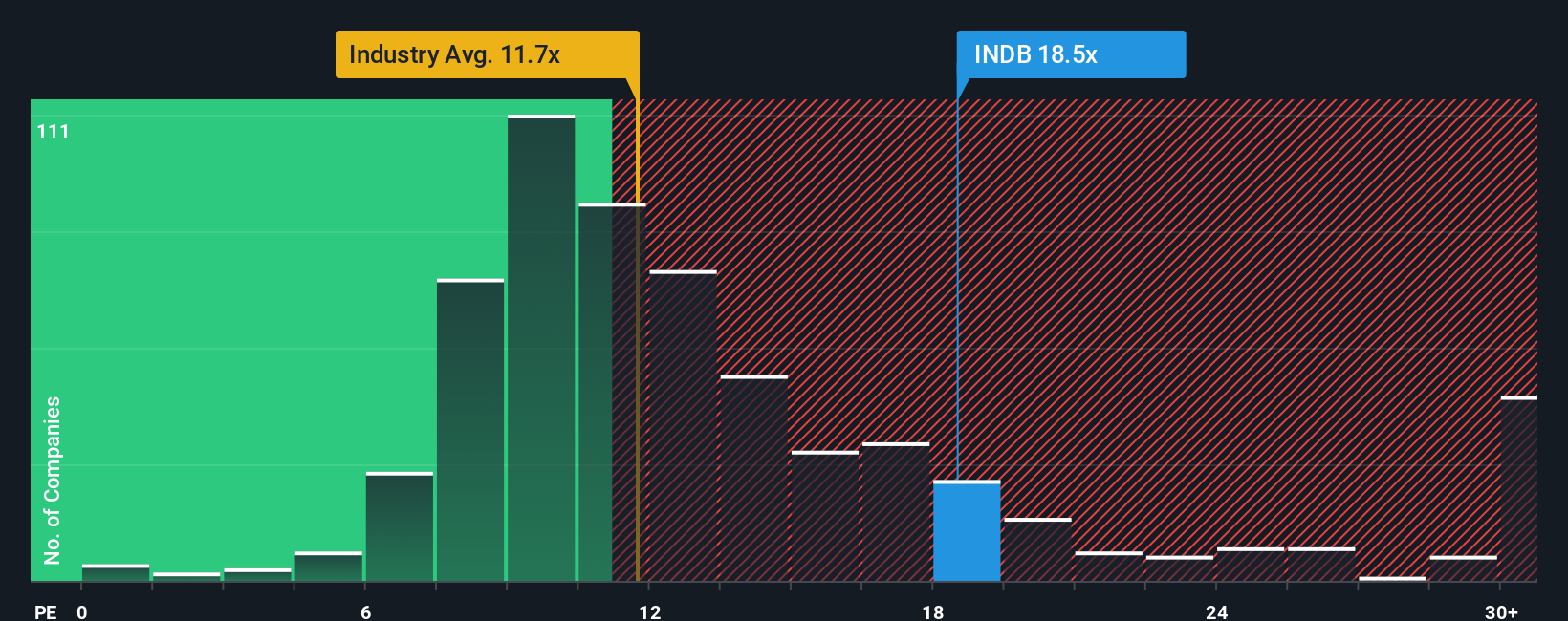

While the fair value estimate and outlook point to potential upside, Independent Bank’s price-to-earnings ratio stands at 19x, which is significantly higher than both the US Banks industry average (11.2x) and the peer group (18.8x). Even when compared to its fair ratio of 17.5x, the company looks pricey. This gap could indicate valuation risk if the market shifts toward those benchmarks. Is the optimism supporting the premium truly justified, or does caution have the upper hand now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independent Bank Narrative

If these perspectives do not fully capture your outlook, or you would rather reach your own conclusion from the data, try building your own view in just a few minutes. Do it your way

A great starting point for your Independent Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover your next opportunity with handpicked screens trusted by savvy investors. Stay ahead and make your portfolio work harder by checking out these standouts today:

- Pinpoint value by targeting these 868 undervalued stocks based on cash flows, which could be set for strong returns as the market catches up to their fundamentals.

- Boost your income potential and stability by accessing these 15 dividend stocks with yields > 3%, with yields over 3% for reliable cash flow.

- Seize the future with these 27 AI penny stocks, at the forefront of artificial intelligence innovation, poised for dynamic growth and transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives